Clean Power Plan Assessment from a Market and Engineering Perspective

There are many reviewing the recent EPA – Clean Power Plan. Many argue from a policy perspective and rarely actually review the details and the numerical results. In this discussion, I will share with you my initial takeaway from reading the 645 Clean Power Plan along with hundreds of other pages in the Technical Source Document (TSD) plus the Excel files supplied. In addition, I did use my Power Market Analysis (PMA) model to validate and cross check some of the results.

Let me first give some background to those who do not know me. I am a Chemical Engineer from the University of Texas at Austin (hook’em horns) by training, however I have spent most of my professional life in analyzing and understanding energy markets (Purvin & Gertz (now IHS), Deloitte Consulting, American Electric Power). Please don’t hold the American Electric Power experience as a foretold bias on coal. I have served on the National Renewable Energy Laboratory (NREL) technical advisory panel so I do know the issues and trends of renewable power. My fellow panel members would vouch for my impartial attitude. I am a numbers person who holds not personal bias other than the desire to optimize the numbers. Truth be told, I was a leader in the AEP organization in terms of indicating the need to diversify and support gas investments even as gas markets were soaring, as my groups long-term forecast indicated prices to settle between $5-7/mmbtu for my entire tenure at AEP (2002-2010), to the angst of many AEP colleagues. My forecasts are not driven by personal biases or political motivation, but the desire to understand and know the markets. I live by the University of Texas motto “The Truth shall set you free”.

I have approached the Clean Power Plan Assessment in a similar fashion. I am opened minded on the need and societal desires to be cleaner. Striving to have a positive or the least negative impact on the earth will always be a good intention. As long as people are clear on the cost and potential gains, I would not challenge the path society has chosen.

There is so much one can note on a 645 page plan. The document was repetitive in several places – the ironic thing is on page 581 there is a note on the Paperwork Reduction Act. I was taking my own notes as I read the document. My notes ended at 17 pages. I have reorganized my thoughts to hit the most impactful points first.

I think the very first thought that should rush into everyone minds is the rate focus EPA has. The EPA, compared to many of the previous emission reduction goals, is now pushing a rate based target (lb/MWh) vs. a tonnage limit as seen in SO2, NOx, and even the initial HG program. They do offer the option of mass based target, but clearly favor the rate based approach. This took many nights to truly understand and absorb all the nuances as to why this is the case. The first thing in order to understand this approach is to understand the rule is focused on EXISTING units and those recently under constructed. This is a key issue on why the buildings of new gas plants are not listed as an option for Best System of Emission Reduction (BSER). Currently the new gas plants will likely be limited by section 111(b) of the Clean Air Act (CAA). “In January 2014, under the authority of CAA section 111(b), the EPA proposed standards for emissions of CO2 from newly constructed fossil fuel-fired electric steam generating units (utility boilers and integrated gasification combined cycle [IGCC] units) and for natural gas-fired stationary combustion turbines.” The limits proposed for new gas plants would be an achievable solution for 24 states. The other states will have to go lower than gas plants. For this reason, I suspect the gas plants were not a BSER solution nor were they discussed for more than a few paragraphs.

The rate method also allows an “easy” way to give value and credit to EE and renewable projects. There seems to be some conflict in allowing this given the plan currently notes: “Based on the EPA’s application of the BSER to each state, the EPA is proposing to establish, as part of the emission guidelines, state-specific goals,expressed as average emission rates for fossil fuel-fired EGUs.” However by allowing EE and Renewables to modify the rate calculation, it seems to have conflicted with the above statement. The argument is made that EE and renewable generation can be attributed to the affected EGU. “A MWh crediting or adjustment approach implicitly assumes that the avoided CO2 emissions come directly from the particular affected EGU (or group of EGUs) to which the credits are applied”

EPA spent much time focused on their BSER suggestions laid out in four blocks:

“1. Reducing the carbon intensity of generation at individual affected EGUs through heat rate improvements.

2. Reducing emissions from the most carbon-intensive affected EGUs in the amount that results from substituting generation at those EGUs with generation from less carbon-intensive affected EGUs (including NGCC units under construction).

3. Reducing emissions from affected EGUs in the amount that results from substituting generation at those EGUs with expanded low- or zero-carbon generation.

4. Reducing emissions from affected EGUs in the amount that results from the use of demand-side energy efficiency that reduces the amount of generation required.

Based on that evaluation, the EPA proposes that the combination of all four building blocks is the BSER”

The EPA first BSER seems to be somewhat of a red herring. They spent quite some effort only to conclude a small impact. I oversaw a paper on power plant efficiency for the National Petroleum Council Hard Truths. A very similar conclusion is shown in that only a few percentages are likely to come from an existing unit improvement. This impact is the smallest by many percentages compared to blocks 2-4. I do have concerns in their extrapolation for opportunities for improvement in the existing US coal fleet. In their spreadsheet model, they take 2012 generation and assume a 6% improvement. The issue I quickly see with this math is the fact the likely remaining coal units that are running after 2020+ are likely the best of the best coal units to begin with. These coal units did not get to be the best ignoring best practices, therefore the remaining coal units will have much less opportunity to improve heat rates compared to the units that will likely be retiring (From EPA own analysis 72 GW 2016 to 101 GW by 2030 (cumulative)).

The second block is the most interesting block in my mind. It is also the second most impactful of the blocks only few percentages away from #3. When dispatched is discussed, one should quickly jump to market conditions. A dispatch of power plants is largely driven by load and fuel commodity price relationships. The first issue, largely perhaps by coincidence and unintentional is their use of 2012 data. Out of all the years one could choose, 2012 is probably the LEAST likely year in the future in terms of commodity price relationships. The spread between coal and gas prices was less than $0.40/mmbtu. Nowhere in the forecast is this price spread being predicted. In the models being used, the spread is closer to $3/mmbtu. This produces an abnormal level of coal generation to start their calculation of targeted rate. In order to get gas units to perform in the 70% utilization range, retirement of existing coal unit and/or the spread of the fuel cost need to narrow. Using a carbon cost will narrow the economics. I did run a 2016 carbon case with $30/ton, and it did produce NGCC utilization rates close to 70%. Therefore there is an agreement with the statement “For the scenario reflecting a 70 percent NGCC utilization rate, comparison to the business-as-usual case indicates that the average cost of the CO2 reductions achieved over the 2020-2029 period was $30 per metric ton of CO2”. What I will be concerned with is the statement “Projected wholesale electricity price increases over the same period were less than seven percent in both cases, which similarly is well within the range of historical electric price variability” I think they are referring to the gas price change impact due to more demand. However the question really should be the impact of making the gas units 70% utilized which is done by adding the $30/ton carbon cost. The 7% increase would seem very unreal with the math of only dispatching difference and carbon of $30/ton. When I model 2016 with and without $30/ton carbon, it results in significant price increases. PJM-West prices rise 50%. In terms of total system impact, the 2016 case without carbon is showing total US energy revenue for all the plants of $168 Billion. Adding carbon increases the energy revenue to $253 Billion, an increase of 51%. It is possible to lower the cost as certain markets are closed system and may not pass the cost directly to the consumer. However, market principle for the majority markets would apply and this is increasing as more utilities de-regulate their generation. Another potential for price increase mitigation could be if they model more than block 2 and included renewables. Renewable PPA deals do collapse the wholesale market, but those cost show up on the retail prices. However they discussed this in the block 2 discussion. There are regions where prices move up only 17%, but, on average, prices are up 50%. This brings up another can of worms in terms of state impacts from one to another. Out of the hub reporting I am looking at, Indiana will be the biggest hit. I am at loss to understand the minimal discussion of energy price impact of $30/ton carbon cost. A true impact study should show the case where coal units are running and then adding carbon cost to essentially push out coal units should be the comparison. They do note the multi-pollutant benefits, counter to that they should also identify the multi-pollutant cost by modeling a business as usual case (no MATS, CSAPR, CPP, etc…).

