Adding insights to PMA

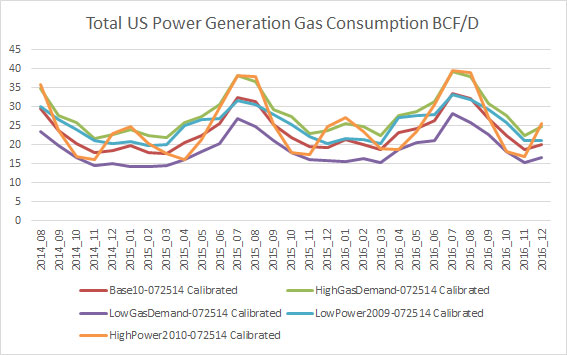

Power Market Analysis (PMA) is now even more insightful with the addition of two more additional runs to the base case. PMA understands the future holds much uncertainty. The value of PMA is to understand that uncertainty. PMA is a tool to help those in the Gas and Power markets. Already PMA tries to formulate the maximum and minimum power price across the country. The power cases allow for one to compute the risk of a trade decision, plus using these cases can also help identify winning trades as previously discussed. Even if you are not trading, but in a role to make decisions on energy procurement, PMA can help you understand your decisions. Adding our expertise with PMA, we can help end-users develop a comprehensive hedging strategy.

Now PMA is producing a maximum and minimum gas demand case. Using the 10 year weather analysis done previously, a constructed maximum and minimum gas demand was developed. In addition, the forward curve is adjusted downward by 50 cents for the high gas demand case and upward by 50 cents for the low gas demand case. These cases will help those trying to understand the gas markets. They can be used to help give you a good sense of when the market is at the bottom or top in terms of power demand.

In summary, PMA has added two new scenarios within their daily produced runs. All 5 scenarios are now part of the trade screener, thereby giving more certainty for the recommend trades being produced by PMA. Don’t be caught off guard by potential changes in the market, sign up now for PMA.

Please call or email to schedule an online demo of the latest most advance way to analyze the power markets – [email protected] – 614-356-0484.

Your Ever Improving Energy Analyst,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Winning Power Trades Identified by PMA

Many have given up on power trading due to various reasons from new banking regulations to limited volatility over the past few years due to gas prices. However as many leave the market, there is much opportunity being created in the market place. The power markets are vast and complex requiring a comprehensive energy background to truly understand the inner workings. With many years and significant market knowledge, Power Market Analysis (PMA) was developed to help unlock the opportunities in the power markets. The following will present post analysis of June trades and an example value of PMA.

One of the latest tools within PMA is the power trade screener. The power trade screener is capable of processing the entire N. American markets and producing a table of trades given a set of criteria on the various dispatch simulations used in the PMA. The basic PMA offering is running three runs focused on power price volatility – Base, High, and Low power price cases. The formulation of these runs are available for subscribers plus can be customized for each client depending on location interest and volatility expectations. The current criteria for the screener is to find trades that in ALL three cases produce a result that lies on one side of the current forward curve. Therefore if all three cases are below the forward curve, it is a sell. And if all three cases are above, it is a buy.

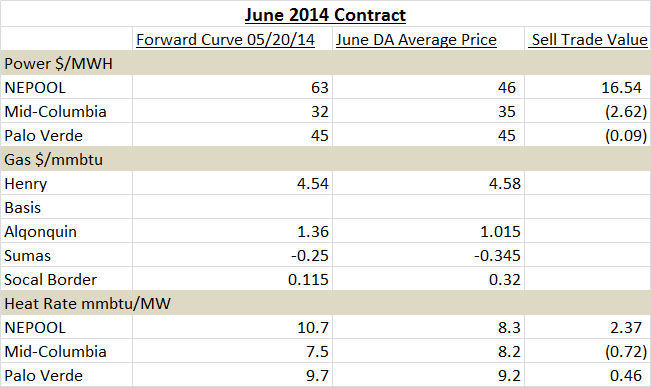

On May 20th 2014, the following represented the power trade screener view examining On-Peak Trades for the month of June. (Click on Image to Zoom)

