Energy Policy – Too Complex to do for the US?

In several energy conferences I have attended, many people are dismayed on how we fail to have a national energy policy in the United States. At the same time, many people are actually very grateful for that fact. This is typically coming from those who are very cynical of government action and ability to appropriately execute. An in-depth national energy policy for the United States is likely infeasible due to the geographical diversity of the US to use various energy forms and the complexity of energy. The only energy policy I could see from a US federal perspective would be a generic focus on allowing inter-state energy transfer no matter what form of energy, a focus on maintaining some level of energy security through technology, storage, and trade, and finally a push to use energy productively.

Energy is a means to many ends. Having energy does nothing useful without an objective of using the energy. The discussion of energy in the public space is typically done with a bias to favor one form of energy to another even though they may not even be directly related. Energy is so broad making it very complex. The complexity allows the energy discussion to be manipulated to the public. This manipulation is sometimes intentional and sometimes out of ignorance.

The two broad forms of energy is potential and kinetic energy. Kinetic energy is the useable form of energy. The potential form of energy is eventually converted to kinetic for final use to achieve an end goal. An example of end goal could be heating your house to traveling from point A to point B. The usable forms of kinetic energy are radiant, thermal, motion, sound, and electrical. To produce those forms of energy, a medium is needed. These can be Oil, Natural Gas, Wind, Sun, Coal, Earth (Geothermal), Hydro, Atoms (Nuclear), etc… Within each of these forms and mediums, people have dedicated their lives to them generating multiple academic and business people. Only a few actually involve themselves across the various forms of kinetic energy and the mediums.

I was fortunate only because of my career path and my desire to continue to learn. Most of my colleagues and friends in the energy space are dedicated to one medium and one form of kinetic energy. This highlights the complexity of the space and the desire for individuals to bias a certain form and medium of energy. My Oil and Gas colleagues would not be interested in understanding the Demand Response call option value compared to the tariff rates structured, just as my Utility colleagues would not be interested in understanding the light-heavy relationships in petroleum products and its impact on crude oil valuations. At some level each of the groups will be “fighting” to support his or her industry. Therefore just as Eisenhower was concerned about the military-industrial complex, I would be concerned about an energy policy driven by one of the energy forms complex versus generating a generic goal of using energy productively and securely.

Having a clear discussion on energy is near to impossible because of the generic “energy” concepts. Energy discussions are littered with ignorant or bias agenda. Case in point, many articles will point to the renewable initiatives leading to a reduction of petroleum products (gasoline, diesel, jet fuel, etc…). However, this is not genuine since the renewables mediums are generally focused on the electric form of kinetic energy whereas the petroleum medium is focused on the thermal form of kinetic energy. Therefore, significant transformation to renewables will not displace the petroleum uses without a mass change in vehicles which in itself will take decades.

State energy policy focused on specific mediums would make more sense than federal. If federal policy were to take a medium stance this would immediately favor certain states over other states. However, keeping it on a state basis allows the state to excel their mediums and create a competitive landscape. The evolution of civilization to use one form of medium to another is typically not altruistic, but of natural evolution of necessity. People always point out the vast nuclear usage of the French as a potential ideal goal for a carbon free world. The French did not set out to do this for the sake of carbon, but because France lacked the abundance of oil and coal. If France was sitting on the Powder River Basin or Barnett Shale, France’s nuclear fleet would be much smaller. The same can be said of the US distribution of energy medium uses in the various states. There is an abundance of hydro plants in the North West and coal plants in the Appalachian area because of the resources there. If there were significant coal in Washington and huge hydro opportunities in West Virginia, they would be promoting each other’s current concerns. A national energy policy would have to be careful to not pick winners, but to support the individual states and a national goal of energy security.