There is much to digest here so I will pause before discussing blocks 3 & 4.

We can help the policy discussion in terms of running independent assessment and help develop strategies to best plan for the future. Please contact us 614-356-0484 or [email protected]

Your Inspired Energy Consultant,

David

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Finding Power Trades Arbitrages

Markets are only efficient in their ability to process and understand the markets. Power markets are likely one of the least efficient markets moving a month out largely due to its multi-variable dependency on multiple commodities and its lack of storage capabilities. Given this, there are many trading opportunities. PMA has incorporated trade screening capabilities to help identify arbitrages in the market. Three screeners were developed and can be customized – power price, power heat rates, and power spreads.

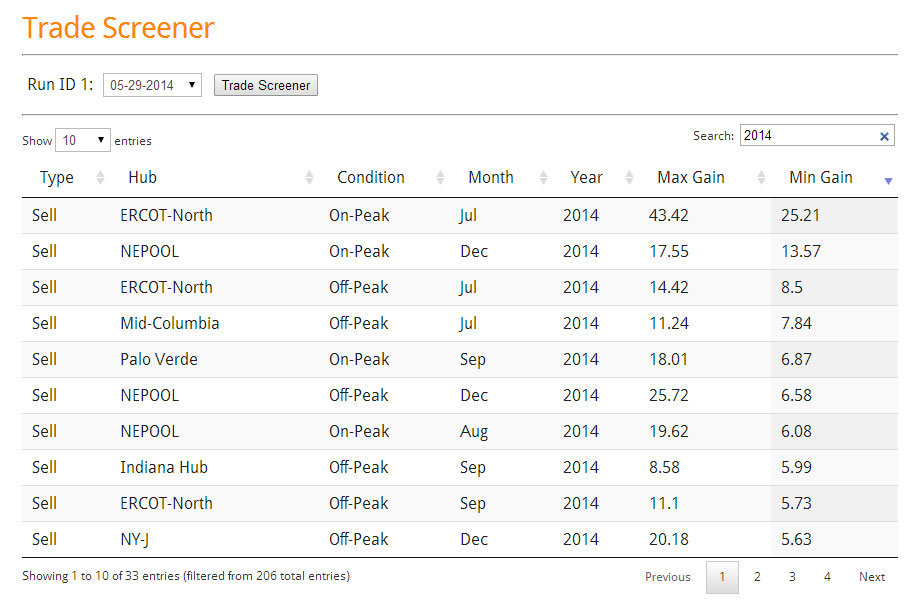

The power price screener searches through all the curves produced by the PMA process in all three cases – high, low, and base. The criteria for developing the high, low, and base can be customized. The screener compares each case to the forward curve. In the current default, the screener is finding trade opportunities where all three cases sit on one side of the forward curve. If it is above the forward curve it notes it as a BUY and calculates the maximum gain and minimum gain. If it is below it notes it as a SELL and calculates the maximum gain and minimum gain. Each morning you can come into PMA and process this. It takes less than a second to produce an interactive table where you can easily sort and search. As an example, we have a screenshot below:

Power Price Trade Screener

(Click Image to Enlarge)

In the above screenshot the model has screened through 1,620 potential cases. In less than a second, 214 trades identified and filtered to show only the 2014 trades. The trades are sorted on min. gain which essentially is identifying the best opportunities in the market with limiting risk. The model is favoring selling based on the filter criteria which is a reasonable expectation given the market premiums are rather large due to the strong winter experience.

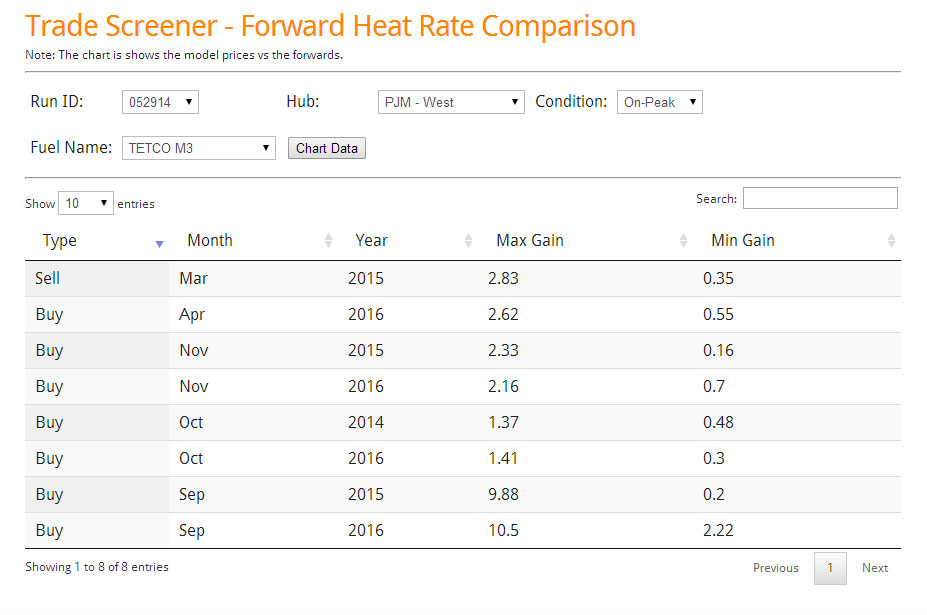

The next trade screener is the Heat Rate Screener. In this case, you have to pick the market and the gas basis you would like to use.

Heat Rate Trade Screener

(Click Image to Enlarge)

The above screenshot screened the PJM-West/ M3 heat rate curve. Only 8 trades passed our criteria.

