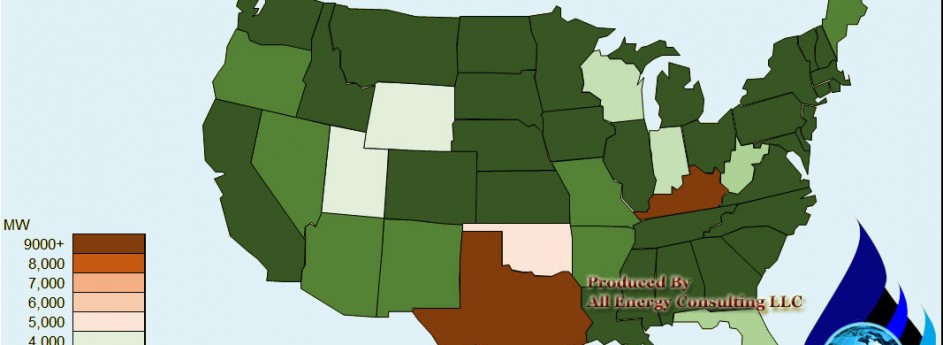

Peak Demand in US Electric Sector

Continuing with our analysis from the previous post discussing Peak Energy, we delved into the Peak Demand. Peak Demand is measured in MW vs. Peak Energy MWa. Peak demand is typically define as the highest point of energy consumption. This is very important due to the nature of electricity. Compared to other commodities, the whole market would not crash for an extended period of time if one could not supply the peak demand point. However, in the case of electricity this becomes a real problem. Therefore, much planning is focused on peak demand and figuring alternatives to avoid peaks. Many commercial and industrial customers can see the bulk of their bill is tied to the peak vs. their average energy consumption.

As we discussed in the previous post, our objective is to produce a forecasting method for our new product, Power Market Analysis (PMA). Now that we had a very good system in forecasting monthly energy across N. America using GDP and CDD and HDD from various parts of the country, we needed a way to forecast the monthly peaks. The analysis of peak demand differed greatly from the analysis of peak energy. Applying the same statistical approach used in peak energy was going nowhere. First, we had to replace the monthly CDD and HDD with weekly maximums given we wanted to forecast peaks not averages. This improved the analysis. As expected, given the economic value of reducing peak vs. energy efficiency we saw many more regions decouple from economic growth in establishing peaks. We also modified the analysis to look at the relationship between average energy and peak demand. This method established a range for expected peaks in both a normal expectation of weather to extreme cases of weather variations within a month.

Counter to many who are have been alarmed at peak demand growing faster than energy, our analysis leads us to forecast a much slower growth in peak vs. energy. This is supported by the economic incentives to reduce peak demand is far greater than reducing energy consumption. In addition, measurement and validation of the various programs to mitigate peak demand is much more “accurate” than energy efficiency programs.

Power Market Analysis (PMA) will allow subscribers a very good view of the power markets and their relationship to the Coal and Gas markets. One of our goals is to increase the fundamental understanding of the market. We will issue monthly studies to our subscribers. The inputs will be clearly displayed for both the base and the extreme cases. Subscribers will also be able to customize runs. There is a large incentive for early bird subscribers. Please do reach out to me ASAP if you are interested in signing up to PMA (614-356-0484 [email protected] ). We will send a sample file you can expect from PMA. The official product launch likely in the later part of February. Besides a financial discount early birds will also be able to guide the product development of PMA and be able to get “free” reports while we finalize the product. We are building PMA to allow the evolution of the product. Our current long-term vision could have users having the ability to submit input changes and output be generated for them overnight.

Your Enthused Energy Consultant,

614-356-0484

Twitter: AECDKB

Refining Outlook Refined for 2014

As I review my last year’s thoughts on refining with updated data, it has caused me to be more bullish on the outlook for refining – which historically is very hard to do. US refining may be entering another golden age – or perhaps it never left, but just took a nap. There will be refiners who benefit more than others. However, the overall market should see additional boost.