Energy is too generic and covers too many topics for too many people. A discussion on a particular medium and form is required for people to understand the topic. However, the fact is a global market for thermal uses have grown. The domestic surpluses of the electric form of energy have been consumed. US society is slowly changing from a thermal to electric form of energy. This is seen in electric vehicle to telecommunicating. The growing abundance of our gadgets from laptops to tablets to phones has increased our dependence on electricity vs. thermal.

In addition, the mediums of energy are being used in different forms of energy versus historical norms. Natural gas typically was used in thermal form of energy, but is now being more used in its electric form. Coal to liquids could become an option as coal plants are being shunned. Renewables offer a competitive option to not only substitute electric mediums, but could be used to substitute thermal forms of energy. In order to use energy productively we need to cross over the various forms and mediums to develop an optimal path. More people who have experience and knowledge in multi-energy forms and mediums need to be developed.

The cross overs are very hard. I have consulted with Oil & Gas companies to let them know the future of their largest demand source, but several don’t like to understand the regulatory nuances. I have tried to discuss with utilities the dynamics of the gas business, but several don’t like the market risk and the need to change. I have also consulted with renewables institutions and companies. I did serve on the National Renewable Energy Laboratories (NREL) technical advisory team. The issue I saw at NREL is the limited commercialization focus and the limited appreciation of the other fuels. They did a wonderful job in the technical world for renewable, but to see how it was going to enter the market space you have to understand the current investments.

In the end, the convergence will be made and those standing in resistance or blissfully ignorant will likely be left behind. A convergence in the various forms of energy and the mediums has become inevitable. A larger holistic approach to energy planning is needed not just on a national and state basis, but in individual companies. Companies who consider themselves an Oil & Gas or Electric Company should rethink their models and their plans.

Energy is a means to many ends. The energy sector serves society not the other way around. If we do develop a national energy policy, let us hope the developers remember that. States with abundant mediums of energy should think about using the energy. To export the energy medium to only buy back the medium in another form of energy is not optimal for the state economy. Optimal economic benefits occur from productive uses of energy not exporting energy mediums. This is one reason Nations (e.g. Venezuela, Libya, Mexico, etc..) with huge oil resources fail to progress as they do not come up with productive uses of energy and in the end purchase back their own energy mediums, but in more expensive forms.

Let me end with a Thank You! I am grateful for my past in order to have the current moment. I wish each and everyone a wonderful and enlightening 2014.

Your very grateful and humble Energy consultant,

David K. Bellman

Shale Gas and Carbon thoughts

Taking a break on the various issues of utilities from my previous blogs, I was inspired by this article to take on a macro issues of energy involving Shale gas and carbon issues – Is shale gas our future or should we look at other sources of energy? (Molten Consulting).

The title is opened ended… how far is future? And whose future? Shale gas does not and will not make up the majority of energy usage worldwide. It is a substantial portion for the US oil and gas balance. Before there were shale expectations, the theme to balance the energy market was to use all sources of energy including improvement in efficiencies. Supply and demand always meet, it is just a matter of convergence with price as the critical variable to impact supply and demand.

Before Shale:

- LNG imports were going to save the US from sustained $8+/mmbtu prices.

- Imports of crude with a large dependency from Canadian tar sands were going to fill in to maintain oil markets while we slowly convert the US auto fleet to alternative fuels.

- Advance coal would even play a part.

- Nuclear plants were going to easily be relicensed.

- Wind and solar cost would come down in cost and the cross intersection with gas prices at $8+/mmbtu would allow the elimination of subsidies in a few years.

However, shale has allowed this delay as it came with a bonus of liquids production. Middle East LNG and Canadian heavy oil are still there. Both coal and nuclear are actually being hampered because of the shale gas producing poor economics, therefore a significant decline is likely in the US. Renewables will likely continue to require subsidies, and the ability to transform quickly is hampered by the fact that there are physically known recoverable sources of energy to be used if shale gas drops off whether heavy oil, LNG, or even coal.