In addition to the power trade screener, the heat rate screener also shows the same June Sell alerts for those regions. (Heat Rate trade is Power Contract / Gas Contract – if you believe heat rates are going down you sell power and buy gas)

The results of these trade recommendations can be examined now. The below table show the results of those trades. (Click on Image to Zoom)

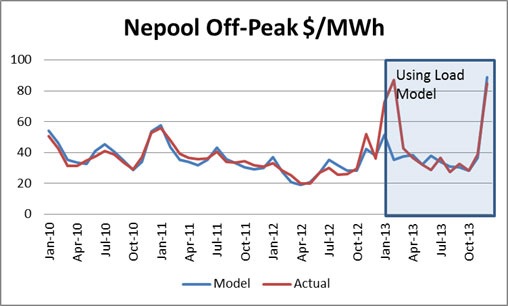

The power trades identified by the screener produce 1 out of 3 winning trades. However, if each trade was purchased in equal volumes the trades would have netted out $13.8/MWh. The best trade was NEPOOL. This is also supported by the backcasting of NEPOOL in the model being superior relative to other markets. On a heat rates basis, 2 out 3 trades would have been winning trades.

Everyday, this analysis is done. Users can learn the patterns and make the adjustments. There is money to be made with markets that are less liquid for those who have the financial and aptitude capabilities. The screener and the simulated runs can be customized for each client.

Please contact me for a demo – [email protected] – 614-356-0484

Your Ever Improving Energy Analyst,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

A Balanced Discussion on the Merits of SB 310 – Throwing the Baby out with the Bathwater?

Summary of Senate Bill 221 and Senate Bill 310

Let me begin briefly explaining Ohio Bills Senate Bill 221 and Senate Bill 310.

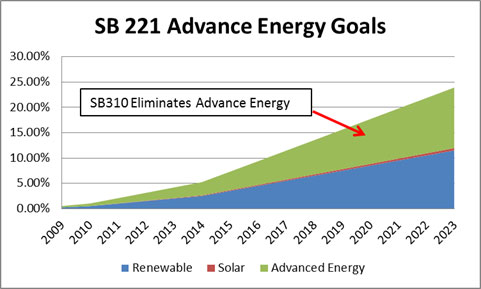

SB 221 is a bill focused on increasing the state diversity of energy to cleaner and potentially game changing technology while focusing the state’s consumers on becoming more energy efficient . The bill mandates that a certain percentage of the generation come from advanced energy resources as defined by the State Commission NOT the utilities. This is important to understand. Examples of these sources can come from carbon neutral technology (e.g. modular nuclear, wind, solar, etc.) or technologies that improve how efficiently energy is consumed (e.g. combined heat and power, distributed technology, etc.). Of the advanced energy resources, the legislation calls for half of the targets to be made using traditional renewable sources (mainly wind and solar). The bill also set efficiency targets for the electric utilities to drive the consumers by implanting programs like CFL light subsidies which can be evaluated, measured, and verified by an approved vendor. The targets contained in SB 221 specific to development of advanced energy resources had price caps to prevent significant price increases for the consumer. The efficiency targets do not contain any price caps.

SB 310 is a bill focused on delaying and cutting back on SB 221 mandates. In other words, SB 310 waters down SB 221. SB 310 is designed for the utilities, because it eliminates the portions of SB 221 that threatens the utility business model (more on this later). Everyone seems to focus on SB 310’s 2 year delay of the targets outlined in SB 221 while further studies of its ramifications are conducted. SB 310 also eliminates the advanced energy resource requirement, except for the traditional renewable targets (solar, wind) which remain the same, but are affected by the two year delay. The other advanced energy portions of the bill could have enabled end-users to identify and pursue energy savings opportunities at their facilities within the state.

History of the Bill

As the dust settles on the controversial Ohio senate bill 310, critics and supporters must reassess the situation. Regardless of your position, the bills bottom line impact needs to be understood in dollars for both actual value and potential value so that informed decisions can be made on the bill and its potential changes. As noted above, the bills intent is for diversity of energy and development of new technology. This comes at additional cost that does not always show value right away.