What is new or more reaffirming from last year’s review:

- Continued liquids production from the shale plays.

- Crude imports are coming whether we like it or not by rail or by pipeline.

- Continued growth in developing countries.

Shale Play

Shale production continues to beat expectations. I researched over a dozen papers reviewing and analyzing shale decline curves and initial production rates. The amazing outcome is not the technology acceleration, but the ability to learn to use and adapt existing technology is accelerating. Each shale play is unique with an initial set of known. Applying the techniques done in one play to another play generally does not optimize the production. The ability to be creative with the tools and resources available has clearly shown an increase in production. Data is available showing initial production rates to decline curves are improving at wells within existing plays. In addition, the newer plays are seeing even a more accelerated path of improvements than the Bakken.

It is our belief, this will continue leading to more oil production in the US. And this oil production is of the sweet and light crude oil. This very fact is causing the US producers to want to lift the ban on exporting crude oil from the US. As discussed in my previous refining outlook discussion, the US refiners outsmarted themselves and built the wrong refining configuration. All is not lost; they just don’t value the sweet crude as much as the outside world might. At some discount, the oil will be processed and changes will be made in the US refining complex. This discount is driving producers mad and so the hope is with the ability to export. They could find better buyers across the ocean. In the meantime, without the lift in crude oil exports, we should continue to see a feedstock price discount to several refiners. This will cause a drop in finished product prices in the US for the consumer. However, I anticipate the drop in finished product prices to not be as low as the drop in feedstock prices given the export outlet for finished products.

Crude Imports

Crude imports are coming no matter what you are hearing about the Keystone pipeline issue. The Keystone pipeline encompasses a greater plan which is shown on this website. The project is actually three parts with 2 of three pushing forward as the main Keystone Pipeline still is being debated. Right now, we have 180,000 barrels/day of crude oil moving by rail from Canada to the US. The debate perhaps is really the rail industry supporting the ban on Keystone, because the oil will come, it’s really just how you want it to come here, assuming we still want to maintain free trade with our Canadian friends. This crude oil is more to the liking of the US refining sector. I suspect logic will prevail and the pipeline will move forward and pressure on the US crude oil markets relative to the foreign markets will maintain itself. The forward curve as of 02/06/14 continues to show a very stout spread between Brent – WTI of $14/bbl. Overtime, I suspect that to come back down to perhaps the $5/bbl range. However, I think gone is the convention that on annual basis they will trade in parity.

Non-OECD Oil Demand Growth

Over the last 8 years the OECD region demand dropped nearly 5 million b/d. The US represented nearly half of this drop with half of that drop coming from the push on alternatives fuels mainly ethanol. Ethanol production now stands at 0.9 million b/d. Biodiesel adds another 0.1 million b/d. Even though much is talked about renewable in the power space that there is now significant volumes to be discusses in the petroleum space. As I indicated in the power space reaching a peak consumption one can conclude the same in the oil space for US consumers.

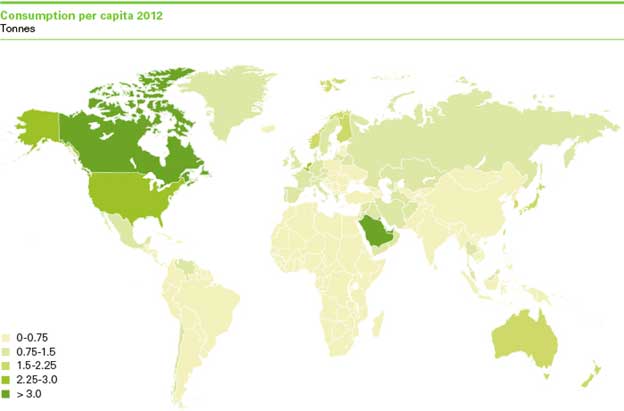

With the entire demand decline in OECD region, one would think prices should have declined versus rising 70% in the US gasoline markets. However, Non-OECD demand grew 9.7 million b/d over that same time period OECD was declining. There is so much more room to grow for non-OECD region. BP shows a graphical view of oil consumption per capita across the world. Even though the US observed a great drop in demand there is still a large gap between the US and the majority of the world.