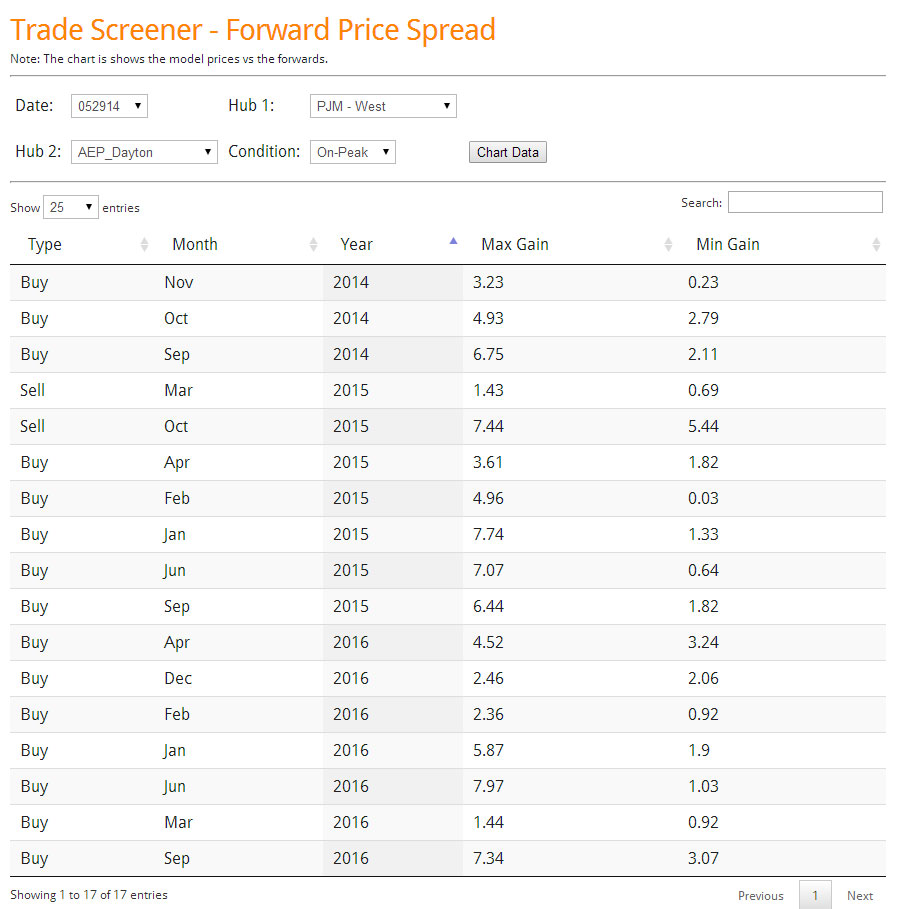

The final screener we developed is the spread screener. In this case, you pick the two markets you would like to examine.

In the above screenshot, we show the 17 trades for the PJM-West minus AD-Hub that passed the criteria. One of my personal favorite trade is showing up here – PJM-West-AD-Hub Jan Buy with a potential gain of $7.74/MWh and an expected min of $1.33/MWh. If the market gets colder you can probably anticipate higher prices in the west relative to AD. I suspect coal units this winter will perform much better than last winter per lesson learned. Likewise, if it gets warmer we can expect AD to fall much quicker with gas basis dropping more significantly in the region to compete with the coal units.

All these screeners and also the criteria for high, low, and base runs can be customized for you.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

We are focused not only on supplying answers, but empowering you to find answers.

Your Inspired Energy Consultant,

David

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

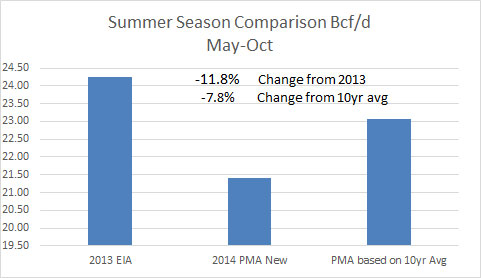

Gas Storage Model – Predicting $1/mmbtu Weather Risk

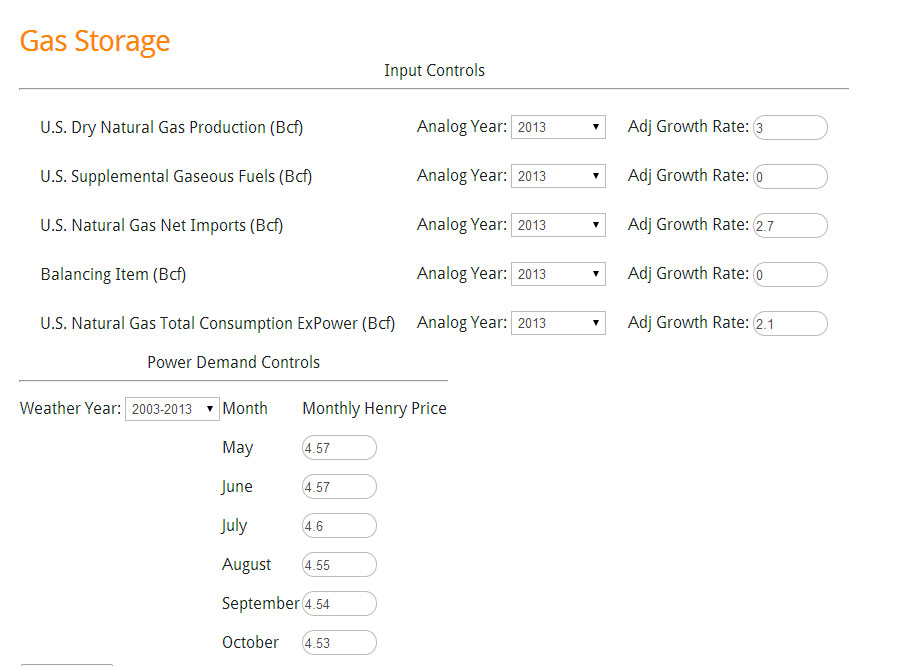

A new tool is added to the PMA package – an interactive gas storage model. The gas storage model value lies in the set of 35+ pre-set runs for the power sector enabling the user to create their own version of the future without having to wait. AEC specialty lies in the power modeling world. With this in mind the model allows users to change their assumptions in the other areas of the gas balance (e.g. production, imports, demand outside power sector, etc.).

A demo version is available http://allenergyconsulting.com/Data/DemoGasStorage.php . The demo gives the user all the capabilities other than changing the prices for Henry hub in the months of Jun-October. An example of using the tool is described below.