I had previously spent time reviewing Senate Bill 221 while I was the Managing Director Strategic Planning at American Electric Power. SB 221 was passed in 2008 by a 132-1 margin (Republican-controlled House and Senate, combined) and signed into law by former Democratic Governor Ted Strickland. Senate Bill 221 was initially proposed with the good intentions of increasing the state diversity of energy, moving towards cleaner and potentially game changing technology, and becoming more efficient. It would be hard to vote against, hence the 132-1 margin that passed the bill. Given the current design of the utilities and public utility commission, the bill really did not have a chance to be successful.

Issues with SB 221

SB 221 bill only attempts to change the utility, not the commission. The bill adds more responsibility and oversight to the commission, but does not offer any additional budget or suggestions of any action plans to the commission. The bill offers some rewards, incentives and penalties to motivate the utilities to change . The utility typically are slow to innovate and turn change into opportunities, and therefore largely sees only the penalties. “Where there is change there is opportunity” applies to many, but not those who do not want to see change. Given their history of regulation, the utilities need to be nudged into acting more pro-actively . Therefore, bills such as SB221 were needed. However, the commission responsible for the nudging is ill-equipped.

To understand why the utility culture is not designed to capture opportunities of change, one needs to understand the history of regulation. (For more details read Regulation vs. Deregulation Utilities). The utility and Public Utility Commission capabilities are not designed for the new technological world of competitive advanced energy resources and energy efficiency. The utilities failure to innovate largely stems from their incentive structures and historical legacy. The typical consumer wanted reliable power at a reasonable price and was not really interested in the details beyond that. The end-user just wanted to turn on the switch and when the electric bill arrived, they did not want to be surprised.

Utilities have, therefore, worked hard to maintain strong relationships with the Public Utilities Commission since it regulates and approves all utility rate structures. It is no surprise that utilities remain friends with the commission since this keeps the cash flowing to their bottom line. However, when enough consumers react to poor service, the commission could be forced to insist on changes at the utility. This creates a strong incentive for utilities to maintain the status quo, rather than shake things up. Innovation requires some trial and error, which results in increased cost and potential disruptions. The cost based structure, where the Public Utility Commission approves the utility costs and fixed rate of return, does not provide additional rewards for innovation. Thus utilities have traditionally seen zero return for innovation. This mechanism focuses on reliability and reasonable costs, not innovation. This scenario has played out largely unchallenged for decades, but a shift began to occur as a growing group of society started to become more aware of the environment and vocal about repairing and improving it. That movement caught the utilities and the public utilities commissions somewhat off guard . Policy makers moved ahead of the utilities and the commission by implementing policies including SB 221.

The commission’s existing knowledge base was sufficient to oversee reliability while minimizing cost. However, the commission is ill-equipped to oversee an energy industry with new challenges and new technologies. The mandates ask for advanced energy resources and energy efficiency to be implemented with competition and un-bundling in Ohio’s shopping marketplace. Now, there is a tug-of-war between the consumer, the marketplace, and the commission with the utility stuck in the middle. At odds with the commission skill sets, SB 221 is pushing for change . The commission is now required to manage and think beyond current experience. If the commission is to acquire the needed new knowledge and experience, the budget at the commission will likely require an increase, so that they can recruit and retain the right talent to oversee Ohio’s new energy marketplace. Larger utility management teams are making nearly twice as much as commission senior staff. Yet the commission is expected to comprehend the multiple utilities plans cooked up by well-funded teams of experts whose goal is to limit disruptions of the current utility business model. Thus the commission will likely not succeed in effectively regulating policies requiring utilities to change from their current form. Any legislation is only as good as the regulation and enforcement of the bill.

Changes to SB 221 in SB 310

Advance Energy

There are many issues with SB 221. However, these concerns could have been fixed without the drastic change in SB 310. As noted, SB 310 eliminates the advanced energy resources initiative, but leaves the renewable requirements.