Technology breakthrough in energy is extremely tough given the capital intensity in the industry. New technology cannot plan or wish for peak oil to produce higher prices to enable their technology. Shale gas has pushed the peak curve much farther out than any of these peak oil theorists would ever imagined. Mr. Shaw brings up the carbon issue as a critical path. Once again, as much new technology cannot plan for peak oil, they probably should not plan on significant carbon prices to make their technology viable. Carbon is not going away, but when countries and individuals cannot even balance their check books, can we really plan beyond 10 years much less 100 years which many of the impacts of climate change will be felt? Debt is no different than carbon, it is kicking the can for the next generation. Therefore, to see any government put in a sustained economic penalty for benefits not seen in decades does not seem likely.

The stretch goal for all new technology in the energy space try to compete with prices now, not on a dependence on something in the future. Just as shale gas came into the picture, other sources of technology have the same opportunity.

Your Optimistic Energy Consultant,

614-356-0484

ScottMadden Energy Update 2 – Coal generation and capacity markets in flux

In this blog, I am moving forward into the ScottMadden Energy Industry update from the previous posting on the Executive Summary. As I noted many times, the real meat of the discussion is in the details. ScottMadden brings up much meat to generate insights.

Coal & Capacity Markets

In terms of the coal retirement story, two fascinating things bring to mind that were not discussed in the update. The first one is the PJM capacity auction which is and should be in serious flux, given the required must run (RMR) status put on First Energy Hatfields Ferry Power Station. A moral hazard has been created probably without intention.

In July, after the capacity auctions dropped from the last auction, First Energy announces the retirement of the plant. In theory, the capacity auction should be high enough to keep the necessary units running. Hatsfield Ferry already has SO2 controls and some mercury mitigation which they recently spent $650 million. It is quite peculiar they announce a retirement for such a plant. Nonetheless, with an RMR designation, First Energy is in the driver seat for this plant. They can in effect “guarantee” a return for the plant regardless of the market condition – low load or low gas prices. This may be quite unintentional but perhaps other utilities should follow and announce retirements.

There is no real mandate one has to follow through with an announcement – similar to announcing a new power plant. (Tidbit of fact if you look at new power plant announcement only around 10-20% get built). One could at least see if they can get their plant to be guaranteed for some time. If not decide later to retire or not retire.

Another point worth discussing, coal in areas of significant wind development (e.g. MISO), how can you not mention the interplay with wind. The big debate is how much wind can be attributed to capacity. When you need capacity in times of high load typically wind is not blowing. The most obvious occasions are the very hot days. However, even on very cold days there is a good chance there is too much ice buildup on the blades to obtain any electricity. Therefore, the wind capacity is generally discounted for capacity value. At the same time a trend you can see to the angst of coal units in markets with large wind is the intermittent availability. The coal plants cannot cycle without significant risk of increase maintenance. This has led some coal units to just turn off versus trying to chase the wind.

To capacity market or to not is the question of many market organizers. ScottMadden presents the grand experiment in ERCOT with an energy only market. Discussing capacity markets are as contentious as religion as noted in my Regulation vs. De-regulation blog. In hopes of taking out some of the religious fever on the topic I like to discuss it on a math basis. A market with regulation typically gets a return on investment between 8-12%. If the market is free to compete, the risk is increased. Therefore, the reward needs to increase above the regulated return requirements. This increase leads to boom bust cycles as rewards are large and eventually attract many suppliers.

Not all the suppliers are smart and so herd mentality is likely leading to a market bust when in a boom and market boom when in bust. A boom bust cycle is okay for goods such as beanie babies to cars to cell phones etc… However, power and water have become essentials for society and producing boom and bust cycles will likely lead to very instable society. The spread between the current regulated framework of 8-12% return to now 15+% rate of return, I contend is too great for society. I do agree the potential for a more efficient market is very possible with an open market, but society is not willing to take the means needed to achieve the ends of a more efficient market.