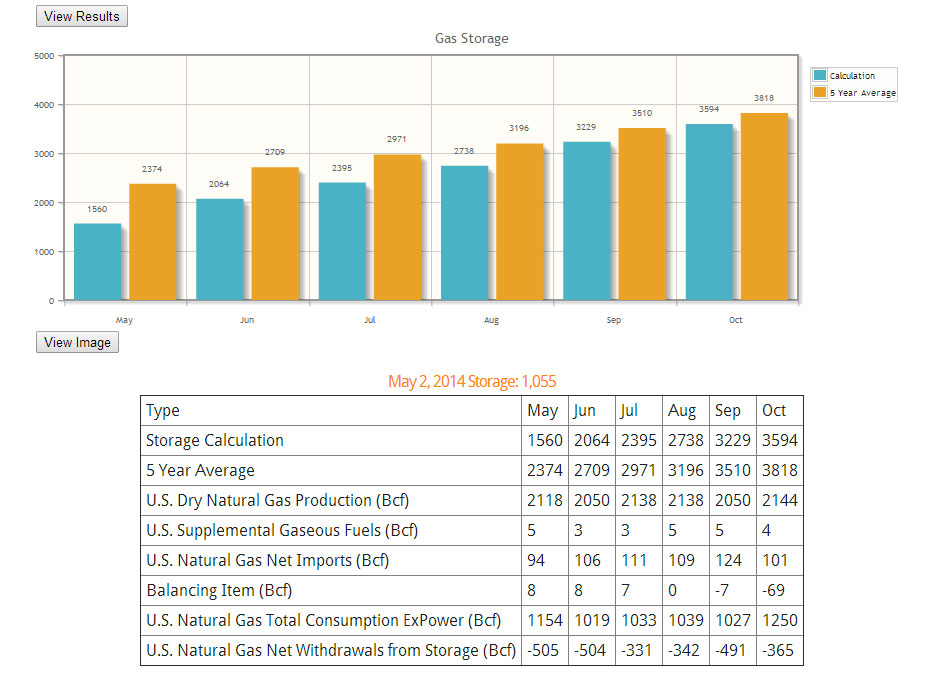

Recently the EIA did their own analysis of the end of summer inventory. In their analysis, they conclude ending storage level will be 3.4 TCF lower than the 5 year average of 3.8 TCF. To test our model, we used their assumptions outside the power sector. EIA assumed production only grew 3% from 2013. To put that into perspective, the 5 year average is closer to 3.8% and this was during very low price signals. EIA used imports that are much higher than the recent trend with an increase of 2.7%. 5 year average imports have declined by 15%. We also incorporated their price forecast – see below image.

Gas Storage Model Input (Click to Enlarge)

Using the 10 year average weather, our models show the final storage numbers closer to 3.6 TCF using all the assumptions. This was expected given the general under-estimation of the power sector to respond to significant rise in gas prices.

Gas Storage Model Output (Click to Enlarge)

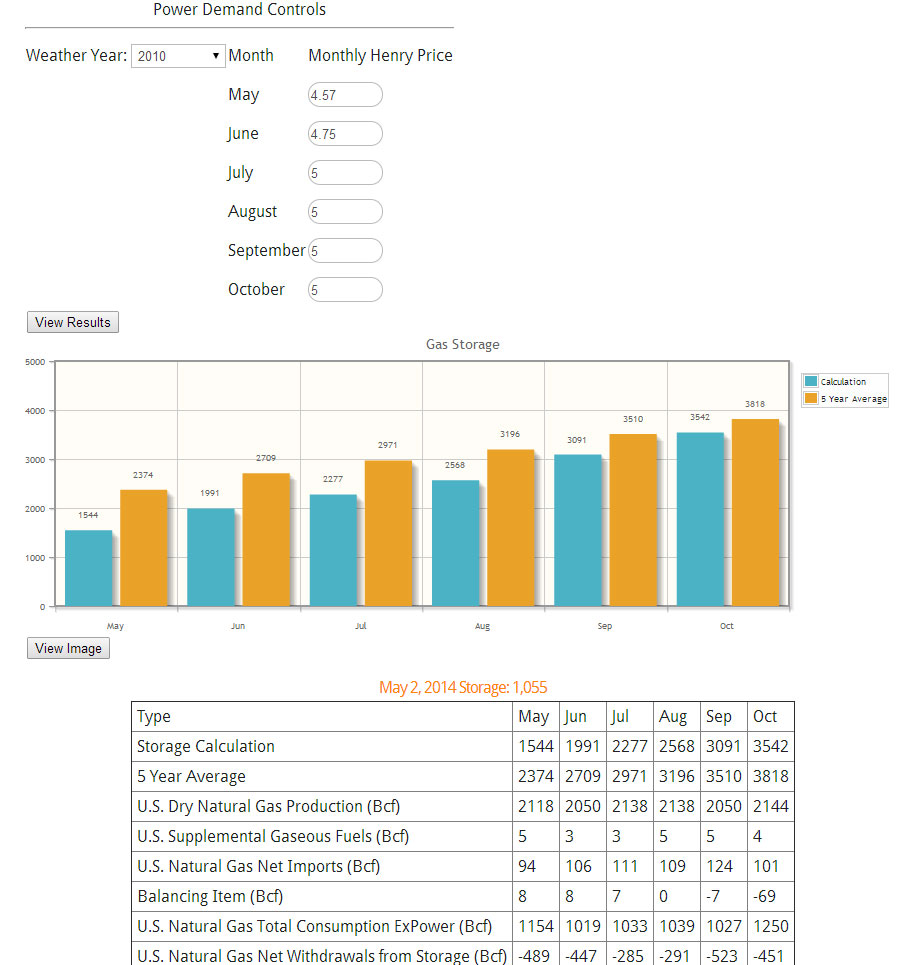

Another use for the model is to create your own gas price forecast by targeting a storage number. As an example, if we changed the weather to be an extremely hot summer, we can change the weather drop down to 2010 per our 10 year weather analysis report.

In this case, we had to change the gas prices in order to maintain a 3.5TCF ending inventory. The gas price that solved for this was $5/mmbtu. One can put even more finesse into the forecast by adding more seasonality than what was shown. In addition modifying the non-power demand would be a prudent task.

Gas Storage 2010 Weather Scenario (Click to Enlarge)