With those three outlooks solidified, I am optimistic on US refining. Within the sector, there will be winners and losers. I can help the refining sector by offering crude oil evaluation to strategic planning to optimize the above concerns. A fundamental view of crude oil prices and refined products are available.

By the way I do have an opportunity for those interested in a 80,000 bpd condensate refinery in the Caribbean. A detailed cost study along with an economic analysis was done showing an investment need of around $600 million producing 20+% IRR. To build a brand new refinery of this scale would be around $1.2-$1.8 Billion. Please contact me if there is interest in this investment.

Your Continually Refining Energy Consultant,

Peak Energy – Are we there in the US?

Peak energy can be related to many things from Peak Demand, Peak Oil, etc… Let me clarify my discussion. Peak energy in my context is the electric energy being consumed by the end user each hour and averaged. Therefore, the unit of peak energy is Megawatt Average (MWa). This is much different than the peak demand Megawatt (MW) which occurs in one hour.

I am writing about this topic as I have just analyzed 118 Load Zones across the N. American continent. Statistical analysis was done on those areas incorporating 26 variables, which included 9 weather zones (CDD & HDD) and 8 economic regions starting with data back to 2009. This was an arduous and complex task as each individual zone needed its own menu of variables to optimize the analysis. AEC is about to launch a new online product – Power Market Analysis (PMA). PMA will be an online product with annual subscription access to power prices projections across the country and fuel consumption forecast of coal and gas in the power sector for the next two years – More information on PMA to come. Load represents a fundamental input in analyzing the power markets, so the task had to be done.

The results of the analysis are very eye opening. The R squared (indication of how well data points fits to the variables analyzed with – ranges from 0 to 1, poor to perfect fit) across all 118 load zones averaged 0.92. There were several regions which have now begun to decouple from GDP. The economic well-being of several regions is no longer driving the growth of power. At this point, I can hear grumblings and concerns at investor held utilities since the load growth is the main mechanism on shareholder returns. Don’t stop reading, it’s not all gloom or doom for all utilities. There are two main reasons for this decoupling of GDP. First is the increase spending in Demand Side Management programs across the country to a tune of $9 Billion. Second, we may have reached a peak point in energy consumption per capita. As you look around, how many more devices can you obtain? Each new device is incorporating better and improved efficiency. At some point, we will hit a limit to the energy consumption each of us can do. We are clearly seeing this in this analysis in certain large metropolitan areas when you strip out the weather component. However. I am only seeing this in certain regions.

The EIA put out a briefing on March 22, 2013 alluding to this. The graph below does not seem to be weather normalized. This can lead to a skew vision of what has gone on recently.

Weather has been a large factor over the recent years. If you look at the GDP from 2010 to 2013 the growth is close to 4%/yr. If you look at electricity consumption without normalized weather the picture will show an annual decline of 1%/yr. However, if you strip out the weather component, the load growth is closer to 2.3%/yr. 2010 was an extremely warm year with cooling degree days across the country 21% greater than a normal year.

Weather variations will lead to consumption change as we have become quite temperate in our ability to adapt to various climates. The weather piece will need to be stripped out of the discussion when it concerns understanding the relationship between power consumption and the economy. Peak energy discussions cannot include a conclusion on the basis of extreme weather events. Based on our analysis we still project a rather robust growth in power consumption of 1.9%/yr for N. America based on normal weather and GDP growth around 3%. Areas that are seeing significant growth are related to the Oil & Gas areas such as Texas, Alberta, Louisiana, and even pockets in the Midwest with shale development.

PMA will offer a daily view of the next two years with three different scenarios – base, high power price, and low power price. The changes between the cases will be weather, GDP, and gas prices. In addition subscribers to PMA will be presented monthly with scenario and sensitivities which delve into the greater market dynamics seen in the power space. PMA will be valuable to those in the Oil & Gas, Coal, and Power industry. For the Oil, Gas, and Coal companies the focus will be on better understanding on fuel consumption in the power sector. The power industry the fuel and power prices will be available. In terms of functions within an organization, expect value to be given to Trading, Fundamentals, Budgeting, Fuel Contracts, and Policy groups.