Outside ERCOT, many are trying to rectify the de-regulation imbalance with the security of regulation by offering a capacity value to incentive build before the energy only market induces a build. I believe that there needs to be a more creative way to reduce risk, thereby reduces rewards requirements. As an example, one source of reducing risk is to offer pre-designated projects with permitting and locational issues cleared by the RTO. The RTO can then auction off these locations.

We are now at the half way point of the ScottMadden Energy Update. As you can see the update is more valuable in not just the facts they present, but from those facts the ability to stimulate alternative ideas and potential concerns – insights as like to call it. I will continue on with this in my next blog.

In the meantime, please do consider All Energy Consulting for your consulting needs as I can help you see beyond the facts to find issues impacting your business directly.

Your Energy Consultant,

614-356-0484

Integrated Resource Planning (IRP) Continues to Use Antiquated Methods – Strategist at risk of disallowances

The most popular software for Integrated Resource Planning (IRP) in the US is probably Strategist by Ventyx, who is now part of ABB family. ABB focus is power and automation technologies with revenues of $40 billion. Unfortunately, for Ventyx, software represents a speckle in terms of revenue in the grand scheme of ABB business.

The history of power planning involved numerous methods of short cuts, given the instantaneous nature of power and the lack of processing capabilities in the past. The instantaneous nature continues with power markets being settled hourly, if not sub-hourly, in some markets. Processing power has well advanced forward, following the famous Moore’s law. However, we still see short cuts in software such as Strategist.

In the recent filing done by Public Service of Colorado – parent company Xcel Energy – http://www.dora.state.co.us/pls/efi/efi_p2_v2_demo.show_document?p_dms_document_id=240772&p_session_id=

You will note in the documentation: “The Strategist model represents load for each month with a typical week composed of 168 hours that is then repeated to capture the full load for that month. As a consequence each 168 hour week is individually dispatched to minimize system cost.” A large assumption is being made that a week hourly shape within a month is relatively consistent. This is not a good assumption given the changing of seasons plus just the very nature of weather. Averaging the weeks into a month loses the variability of peaks and troughs. Historically, this was not important when intermittent resources were not so relevant, and computing power was limited.

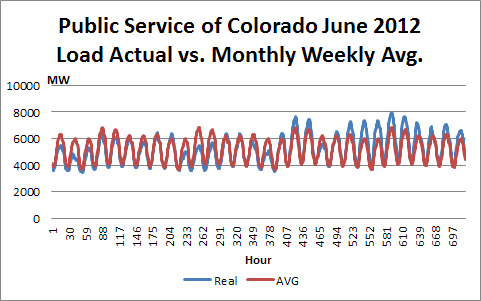

However, times have changed and the process need not be shortcut. Below is the graph of Public Service of Colorado hourly load for the month of June 2012. The graph compares the average weekly line that would be used in a tool like Strategist to the actual hourly data. You can see significant differences in the shape. In fact the peak drops 14% and the minimum load rises 7%.

I currently don’t work for any software company, nor am I being paid to endorse any software product so I can say without a bias, Strategist,in its current form, is a risky software to use in the world of intermittent resources. With cost rising in all areas in the utility business, any misstep can lead to significant disallowances. Also, noted in the same document was an issue of space which limited the software to do a full optimization. “Despite algorithm efficiencies and Company efforts, such as locked expansion plan tails, this particular approach to expansion planning has the potential to eventually build more candidate plans than the data storage capabilities of the software can accommodate.”

This concern came from a result of Strategist design to evaluate the various options. Strategist will calculate all permutations regardless of cost effectiveness. Strategist limits some of the permutations by employing the Bellman Optimization method – no relation to your Energy Consultant but worthy tidbit of knowledge. To a large degree, I concur with this method. You want to see the various permutations since the most likely case to choose from will be a plan that is likely suboptimal in all reasonable scenarios. At the same time, it is also cost effective in all scenarios. If one were to focus on a particular optimal plan, feeling certain about the future would be too much of a gamble given the many moving parts in the energy space. A robust and resilient plan, that can be relatively cost effective in low and high for natural gas price, economy, carbon constraints, etc. world, is the better plan. This resilient/robust plan in each individual outlook of the future will likely be sub-optimal.