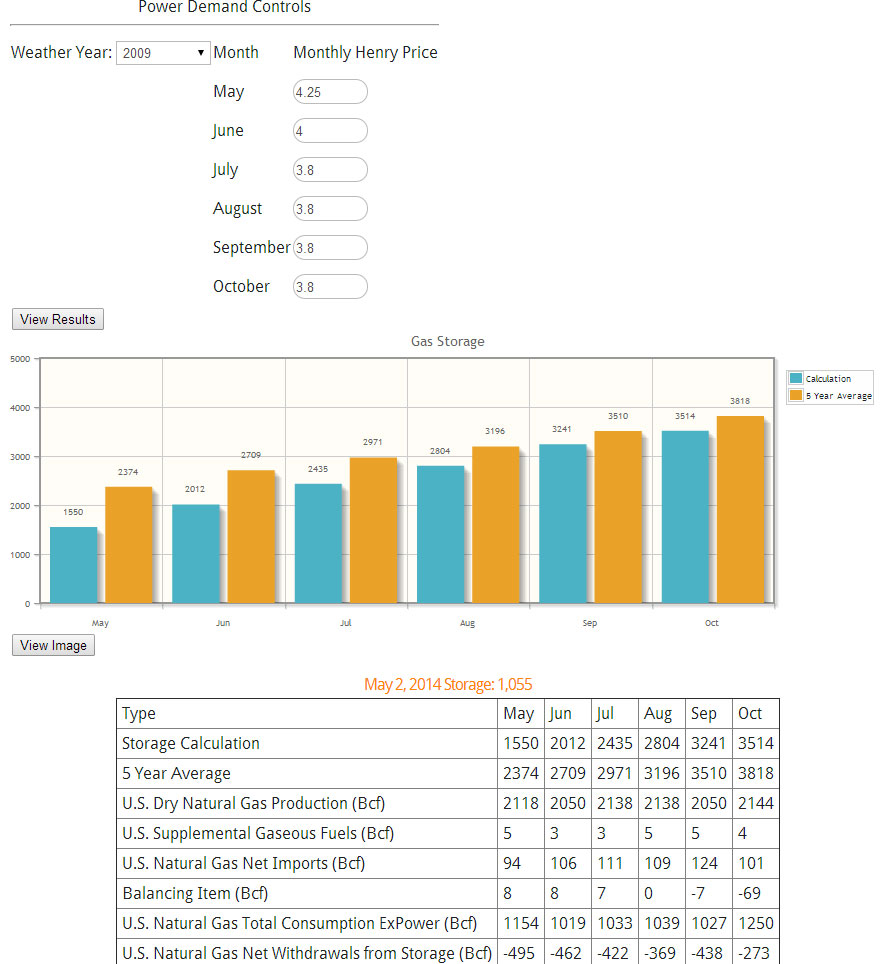

The opposite of 2010 would be 2009 weather. Applying the same technique and target of 3.5 TCF, we get a price level of $3.8/mmbtu.

Gas Storage 2009 Weather Scenario (Click to Enlarge)

Rather quickly, we now understand the weather risk involved in gas can amount to over $1/mmbtu.

The model does require updates since each week there is an update to the storage number. In addition, the relationships were established based on the April 22nd 2014 market prices. We plan to update the relationships monthly. The coming update for the model will include enhanced basis control plus be expanded to cover to the end of March of next year.

Besides the gas model, PMA subscribers get the daily files, and the study files. In addition, prime members receive-at no additional cost reports such as the the Summer 2014 Outlook report and the 10 year weather analysis. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

We are focused not only on supplying answers, but empowering you to find answers.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sell Winter PJM-West? Trading & Risk Product

A common question is how can I use PMA in my organization? There are multiple ways PMA can help your organization including enhancing all focus on the gas, coal, and power markets. PMA can increase your fundamental understanding in the gas, coal, markets. PMA can help you evaluate generation assets and portfolios. PMA can also be used to evaluate risk and trading opportunities. In the following example, we will describe a simple case of how PMA can deliver a potential trading opportunity and be used to evaluate risk and reward.

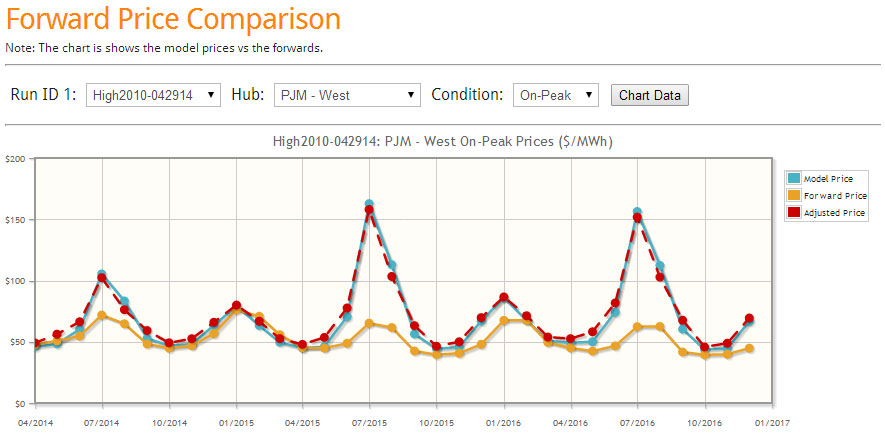

With the new online interface, one can quickly get an assessment of the model in relationship to the forward curve. PMA runs every day with the latest futures markets prices for natural gas and coal. Three scenarios are run each day – Base, High Power Price, and Low Power Price case. The Base uses a normalized weather based on 2003-2013. The high uses the 2010 weather pattern, and the low uses the 2009 weather pattern. The selection of these years are based on our 10 year weather analysis just completed a few weeks ago. The high and low also changes henry hub and retirement and builds plus forced outages – a complete description of the cases are available for our subscribers.

The following are direct screen shots from our latest online interface for the April 29th runs. Three lines are presented. The yellow solid line represents the forward curve. The blue solid line represents the model output. The dash red line represents the historical tendency of the model from our 4 year calibration run by month. In the example below, the model has a tendency to under-forecast the shoulder months- therefore the dash red line above the blue line.

Base Case (click image to enlarge)

In the Base Case, we can identify that this year summer and winter could be a potential sell given both red and blue line below the futures curve.

High Case (click image to enlarge)

In the High Case, the summer sell is not looking too good. If the summer temperatures are to be similar to 2010, and gas prices move up 50 cents and planned new builds fail to perform or deliver as expected, PJM West summer prices can blow up leaving the sell summer trade losing over $30/MWh in July. However, the winter trade shows a rather smaller worse case scenario of $5/MWh in January.

Low Case (click image to enlarge)

The Low Case represents the potential reward of the sell trade. In the summer, the potential gain in the sell trade is around $12/MWh for July. This is the same spread seen for the winter sell trade for January.

Clearly, the risk and reward view would point to the winter trade over the summer trade. I would suggest a few more next steps before exercising the winter trade. Potentially, I would identify a spread to be long to balance mitigating against any major catastrophic event such as major gas pipeline issue. This spread can come in the form of ON-OFF peak spread, location spread, to a heat rate trade. To identify the other side, one can easily research that by using the drop down menus and following the same analysis above. Another step I would take is to run additional price, weather, and outage scenarios. PMA subscribers have complete access to all this.

Besides the easy to use online interface, PMA subscribers get full access to the data files. PMA subscribers get the online access, the daily files, and the study files. In addition, prime members receive-at no additional cost reports such as presented above, the Summer 2014 Outlook report , the recent briefing on what is causing the gas demand drop, and where it is coming from. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

A demo of the daily file is available with restricted viewing. Click here to download. Please contact me to schedule an online demo meeting[email protected] or 614-356-0484

We are focused not only on supplying answers, but empowering you to find answers.

