US Natural Gas Demand Outlook

Natural gas demand outlook is probably more uncertain than the production side of natural gas. The natural gas production is limited on the upside by the technology capability and infrastructure. To the production downside, there is some political constraints. However, the variability for natural gas demand is likely more uncertain as the upside could be quite high with exports, revitalization of the US manufacturing base, and the power sector increases. All of these variables involve the economy and the political willingness to act.

Whenever one starts with fundamental analysis, it is always good to take a trip down memory lane. Of recent, the largest impact to demand occurred in the winter of 2011-2012. Examining the winter residential demand, the volume has been at its lowest since the winter of 1986-1987. This was a drop of 3.2 BCF/D compared to the 5 year average. The significance of this mild winter is comparable to the supply disruption that occurred from Katrina in 2005. Therefore, it is very important to put that into context that the 2011-2012 was the once in one hundred year winter. The impact of such event should and has been felt for multiple years similar to the Katrina impact. The timing of the winter with the coincided shale gas production has led us to observe low gas prices over the last two years. I would contend without this winter impact, we likely might not have observed the prices below $3/mmbtu. The Katrina impact took about 18 months for the market to come back to fundamental balance. The disruption of 2011-2012 winter should be done by this year. The remaining bearish impacts will be directly with a function of shale gas production.

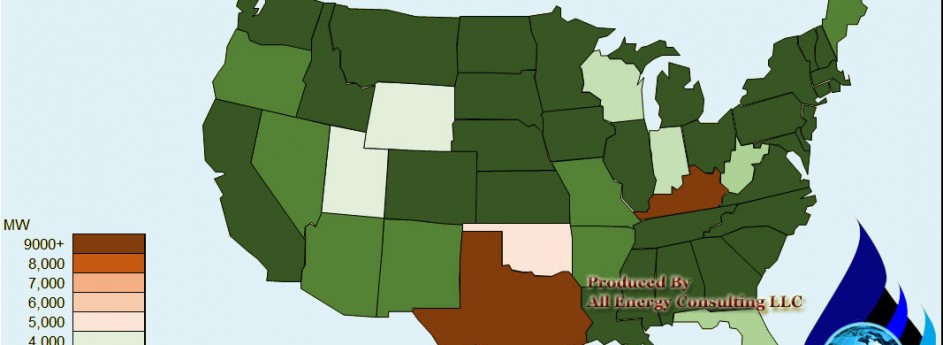

Another demand for natural gas which cannot be avoided, given it now represents the largest demand sector for natural gas, the power sector. A historical phenomenon for natural gas demand was the rise of natural gas demand in the power sector which occured with one of the largest price rise. From 2002 to 2008, we observed a 15% annualized growth of natural prices while demand in the power sector grew nearly 4% on annualized basis. Most people outside the energy space do not realize this. The reason this happened was the incremental load growth had to be met and the spare capacity in the markets came from the over build out of gas units in the later 90’s and early 2000’s. Load growth was averaging 1.2% from 1998-2008. The rising price of natural gas demand would not stop gas being used in the power sector. Therefore the load growth was expected to add around 1 Bcf/d of gas demand each year. This also played a crucial part in natural gas price collapse. As load growth has been stymied since the 2008 financial collapse. Three areas are driving the lack of growth one economic, the other, the push on energy efficiencies initiatives and the huge renewable development. Renewable growth is likely to slow down, now that gas prices are putting damper on renewable economics. Energy efficiencies still have room to alter the demand landscape, but the big unknown is the economic recovery.

As noted in the previous report on the challenges in the power sector, the growth is far from the trend line. Will there be a reversion to the mean trend line? Will low natural gas price stimulate not just natural gas demand for the raw material but will it generate electrical demand from a manufacture revival? For the base case, I have decided to take a conservative approach to revert demand back to the trend line as if it was going to get reset. In addition, due to the $9 billion energy efficiency market, I have trimmed load growth by 0.5% similar to the EIA load forecast of 0.58%. Counterbalancing the load reduction is the increase retirements. Without load growth much of the old units whether coal or other types of unit cannot afford their fixed cost to operate. Therefore we still see incremental power demand will add 1 Bcf/d of natural gas demand each year in the outer years.