An alternative way to produce the robust/resilient plan with limiting the permutations is to go ahead and solve for the optimal plan given a discrete input. Ignore the various permutations. Alter the discrete input/scenario and solve again. In the end, you may generate many optimal plans in the various discrete input/scenario. With the various optimal plans, one could then run the optimal plans in the various discrete inputs/scenarios and see the additional cost of not knowing the future exactly. In addition, one could also create a permutation from the runs and see if it would produce a net benefit in terms of the cost in all the discrete inputs/scenario. The most robust/resilient plan will demonstrate a cost limiting plan in the various discrete input or scenarios employed. One could also test all the plans through a Monte Carlo simulation giving additional analytical rigor to the robustness and resilience of the plan.

I have spent much time thinking about devising ways to enhance and produce robust and resilient resource plans. There is much thought and process that can go into making a plan that would be at the very least considered a CYA plan. Taking short cuts in calculating and processing the power markets given its reliance on more and more intermittent resources should be avoided. Processing power, the value obtained, and the precision available for the various inputs support moving to hourly modeling without shortcuts. Sub-hourly inputs are not precise enough to do long-term planning runs and the benefits will be limited. Strategist could still have its place as an IRP software given that they spend some time upgrading it.

Your Resource Planning Energy Consultant,

614-356-0484

Be wary of Energy articles ….take the time to go an inch deep

I found this article highlighted and posted on several sites – http://www.renewableenergyworld.com/rea/blog/post/2013/09/utility-agrees-their-solar-should-supplant-natural-gas#!

I was not planning to respond to this article posting as I did not want to legitimize the article, but it looks like there are so many comments on it already and that it has spread to many other sites. I think I can, at least, use the article to highlight the fact that many people post them without much substance, and it seems like the public does not mind or care. All you have to do is look an inch deep to see this article is not credible.

This article is clearly bias from the author to the publisher – probably no different than those found on the American Petroleum Institute on Oil & Gas related documents.

The article tries to relay an analytical unbiased rigor – however, that is clearly not the case with just a simple digging of the facts. Mr. Farrell reports the cost of a natural gas power plant which at the very least he links to the report. However, I guess he knows the average reader will not look into it, and it will make him look like he is on top of it. The report is a 2009 California report. IF one just took the time to look at it, the report is not a good document to source from. The natural gas price used in the report for 2013 is $8.28/mmbtu and rising to $12.23 by 2020. For a frame of reference the current forward curve for natural gas is marked at $4.96/mmbtu for 2020. The current fuel price shows a 60% discount from the report he is referring his readers to.

In addition as I have noted many times, Levelized Cost of Electricity (LCOE) needs to be taken with some caution – https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ LCOE gives the person who is doing the calculation many opportunities to introduce bias – from assumed operational performance without incorporating reality.

I understand people will post things likely to their bias, but I do not think we should legitimize articles which lack any analytical rigor. I really did not have to dig far to see the article lacked substance. If Mr. Farrell just focused on the falling solar prices – which is a real, credible and worthy of noting – then, the article could have had some credibility. However, he introduces a comparison which is outdated, only to support an attention getting theme, which holds no credibility, but in fact, misinforms the reader.

Please do consider All Energy Consulting for your energy consulting needs – Market Analysis – Technology Review – Modeling – etc…

Your Unbiased Energy Consultant,

614-356-0484

Power Modeling More Complex than Refining Modeling

With my background in refining modeling, I can say power modeling is more complex than modeling most other markets. The process of producing power is not as complex as refinery production, but the final product pricing and market is significantly more complex. The refining modeling focus is typically on optimizing yield value while changing the crude input quality within the refineries capabilities. The products can be stored and transported to the highest paying markets. With power you just do not have that luxury of storing or even watching where it goes. I will admit there are certainly more dollars in the Oil & Gas world than the power world.