Your Inspired Energy Consultant,

David

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

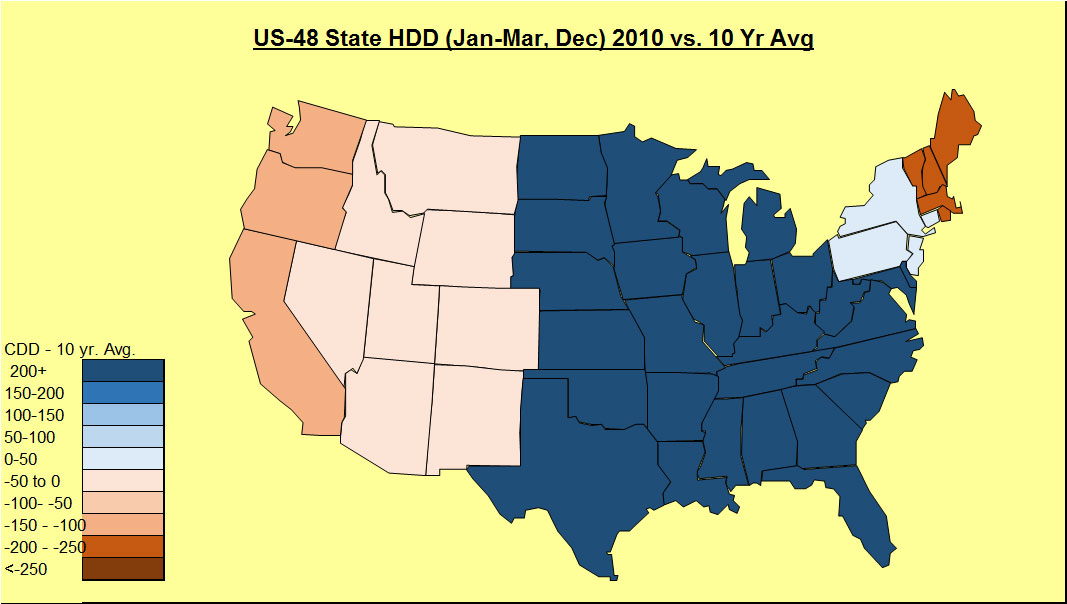

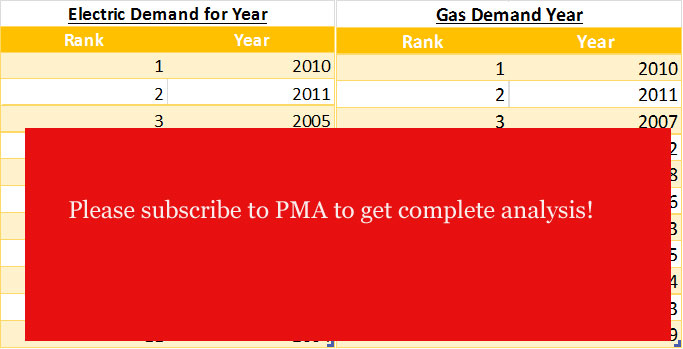

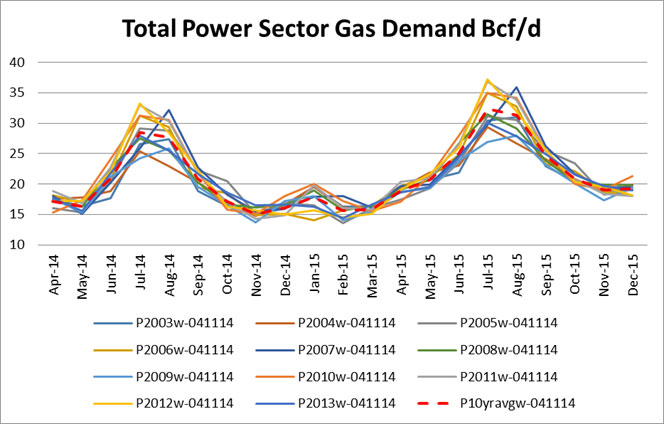

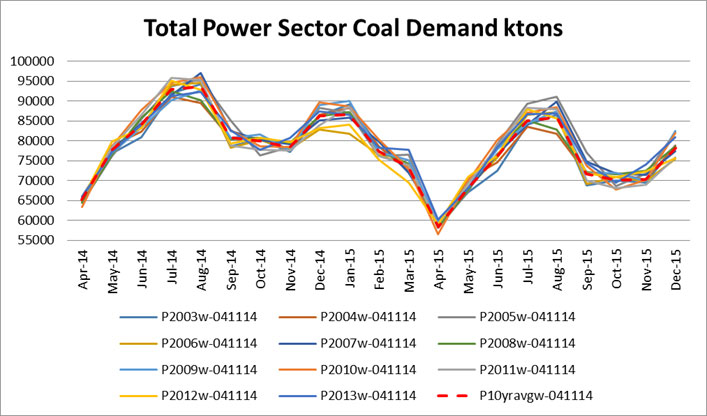

10 Year Weather Analysis Show 2010 Most Volatile Year

Weather has been one of the largest variable for power, coal, and gas markets. In the latest study available to PMA subscribers, each of the last 10 years of weather was put into our load and power model to deliver a concise view of the impact of weather.

The study individually graphed the variation of weather for both summer and winter impact. The most volatile year happened to be 2010.

2010 Winter

2010 Summer

In addition, each year was ranked according to the electric and gas demand. The electric and gas demand do not necessarily align as different regions have various portfolio of generation options.

Total Year Ranking

Fuel burns and power prices are also presented in the study.

Gas Demand

Coal Demand

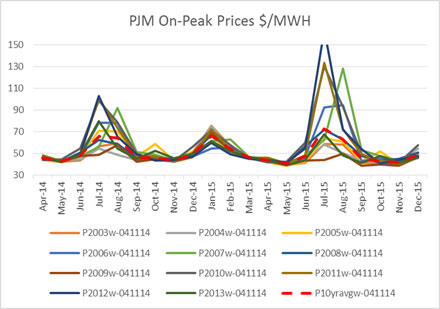

PJM On-Peak Prices

PMA subscribers get full access to the data files. Both on and off peak prices are in the data file plus over 15 regions across the country. Demand can also be broken up by state or even coal basin. This analysis allows weather to be quantified for gas demand, coal demand, and power prices. In addition any asset or portfolio can be extracted from the data to learn how sensitive these assets are to weather.

PMA subscribers get the online access, the daily files, and the study files. In addition, prime members receive-at no additional cost reports such as presented above, the Summer 2014 Outlook report , the recent briefing on what is causing the gas demand drop, and where it is coming from. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