The other major power story is the coal retirements due to environmental requirements. EPA mercury rules hit in 2015, but plants can apply for a year extension and so far no plants have been denied an extension. Basically the rules force existing coal plants to be fully controlled (scrubber, SCR, bag house/ precipitator). This can cost as much as a brand new combined cycle plant. Natural gas will likely need to make up a good portion of those unit retirments. However, many have simply multiplied the retirement times a gas heat rate to come up with the gas demand impact. This is bad math. The coal units do not operate at all hours that would require a gas unit. During many hours, a coal unit fleet will be at minimum operation level which could be around 40-60% of full capacity in order for the fleet to be ready for the on-peak hours. Off-peak hours amount to 43% of the year. Many of these hours will actually be made up by the existing coal fleet, so their requirement to run at minimum would be reduced.

Based on some of my models, I anticipate the number to represent 30% of gas demand. In total, in 2016 we could see an increase of 3 bcf/d driven by the coal retirements from the MATS ruling. Both the demand growth and coal retirements continue to make the power sector the most important piece in the puzzle with much subject to change given EPA rules. For those engaged in natural gas, it is important to monitor this situation. All Energy Consulting can help you out with our power modeling outsourcing option. A more detailed breakout of the power gas demand will be available in the final report and presentation available if you email David K. Bellman . The report will dive into the load outlook and renewable competition.

The next major category for natural gas is the use of the raw material for chemical manufacturing and LNG exports. They are somewhat connected. As I reported in my comments to the DOE – we need to realize the use of our natural resources which will add significantly more to the bottom line economics than to export the product only to buy the products back. However, I am cognizant on the inability of the political process to make it worthwhile to bring manufacturing back into competitive setup in the US. I do believe there will be a compromise needed between the corporate culture and the unions. There needs to be a balance and I believe it can be done through new businesses not established companies. I suspect many established companies are supporting the LNG project and the pipeline build up to deliver products to their sunken investments in the Gulf versus constructing new plants at the source. For the base, I have a higher outlook than EIA largely because I believe there will be balance between imports from Canada. An optimal US economic benefit of LNG would be the LNG exports equal to the amount being imported from Canada. It would be more of economic gain to export Canadian LNG than to let the Canadians export their own LNG. Based on history this would amount to 3.5 Bcf/d.. BHP is projecting11 Bcf/d export from the US by 2030 .

If LNG approach the 11 Bcf/d figure there will be a demand price response. If the global market of gas demand is not growing proportionally to the increase some of the LNG investors may be hit with big losses. The reason I state this is the understanding of the Middle East. The mentality of the Middle East cannot be ignored. They have and will manage the market with the focus on market share. The experience in 1998 cannot be forgotten. This was my 15 minutes of fame in which I was published in many national magazines predicting the crude oil collapse. The basis all came from the fact the supply demand balances showed a large expansion of supply when the demand dropped out from underneath producers as Asia was the growth everyone built for. Saudi Arabia at the time constrained production but eventually lost too much market share and decided to show the world the value of being constrained and as I estimated, the market went below $10/bbl. I think for those who are looking into LNG export from the US need to examine the Middle East. Market share erosion is not taken lightly. Qatar can easily add more capacity now if it wanted to but similar to Saudi Arabia for oil, it is managing the market. However, the management comes with a fee of maintaining market share. I, therefore, promoted some LNG exports but with foreign investors. This will put them into a take or pay situation vs. leaving US investors holding the debt on a non-used asset. If you think shale gas production which on average likely cost greater than $1/mmbtu even with oil considerations can compete with countries like Qatar with gas production cost less than $0.50/mmbtu, you will be in for a rude awakening. Shell pulled out of a gas to liquids (GTL) project in the US Gulf as a result of this concern. , A supporting news for LNG export volumes is Qatar is investing in US LNG with ExxonMobil.,

Another hidden demand is the exports to Mexico. I expect Mexico will not be able to get their act together to manage their resource. It will be much easier for them to build pipeline and import the natural gas from the US. I expect this will be a surprise demand source in many of the models. EIA doesn’t have exports crossing 2 Bcf/d till past 2030. It would not be a surprise to me to see it cross over closer to 2020.

Similar to the supply side, we have a much higher demand than the EIA when we add all these factors together. The final price outlook is that gas prices are expected to be range bound in 2014-2015. With the coal retirement and manufacturing uptick in 2016 we will likely see prices moving strongly up. Then LNG exports hitting in 2018 and beyond would likely give another boost. The real insight will be from the high and low side development of both the supply and demand demonstrating an upside and downside risk. The likely asymmetric relationship can show a great trade opportunity.

A complete report for the Natural Gas Outlook with graphs and excel tables are available with a presentation, in which I will include a report with a high and low gas price developed using the key variables discussed above. If interested please email [email protected]

Your Fundamental Energy Consultant,

614-356-0484

Shale Gas Production Expectations

Shale gas production is probably one of the greatest mind twist component in creating a supply/demand balance for US natural gas. My posting has been slowed as I have promised to come up with a long-term natural gas price outlook. As a longtime fundamentalist, the supply/demand model represents the root of the forecast. The key steps in creating one is to understand the individual components and developing a logical rationale to what makes each of those components tick.