The power market is highly reliant on what the neighboring power plants are doing, and now potentially, your own customers. The other power producers may not be using the same feedstock as you. They also may be operating the plant differently, nonetheless, their actions impact the price and flow of your power in that instant. The amount of information that must be processed in the power markets, to say the least, is voluminous. To do proper power modeling, an hourly model is recommend. If you do not do an hourly calculation you can be misled, for example as in LCOE calculations (https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ )

There are really two types of modeling that one can do. One is to try to understand market pricing and market dynamics, such as coal and gas demand. In this setup, you draw your circle quite large and potentially model the entire N. America, which I have done numerous of times. In this setup you will model over twenty thousand units. The alternative is to model one’s own system for near-term operations or long-term resource planning, or both. The market prices become exogenous inputs to the model. I would caution against this setup in isolation due to the potential impact you may have on the exogenous inputs. However, in most cases, one typically runs a series of exogenous price inputs to capture the variability.

Both alternatives still deal with the commodity inputs and the load forecast, with the latter being the more potent of the two, assuming you use commodity outlooks across a reasonable range. Whether you are trying to understand market fundamentals or your system budget, you will have to deal with significant uncertainties. Market based modeling compounds your uncertainty multiple times. Modeling your own system, you compress a good portion of the uncertainty into the market price. However, you still are left with dealing with policy issues (to Carbon Price or not – Renewable Portfolios – Demand Side Management – etc…). Of the many moving pieces noted in the check list below, most change frequently over time.

Power Modeling Check List

- Load

- Resources and their Fuel Options

- o Coal – by unit, as coal type and transportation is individual (~1300 units)

- o Gas – by unit, as each plant could have multiple fuel pipeline access (~4600 units)

- Resources and their Performance Attributes

- o Uptimes and downtimes

- o Ramp rates

- o Maintenance

- o Cycling

- o Start-Up Cost

- o Minimum Capacity

- o Variable Cost

- o Fixed Cost

- o Emission Rates

- o Secondary Fuels

- o Heat Rate – Heat Rate Minimum and Curves

- o Storage, Recharge and Initial Contents – for battery & pump storage

- o Bidding – fuel adders to multipliers

- o Performance Shapes (Solar & Wind)

- Emission Pricing

- Federal, Regional, and State Policies and Standards (Renewable & Carbon)

I have been power modeling for over 10 years now – both hands on and managing a team. Recently, I have spent two years modeling for a client essentially being their outsourced modeler. The experience has proven to me the viability and value power modeling outsourcing can have. I would not recommend a complete outsourcing, but I can certainly see outsourcing the functionality pieces. As Managing Director of Strategic Planning at AEP, I would have loved to maintain some continuity with my power fundamentals team and my modelers as they left for bigger and better jobs. Each modeler when left to their own devices will devise a custom setup to manage all this information. The new process would likely leave out something or be organized slightly differently. Sometimes you get quite an inexperienced modeler and they leave out some crucial issues in the power model.

Power modeling implementation is not as simple as rolling out a new version of office and should not be treated that way. Even with “out of the box” software implementations from People Soft, Oracle, SAP, CRM, you still need to bring a whole team of consultants to make sure the process gets implemented effectively. Why would you not take the care to make sure your power modeling is implemented effectively? It does not take a whole team of consultants as People Soft, Oracle, SAP, CRM software would, but you should take advantage of experienced professionals. I know some of the software vendors offer implementation help – but just like People Soft, Oracle, SAP, CRM software, it is best to get people who actually do it as a living. The software people are spending their main resources on their software rightly so. Therefore, talent is not necessarily on par to achieve your business needs.

My power modeling offering is here for you to maximize your investment in both software and staffing. To read more about my offering please visit – http://allenergyconsulting.com/2011/11/modeling/

Your Power Modeling Consultant,

614-356-0484