The better option would have been to open up all advanced technology and renewable energies under one category. This would have allowed the marketplace to pick the winners of future advanced technology. By eliminating advanced technology, which cover the following: Distributed generation, cogeneration, clean coal technology, fuel cell, solid water conversions, and few others, SB 310 seriously erodes the good intentions of the bill. One of the reasons discussed for eliminating advance energy resource portion of the bill is the lack of progress made by utilities in this effort. However, the lack of progress is largely due to the lack of effort, limited capabilities of the commission, and the desire of the utility to not disrupt the business model.

The utilities only targeted and developed the renewable portion since SB 221 was enacted. The utilities would have you believe there was no advanced technology that was a cost effective option relative to traditional renewable energies. I don’t believe this to be the case. The better reason was because there were no transparent medium to encourage projects that would supply portions of the advanced resource category. Advanced technology is very broad, covering distributed generation to co-generation. The real issue limiting advance technology development was the lack of incentive for utilities to look for these advance technology. They understand the traditional renewable energies and those projects are less likely to hamper some of the utilities current business operation. Distributed generation projects and co-generation options are smaller in scale and directly alter a customer class, potentially causing havoc in tariff structures. The large renewable projects can be uniformly spread across classes. If it was solicited to end-users that the utility would purchase and operate a combine heat and power in their area, thereby lowering their price of power by at least 20% and reducing the environmental foot print by over 20%, I am sure there would be plenty of projects. Advance technology given its very nature will require a change from historic business operations.

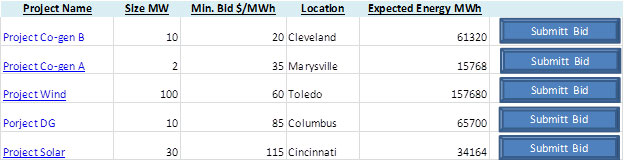

Many deals in the power industry are made behind closed doors yet at times they offer competitive advantages. However, given a case where there is a regulated enforcement for certain projects, it would be reasonable to create a transparent pricing platform. The commission could do an initial pre-screen to qualify the projects as advance technology (this still can include traditional renewables) – SB 221 gave them this power. The state would be acting prudently and wisely by allowing commission to approve each new “advance technology” source. Due diligence would still be required from the utility just like every other project. Creating such a platform would prevent the excuse that there are no cost effective advance technology projects available compared to traditional renewable projects. At the same time, it would give commercial and industrial clients, plus developers, an ability to propose innovative projects that could transform a portion of the energy use in the state towards the intentions of the original goals of SB 221.

The abuse of the system would be limited by price caps and volume requirement in the bill. End-users should realize prices would not climb any more than the explicit price caps – “An electric distribution utility or an electric services company need not comply with a benchmark under division (B)(1) or (2) of this section to the extent that its reasonably expected cost of that compliance exceeds its reasonably expected cost of otherwise producing or acquiring the requisite electricity by three per cent or more.” Utilities should realize their business is not required to transform quickly and drastically given the initial volumes are slowly being ramped up plus the cost limits should mitigate some of the rise. Inside the platform, vendors and developers would submit their project information. They would also submit a minimum subsidy value needed to have the project go forward. The various utilities would then bid on the various projects. A sample screen of the platform I have in mind is shown below:

The platform would enable the commission to have a market price to observe the cost of advance technology relative to traditional renewable. This would also enable the utilities to find projects quicker and develop a portfolio for achieving the requirements while staying under the restrictions of the bill. The end-users and developers would have ways to participate in the future of Ohio energy mix.

The other big propaganda for SB 310 was that SB 221 is too costly. Too costly is questionable given the advanced energy resource requirements had price caps as noted above. If the targets are too costly the utilities did not have to achieve those targets. The overarching cost rise was limited to 3%.