The supply outlook for shale is a very fascinating supply side component for which I spent considerable time understanding. People will generally work their way through running cost and reserves calculations to get some sort of projection. However, I believe this method is invalid here as cost seems to be an impact not a direct variable of production. In the long-run, economics should balance with cost; but in the near term, which could be many years, we can have what is perceived to be irrational, but is quite rational decision making on an individual basis.

The last comment has more to do with management of Oil & Gas companies. With much of the incentives for executive management based on stock price, the decisions do not necessarily become making a resilient long-term decision for the company, but what propels the current share price. If you examine the markets, you have many players being rewarded on the bottom line production numbers regardless of net profits. Shareholders have taken to a metric which does not necessarily promote the best long-term decision. The energy in the ground (AKA btu) is not going anywhere yet there is drive to produce now vs. later which could be more promising. Even looking out on the forward strip there shows a 5% premium a year out. This obviously is not really worth the time value of money, but there is an indication that there are better days ahead for producers. Forward curves are a poor predictor of actual outcomes, but it does show market sentiment.

The analogy of the current market is let’s all slit our wrist and we will see who will faint first. Those who faint, their blood will be taken and used to supply another player still in the game. Therefore, if you are playing the game, you better cut cost and look for opportunities to take on those who can’t cut it. In the long run the market will balance, but in the meantime, expect production numbers to be less connected to price. Added Note 12/16 – I understand all the traditional means of forecasting shale from reserve curves, lease retentions, acreage analysis, and well economics. What I am about to suggest is not random nor taken lightly but the fact is traditional mechanism could not come close to backcasting what has happened over the past 5 years. I don’t believe in using methods that cannot be calibrated to the history. Show me a model that can account for multi-year 40% supply growth using traditional methods and I will accept that method. However I will contend those methods would consistently not been able to forecast what has occurred. This is largely a result of behavior and technology advancement. For this very reason I decided to expand beyond traditional means to see if I could find a METHOD to be able to substantiate the past to be able to potentially understand the future.

With that in mind, one needs to examine the development curves of being productive in order to get a view of shale gas production. I examined oil production back to 1890 and looked at various time periods of production evolution. However, nothing can compare to the current production growth observed in shale gas over the last 8 years. I expect the 2012 numbers of shale gas production will be revised to show more like a 10% growth vs. what you see in the AEO 2013 figure of 4%. Update 12/19 – Natural Gas Annual 2012 came out and BAAM! Shale gas production 10.3 TCF vs. AEC Forecast 10.5 TCF – far from AEO 2013 figure of 8.1 TCF! Therefore for 8 consecutive years, you had a production growth from a single source of technology that produced double digit growth. My quest to find something similar to that pace led me to examine Moores law. However, resources cannot keep up with technology innovation as seen in Moores Law. After many hours of research, I did find a logical and rationale curve which sets the foundation of my supply projections for shale gas. Once again, my past has been my friend. My diverse experience in all parts of the energy markets took me back to coal to find my answer.

The Powder River Basin coal production was able to sustain 11 years of double digit growth of production. Similar to shale gas the BTU was known to exist. It was just about jumping the potential energy to make it work and once that was done it was all kinetic energy that propelled the basin from a zero player to 16% of the largest coal market in the world. Using the Powder River Basin as a foundation and modifying to shale, shale gas supply will likely exceed current EIA projections of shale gas. Before you go out and sell the forward strip, the demand picture is also likely to exceed EIA outlook. Added Note 12/16 – This is not as random as Chilean Sea Bass imports – there is some fundamental connection to shale gas. You had a known energy source, but a large barrier to untapped the source. Once the barrier was overcome a tidal wave of production came. The recent shape of shale does fit the path observed by PRB. The future of shale will likely revert back to the fundamental variables of production, but to be able to account for the current evolution and behavior the PRB history is more capable of describing the potential.

I have described the foundation of the supply outlook, but not the actual mechanism of my forecast as I still need to make due for my lovely family. My demand models are coming along and eventually the final price projections. If there is interest, please contact me to schedule a presentation at your company where I will go over the outlook and take questions and answers. The cost of this endeavor we can discuss on an individual company basis and based on my timing. Those who book earliest will get the best deal. You can contact me at 614-356-0484 or email me at [email protected]

I do have a proven and successful track record in forecasting commodities and developing world supply and demand models. You can see my front page USA Today prediction of the crude oil collapse in 1998 – March 10, 1998. I was also very prescient at AEP –unfortunately those forecast are behind the close door, but many do know I was the bull in the early 2000 and turned to be quite a bear as the market went crazy in 2008. The markets will change and you need to be fundamentally connected at all times.