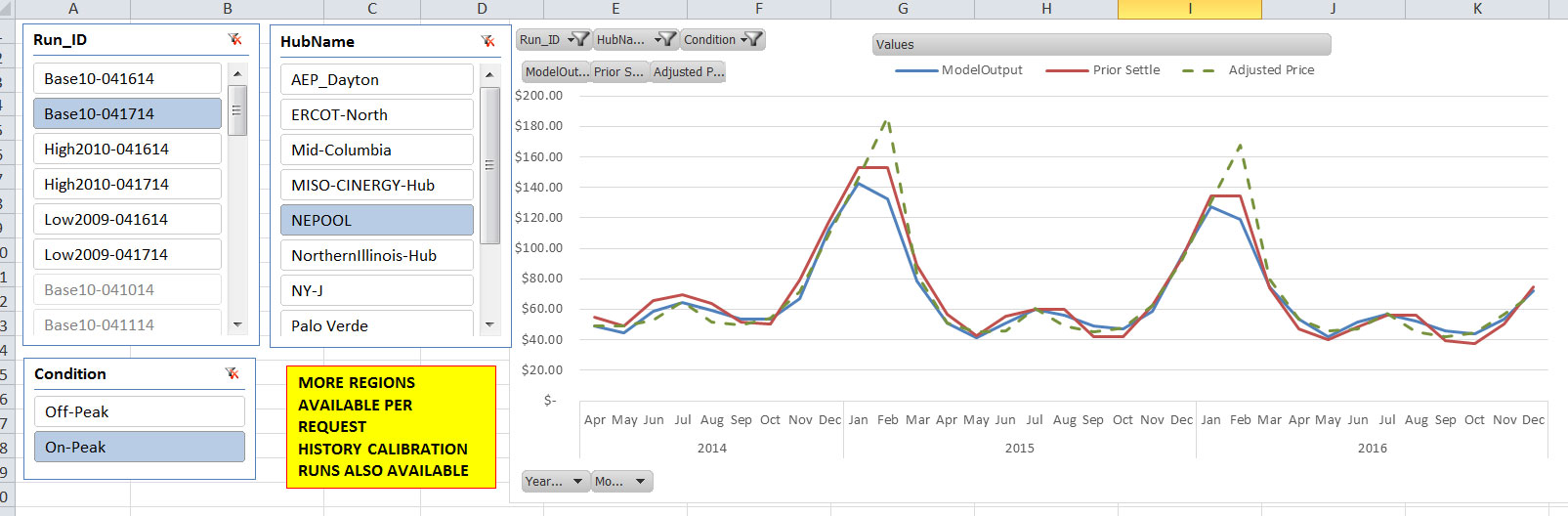

Our latest update to our daily file is designed for power traders and risk teams. The interface allows one to quickly see the current power forward curve along with the models view on the market. There is also an additional line which adjust the models results based on historical tendencies in the model.

A demo of the daily file is available with restricted viewing. Click here to download.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

Your Inspired Energy Consultant,

David

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

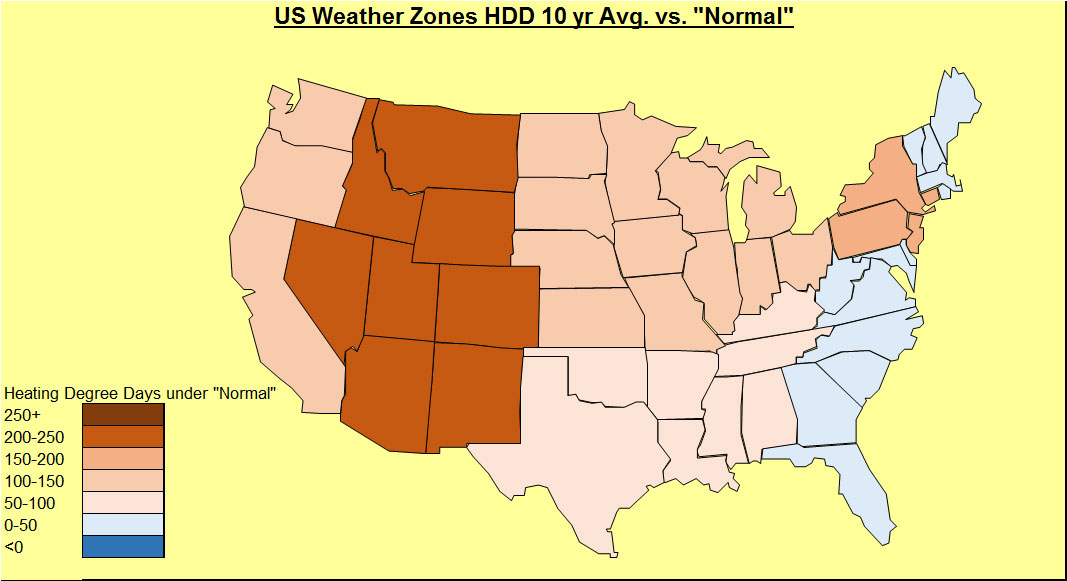

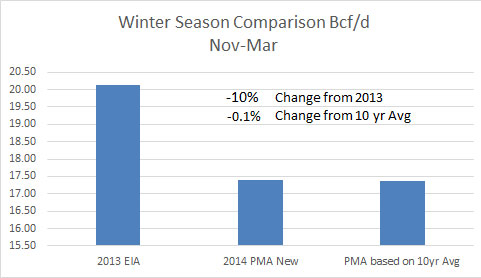

Normal Weather vs. 10 year Average – Significant impact to Gas and Power Markets

We are investigating “normal” weather. Our normal weather came from NOAA. According to NOAA, “Climate Normals are the latest three-decade averages of climatological variables including temperature and precipitation. This product is produced once every 10 years. The 1981–2010 U.S. Climate Normals dataset is the latest release of NCDC’s Climate Normals.” In the last 10 years, not many places have been close to normal. The trend in both HDD and CDD shows to be warmer over the last 10 years as compared to normal. More CDD and less HDD are observed when comparing to normals.

The 10 year average is clearly warmer than the NOAA normals. The impact on our base case in our Power Market Analysis (PMA) product shows a significant impact on the power markets. This translated to natural gas demand in the power sector rising 8% compared to the base case for this summer. Winter is essentially the same.