There were also cost limits, specifically, on renewables:

“The compliance payment pertaining to the renewable energy resource benchmarks under division (B)(2) of this section shall equal the number of additional renewable energy credits that the electric distribution utility or electric services company would have needed to comply with the applicable benchmark in the period under review times an amount that shall begin at forty-five dollars and shall be adjusted annually by the commission to reflect any change in the consumer price index as defined in section 101.27 of the Revised Code, but shall not be less than forty-five dollars.”

In addition, there were limits on the solar piece:

“The compliance payment pertaining to the solar energy resource benchmarks under division (B)(2) of this section shall be an amount per megawatt hour of under-compliance or non-compliance in the period under review, starting at four hundred fifty dollars for 2009, four hundred dollars for 2010 and 2011, and similarly reduced every two years thereafter through 2024 by fifty dollars, to a minimum of fifty dollars”

However, there was a disclaimer that made the use these price caps quite troublesome – “The compliance payment shall not be passed through by the electric distribution utility or electric services company to consumers. The compliance payment shall be remitted to the commission, for deposit to the credit of the advanced energy fund created under section 4928.61 of the Revised Code. The compliance payment shall be subject to such collection and enforcement procedures as apply to the collection of forfeiture penalties under sections 4905.55 to 4905.60 and 4905.64 of the Revised Code.” This basically directs the utility to implement more expensive programs to avoid the compliance penalty since this was not a legitimate bridge.

Those supporting SB310 for cost reasons could have sought adjustment of the above cost numbers versus throwing the entire advanced energy requirement out of the equation. A simple rewrite of the compliance payment could have also assured the utility never spent any more than allowed. The one area which was left open to unlimited cost was the Energy Efficiency and Demand Side Management (EE/DSM) programs. As with the alternative energy requirement, a price cap should have been established in terms of rate increases from EE/DSM programs. SB310 still does nothing to address future cost of EE/DSM programs.

Energy Efficiency (EE)/ Demand Side Management (DSM)

The EE/DSM arena is a scary place given its spectacular growth. As noted in my Clean Power Plan review paper #3 , the industry has grown significantly from $1.6 billion in 2006 to $5.9 billion in 2011 and projected at over $8 billion (figures from the American Council for an Energy-Efficient Economy). With that much money in the system in such short time and the fact that the industry depends on estimates, there is bound to be “corruption” unless there are good checks and balances. EPA notes this in their discussion of EE/DSM – “Regardless of how the energy savings of an energy efficiency measure are determined, all energy savings values are estimates of savings and not directly measured”.

I am a supporter of energy efficiency and conservation programs having seen some fantastic data and work while assisting the Northwest Power & Conservation Council. However, I have also seen the darker side while assisting a utility in Indiana and reviewing some of the AEP plans. The companies who are in charge of evaluating, measuring, and verification are typically working in all three spaces. I have seen an evaluator in one state who acted as a measurer in another state. This cannot be allowed. Given that many utilities get shared savings, they are somewhat indifferent in this discussion. Shared savings is an incentive mechanism created to align the utilities with reducing energy usage. In the traditional regulated format, the utility only gets a return on capital investment, which incentivizes the utility to grow energy usage. If demand is falling, there is less likely any need for capital investment. Shared savings allows a utility to share in the savings of an efficiency program by collecting a certain percentage from the reduction of energy usage. Therefore, when an evaluator approves a plan the utility proposed, and the measurer and verifier support it, the utility would not oppose the assumed large savings in kWh, even though it may not be real, because the cost difference and savings are shared with the utility. The bigger the saving, the more the utility gets back. The only consequence is the load forecast will typically be too low and the rate payer is stuck paying more for plans that really add no savings. Most of the time, the commission is not equipped to understand the nuances in the EE/DSM program, so the utilities can bring in their expensive lawyers and impressive EMV. Before you know it, the programs is approved. The last leg of defense in an overwhelmed commission is the consumer protection council, which was cut in half by Kasich in 2011, even though they received their pay from the utilities, not the state budget. This was in the year they saved the rate payers significant amounts of money and was a true thorn in the utility. “The Supreme Court of Ohio ruled 7-0 in its April 19 decision that the PUCO improperly allowed AEP to charge customers unlawful and unreasonable rates. The Court ruled in favor of the OCC in agreeing that AEP’s 2009-2011 rate plan was unlawful by including $63 million in retroactive rates, $456 million in costs to potentially provide default service for customers who shop for an alternative supplier and $330 million in carrying charges for environmental investments.”