There is more to come on PMA as we expect a product launch sometime in February.

Your Tireless Analyzing Energy Consultant,

614-356-0484

Twitter: AECDKB

LNG Export Revisited

LNG exporting discussion is increasing. Clearly the Oil & Gas industry is in favor of the initiative. On the other hand you have the Dow and Alcoa being concerned. Now the environmentalists have stepped in to denounce the plan. As I noted in my previous discussion on this subject last January I was more cautious on the level of exporting in the hopes that we could develop manufacturing and other creative ways of using a cheap and abundant resource. The question is to ask what is best for the country as a whole not to focus on certain questions as will it raise prices. A price rise is not bad in itself.

Since the last year, I have added my perspective by having intellectually challenging conversations with my many energy colleagues and friends. In general, I do agree with the premise that government should not be in the business of picking winners. My Oil & Gas industry friends will use this as instrument to justify their stance to export – not allowing exports you are picking a winning industry. As I noted before I think we should phase in the volume. In addition to staying true to avoid government picking winners – why are my Oil & Gas colleague not supporting my stance on auctioning of the export license in order to phase in the LNG export volume. Going site by site offers some element of picking winners. The US citizens should want to find additional funding for the government versus raising taxes and losing benefits. LNG export volume license would likely bring a decent revenue stream for the government and would avoid “picking” winners. Obviously the company that wins the license will still need to find an approved site along with approved technology which would pass environmental and safety needs.

I am always open to a discussion on merit. Please do send me email or feel free to comment below.

Your Open Thinking Energy Consultant,

614-356-0484

Twitter: AECDKB

Energy Policy – Too Complex to do for the US?

In several energy conferences I have attended, many people are dismayed on how we fail to have a national energy policy in the United States. At the same time, many people are actually very grateful for that fact. This is typically coming from those who are very cynical of government action and ability to appropriately execute. An in-depth national energy policy for the United States is likely infeasible due to the geographical diversity of the US to use various energy forms and the complexity of energy. The only energy policy I could see from a US federal perspective would be a generic focus on allowing inter-state energy transfer no matter what form of energy, a focus on maintaining some level of energy security through technology, storage, and trade, and finally a push to use energy productively.

Energy is a means to many ends. Having energy does nothing useful without an objective of using the energy. The discussion of energy in the public space is typically done with a bias to favor one form of energy to another even though they may not even be directly related. Energy is so broad making it very complex. The complexity allows the energy discussion to be manipulated to the public. This manipulation is sometimes intentional and sometimes out of ignorance.

The two broad forms of energy is potential and kinetic energy. Kinetic energy is the useable form of energy. The potential form of energy is eventually converted to kinetic for final use to achieve an end goal. An example of end goal could be heating your house to traveling from point A to point B. The usable forms of kinetic energy are radiant, thermal, motion, sound, and electrical. To produce those forms of energy, a medium is needed. These can be Oil, Natural Gas, Wind, Sun, Coal, Earth (Geothermal), Hydro, Atoms (Nuclear), etc… Within each of these forms and mediums, people have dedicated their lives to them generating multiple academic and business people. Only a few actually involve themselves across the various forms of kinetic energy and the mediums.

I was fortunate only because of my career path and my desire to continue to learn. Most of my colleagues and friends in the energy space are dedicated to one medium and one form of kinetic energy. This highlights the complexity of the space and the desire for individuals to bias a certain form and medium of energy. My Oil and Gas colleagues would not be interested in understanding the Demand Response call option value compared to the tariff rates structured, just as my Utility colleagues would not be interested in understanding the light-heavy relationships in petroleum products and its impact on crude oil valuations. At some level each of the groups will be “fighting” to support his or her industry. Therefore just as Eisenhower was concerned about the military-industrial complex, I would be concerned about an energy policy driven by one of the energy forms complex versus generating a generic goal of using energy productively and securely.