Your Fundamental Energy Consultant,

614-356-0484

Coal Producer and Coal Generator Strategy to Survive

A block buster deal by Consol along with my continuing blogs with the ScottMadden Energy Industry update in the section on rates, regulation, and policy, is inspiring this insight. As noted in the industry update, several policies are set to minimize coal generation. However, the biggest harm to coal did not come from the government, but the natural gas industry. Shale gas revolution is causing the big harm. If gas prices were to be in the $4-7+/mmbtu range, many decisions to install control equipment at these power plants would have been easily made. However, prices are now at the point that it does not make too much economic sense to invest in a several decade old plant when a brand new gas plant can be built at roughly the same cost. The benefit of added capital cost in the past was made up by the lower fuel price over time.

Shale gas has placed a big question mark on the long-term price of natural gas in the US on the market participants. If prices were to sustain around $3/mmbtu, there is no doubt that a significant amount of coal retirements would occur, including possibly fully control plants, as low power prices are not covering existing fixed cost. Eventually the coal industry would be left with barely a shell from the past. However, before we all jump on that trajectory, I will be willing, as I have been in the past to be the counter forecaster to the rest of the market.

On the bearish side of gas, there is quite a bit of evidence that production cost may actually be coming down for shale. Also, producers have a strong zeal to continue to post strong production numbers in face of relatively poor economics, as share prices are being rewarded. The btu in the ground will still be there for a few years later, but money now is the key for many publically traded companies. Long-term thinking may be pushed to the wayside as management teams have options, and shareholders want dividends now.

On the bullish side, what is not discussed more is the demand response that is likely to occur, but just takes time. As noted in several post, the demand for natural gas in the industrial sector is very binary. There is not ramping of natural gas demand as a brand new chemical plant, power generator, or LNG export terminal comes online. All these investments take time and large amount s of capital. No one places a $1+billion dollar investment for a price move which occurred in a one or two year period. A sustained belief that prices will be relatively low allows investments to be made. As noted in the ScottMadden energy update over 35 Bcf/d are looking for export license. We have at least 5-10Bcf/d already approved and very likely. To put that into some perspective, total US demand in 2012 was around 70 Bcf/d. If around 40GW of coal retire plus the addition of the LNG exports, the total demand from those two activities can surpass the entire US residential demand in natural gas. This is not insignificant.

Note: Expect in the coming months a long-term gas price projection from All Energy Consulting.

With world markets natural gas price north of $7/mmbtu, the US natural gas prices will likely move in that direction, as LNG exports try to capitalize on the market differences. IF coal producers and generators can believe over the next few years, we will see prices north of $4/mmbtu, on a consistent basis coal retrofit decisions become more likely. The coal market participants must realize there will likely be no more coal builds with the number one reason, not being the EPA or natural gas prices directly, but the plain fact the cost of building a coal plant is very high as seen in the recent Turk Coal plant built by AEP. The article is honoring the plant, but that honor comes with a high price tag of $3000/kW, almost twice expensive as the state of the art gas plant. For this very reason, new coal plants will be limited. Therefore, the only coal demand in the US will be from the existing coal plants. Coal producers and generators need to realize this fact. If the units retire, there is no coming back for that demand. Therefore, it is of the greatest need to figure out a way to keep the units economical to the point they do not retire.

My strategy for the survival of the US coal industry is to be creative with coal contracts. Go back to the old fashion way of creating coal contracts which are plant specific and less commodity like (non-homogenous). Both the producer and generator need to do the analysis and/or hire third party like myself to evaluate the economics at each plant. A spread should be produce based on the local natural gas benchmark. This spread should be to the point that it enables the plant to economically run in the current poor gas price. For the shared suffering in today’s price, the producer will then get the upside when the market recovers. If the market does not recover it does not matter anyway. The industry needs to save what they can or it will be lost forever.

As noted in the article, I would be glad to facilitate and produce a contract which produces a win-win situation for both the coal producer and coal plant. I have the ability to produce unique solutions which can benefit both parties. Please do consider All Energy Consulting.

Stay tuned for the Long-term Natural Gas price outlook.