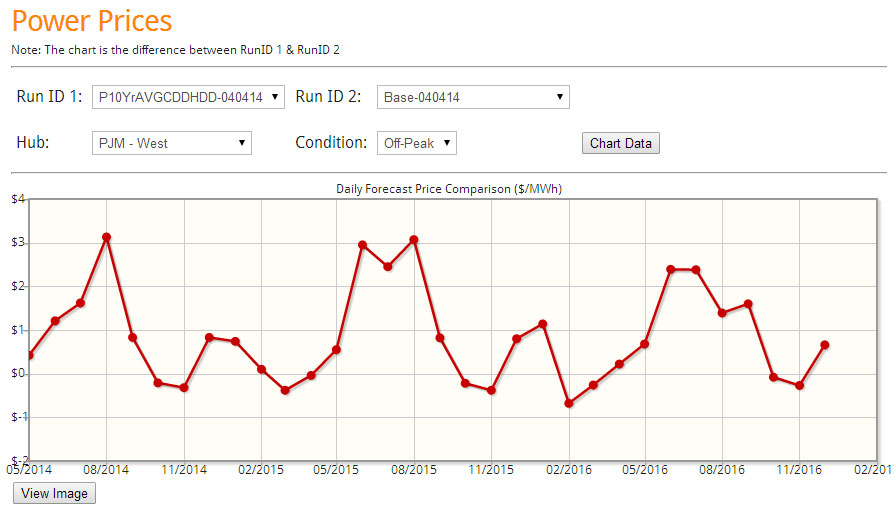

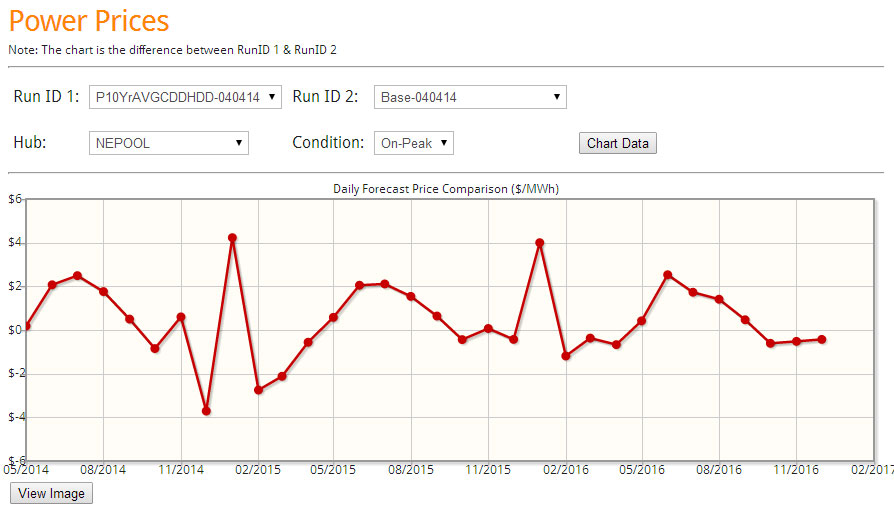

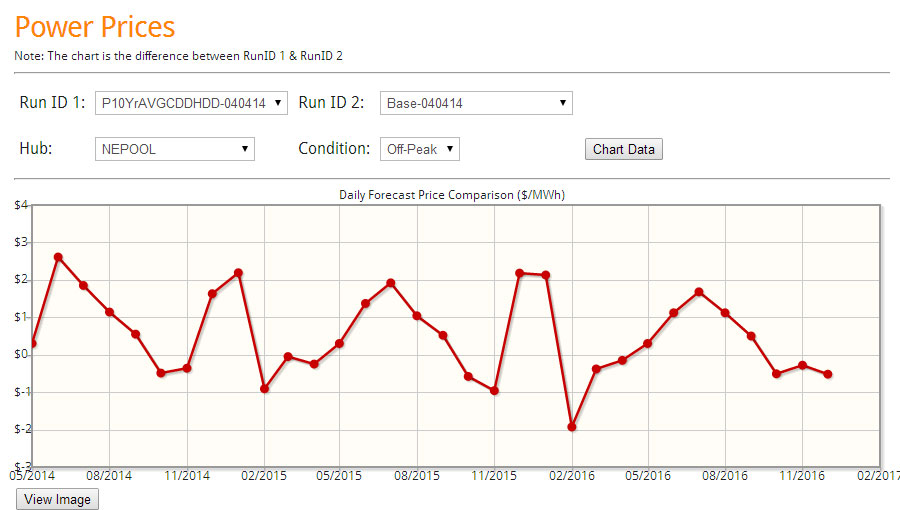

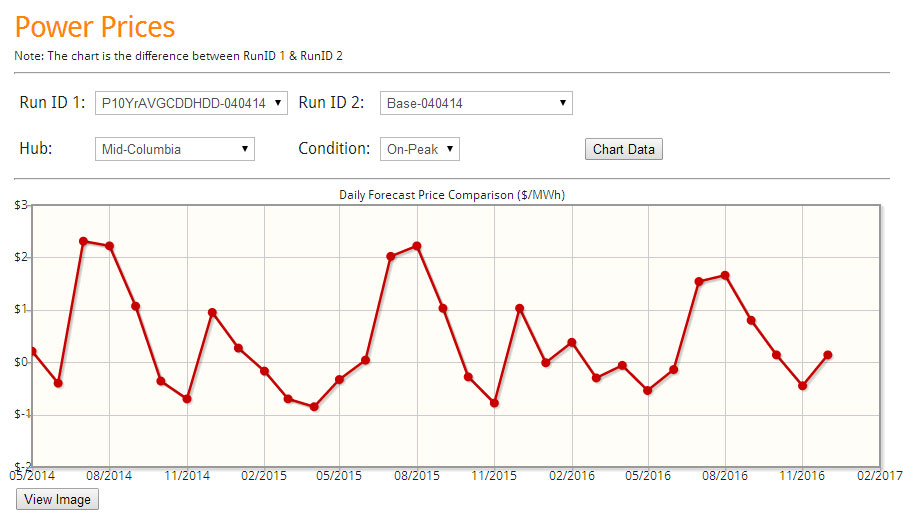

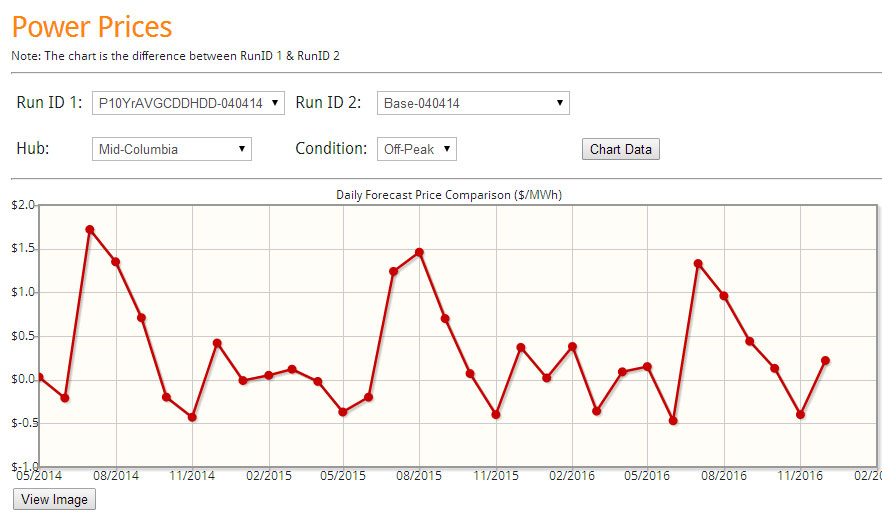

Power prices are significantly impacted by the weather change in certain regions. The below figures are screenshots which come from our online interface for our Power Market Analysis (PMA) subscribers. Each day the model dispatches the entire N. America based on the latest future markets price for coal and gas. Daily files are produced each morning similar to the above graphs. Plus the online interface allows users to quickly compare various runs. In this case, we are comparing the 10 year average weather vs. the Normal weather supplied by NOAA.

Many more regions are available to compare. In addition to power prices, there are comparison available for coal and gas consumption and input price comparison. Easy drop downs allow one to see how the future markets have impacted the power markets. PMA subscribers get access to the files including a complete analysis of 2015 and 2016 comparing the NOAA normals vs. 10 year average.

Soon, PMA subscribers will get a complete analysis of the last 10 year weather. Each year will be individually analyzed allowing subscribers to be able to choose analog years to represent the forecast.

PMA subscribers get the online access, the daily files, and the study files. In addition, prime members receive-at no additional cost-reports such as the Summer 2014 Outlook report , the recent briefing on what is causing the gas demand drop, and where it is coming from. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

Please contact me to schedule an online demo meeting[email protected] or 614-356-0484

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/