Having a clear discussion on energy is near to impossible because of the generic “energy” concepts. Energy discussions are littered with ignorant or bias agenda. Case in point, many articles will point to the renewable initiatives leading to a reduction of petroleum products (gasoline, diesel, jet fuel, etc…). However, this is not genuine since the renewables mediums are generally focused on the electric form of kinetic energy whereas the petroleum medium is focused on the thermal form of kinetic energy. Therefore, significant transformation to renewables will not displace the petroleum uses without a mass change in vehicles which in itself will take decades.

State energy policy focused on specific mediums would make more sense than federal. If federal policy were to take a medium stance this would immediately favor certain states over other states. However, keeping it on a state basis allows the state to excel their mediums and create a competitive landscape. The evolution of civilization to use one form of medium to another is typically not altruistic, but of natural evolution of necessity. People always point out the vast nuclear usage of the French as a potential ideal goal for a carbon free world. The French did not set out to do this for the sake of carbon, but because France lacked the abundance of oil and coal. If France was sitting on the Powder River Basin or Barnett Shale, France’s nuclear fleet would be much smaller. The same can be said of the US distribution of energy medium uses in the various states. There is an abundance of hydro plants in the North West and coal plants in the Appalachian area because of the resources there. If there were significant coal in Washington and huge hydro opportunities in West Virginia, they would be promoting each other’s current concerns. A national energy policy would have to be careful to not pick winners, but to support the individual states and a national goal of energy security.

Energy is too generic and covers too many topics for too many people. A discussion on a particular medium and form is required for people to understand the topic. However, the fact is a global market for thermal uses have grown. The domestic surpluses of the electric form of energy have been consumed. US society is slowly changing from a thermal to electric form of energy. This is seen in electric vehicle to telecommunicating. The growing abundance of our gadgets from laptops to tablets to phones has increased our dependence on electricity vs. thermal.

In addition, the mediums of energy are being used in different forms of energy versus historical norms. Natural gas typically was used in thermal form of energy, but is now being more used in its electric form. Coal to liquids could become an option as coal plants are being shunned. Renewables offer a competitive option to not only substitute electric mediums, but could be used to substitute thermal forms of energy. In order to use energy productively we need to cross over the various forms and mediums to develop an optimal path. More people who have experience and knowledge in multi-energy forms and mediums need to be developed.

The cross overs are very hard. I have consulted with Oil & Gas companies to let them know the future of their largest demand source, but several don’t like to understand the regulatory nuances. I have tried to discuss with utilities the dynamics of the gas business, but several don’t like the market risk and the need to change. I have also consulted with renewables institutions and companies. I did serve on the National Renewable Energy Laboratories (NREL) technical advisory team. The issue I saw at NREL is the limited commercialization focus and the limited appreciation of the other fuels. They did a wonderful job in the technical world for renewable, but to see how it was going to enter the market space you have to understand the current investments.

In the end, the convergence will be made and those standing in resistance or blissfully ignorant will likely be left behind. A convergence in the various forms of energy and the mediums has become inevitable. A larger holistic approach to energy planning is needed not just on a national and state basis, but in individual companies. Companies who consider themselves an Oil & Gas or Electric Company should rethink their models and their plans.

Energy is a means to many ends. The energy sector serves society not the other way around. If we do develop a national energy policy, let us hope the developers remember that. States with abundant mediums of energy should think about using the energy. To export the energy medium to only buy back the medium in another form of energy is not optimal for the state economy. Optimal economic benefits occur from productive uses of energy not exporting energy mediums. This is one reason Nations (e.g. Venezuela, Libya, Mexico, etc..) with huge oil resources fail to progress as they do not come up with productive uses of energy and in the end purchase back their own energy mediums, but in more expensive forms.

Let me end with a Thank You! I am grateful for my past in order to have the current moment. I wish each and everyone a wonderful and enlightening 2014.

Your very grateful and humble Energy consultant,

David K. Bellman