Your Energy Consultant,

614-356-0484

GRID Resilience – Planning and T&D Spending

Continuing with the insights inspired by the ScottMadden Energy Industry update, the slide on GRID resilience offers some insights on planning related issues. GRID resilience is essential in resource planning. The layman needs to know that electricity must be balanced at all times, that means supply/demand must be in sync. A surge in demand must automatically be met with a surge in supply or vice versa, no room for delay is allowed. If there is a delay, there will be a potential for an equipment failure and a prolong outage. During storms, the failure of equipment down in the distribution level causes demand losses which can then trigger imbalances in the system and lead to wider disruptions beyond the initial storm damage.

The graph on Weather Related Outages is very telling of the impact on storms. However, before we account for the increase in outage to just climate change, let me note causation and correlation issue. As noted in my previous posting Power Industry Challenges, the age of the distribution system is worse off than the generation resources. Given that knowledge, it is very possible to have increasing outages without a significant increase trend in weather related storms. A storm ten years ago will not be impactful in terms of electricity outage as a storm now given the aging of the poles, transformer, etc.. Investment in Transmission (T) &Distribution (D) is no doubt needed – more so in D than in T.

In terms of a utility, the level of investment is a function of the level of reliability that society wants to pay for. For the individuals who want more reliability, they can either install back up or self-generate on-site. I suspect the answer is to see more distributed generation only in the fact that the average consumer level of reliability would not be cost effective enough for various applications. If the utility were to set the standard of reliability too high, it would be a very regressive policy.

A utility operation is more of a society tool to offer benefits of basic essentials to society which would be out of the reach for many individuals. If utilities started offering Rolls Royce systems, it would cause a regressive rate structure and thereby, negating their very existence of being the tool to enable the mass of society to obtain a basic essential. The commissions need to examine very closely the cost benefits of these items in the T & D filings, and make sure they are balanced with the need of the AVERAGE consumer. With this insight and the business model change we discussed in the beginning of the examination of ScottMadden update, many utilities will likely be much smaller than they were before.

Stay tune for more insights derived from ScottMadden review. Please do consider All Energy Consulting for your consulting needs as I can help giving you a different look into the challenges that lay ahead in the energy world.

Your Energy Consultant,

614-356-0484

Shale Gas and Carbon thoughts

Taking a break on the various issues of utilities from my previous blogs, I was inspired by this article to take on a macro issues of energy involving Shale gas and carbon issues – Is shale gas our future or should we look at other sources of energy? (Molten Consulting).

The title is opened ended… how far is future? And whose future? Shale gas does not and will not make up the majority of energy usage worldwide. It is a substantial portion for the US oil and gas balance. Before there were shale expectations, the theme to balance the energy market was to use all sources of energy including improvement in efficiencies. Supply and demand always meet, it is just a matter of convergence with price as the critical variable to impact supply and demand.

Before Shale:

- LNG imports were going to save the US from sustained $8+/mmbtu prices.

- Imports of crude with a large dependency from Canadian tar sands were going to fill in to maintain oil markets while we slowly convert the US auto fleet to alternative fuels.

- Advance coal would even play a part.

- Nuclear plants were going to easily be relicensed.

- Wind and solar cost would come down in cost and the cross intersection with gas prices at $8+/mmbtu would allow the elimination of subsidies in a few years.

However, shale has allowed this delay as it came with a bonus of liquids production. Middle East LNG and Canadian heavy oil are still there. Both coal and nuclear are actually being hampered because of the shale gas producing poor economics, therefore a significant decline is likely in the US. Renewables will likely continue to require subsidies, and the ability to transform quickly is hampered by the fact that there are physically known recoverable sources of energy to be used if shale gas drops off whether heavy oil, LNG, or even coal.

Technology breakthrough in energy is extremely tough given the capital intensity in the industry. New technology cannot plan or wish for peak oil to produce higher prices to enable their technology. Shale gas has pushed the peak curve much farther out than any of these peak oil theorists would ever imagined. Mr. Shaw brings up the carbon issue as a critical path. Once again, as much new technology cannot plan for peak oil, they probably should not plan on significant carbon prices to make their technology viable. Carbon is not going away, but when countries and individuals cannot even balance their check books, can we really plan beyond 10 years much less 100 years which many of the impacts of climate change will be felt? Debt is no different than carbon, it is kicking the can for the next generation. Therefore, to see any government put in a sustained economic penalty for benefits not seen in decades does not seem likely.

The stretch goal for all new technology in the energy space try to compete with prices now, not on a dependence on something in the future. Just as shale gas came into the picture, other sources of technology have the same opportunity.

Your Optimistic Energy Consultant,

614-356-0484