The energy efficiency cost you are currently paying can be easily computed from your bill if you belong to AEP. They post the calculation of your rate. Download the excel file and enter your information and review the corresponding sheet that represents your profile. In my case, I am paying $5/month or a total of $60/a year to pay for the energy efficiency program. The residential energy efficiency program is essentially reducing subsidies with a little portion for O-Power. O-Power is a report, telling me how much more I consume relative to my supposed comparable house. Is it truly worth $60/a year to subsidize light bulbs and a report to tell me my consumption relative to other houses? What alternative light bulb would I buy if it wasn’t for the subsidy? Does it achieve the value that the measurer and verification company is stating? In this case, my rate is being impacted nearly 4% by this program.

Better oversight is needed in the EMV space for EE/DSM. Some worthwhile programs can be found in the data, which are likely around 50-70% of the total programs. Many other programs are predominantly number tricks, enabling the EE/DSM industry to support itself and grow. SB 310 should have addressed price caps and better oversight EE/DSM.

Other Changes

SB 310 still carved out a solar requirement in one of the cloudiest states in the country. I think, in large part, the belief was if you had a solar mandate, solar manufacturers would come here. There is enough solar demand in the US market that if the state of Ohio could create a supply chain and manufacturing advantage, they would come here to manufacture and even to export to other states. China is a leading manufacturer of solar not because they placed a solar mandate.

SB 310 also ended a requirement that utilities purchase half of their renewable energy from within the state. This, in effect, produces a subsidy to other states. The purpose of the renewable program for many was to stimulate economic development. As I noted in the solar argument, mandates do not stimulate manufacturing, but if you are going to have a mandate, you might as well force some of the development in the state – or don’t have the mandate at all. One cannot criticize too much on cost given the price caps for cost in renewable compliance.

SB 310 does create a committee – “There is hereby created the Energy Mandates Study Committee to study Ohio’s renewable energy, energy efficiency, and peak demand reduction mandates.” The study will cover 8 objectives which I will give my precursory estimate of the results:

(1) A cost-benefit analysis of the renewable energy, energy efficiency, and peak demand reduction mandates, including the projected costs on electric customers if the mandates were to remain at the percentage levels required under sections 4928.64 and 4928.66 of the Revised Code, as amended by this act;

DKB: Cost for the renewable piece will not rise any greater than the 3% required by the bill. EE/DSM mandates are questionable in cost and delivery of actual kWh savings. The current system over accounts 10-40% energy savings, therefore better checks and balances will be need in the EE/DSM arena. Recommend putting a cost rise limit with EE/DSM as with the renewable goals.

(2) A recommendation of the best, evidence-based standard for reviewing the mandates in the future, including an examination of readily available technology to attain such a standard;

DKB: Having qualified commission staff and consultants with significant experience in the region along with some power modeling experience to analyze future mandates.

(3) The potential benefits of an opt-in system for the mandates, in contrast to an opt-out system for the mandates, and a recommendation as to whether an opt-in system should apply to all electric customers, whether an opt-out system should apply to only certain customers, or whether a hybrid of these two systems is recommended;

DKB: If the commission wants to guarantee savings from current structure an opt-in is applicable. However education is the key for consumer actions.

(4) A recommendation on whether costs incurred by an electric distribution utility or an electric services company pursuant to any contract, which may be entered into by the utility or company on or after the effective date of S.B. 310 of the 130th General Assembly for the purpose of procuring renewable energy resources or renewable energy credits and complying with the requirements of section 4928.64 of the Revised Code, may be passed through to any consumer, if such costs could have been avoided with the inclusion of a change of law provision in the contract;

DKB: This is a very slippery slope. Adding contracts with change of law would result in significant risk premiums. Creating sustainable laws is a better answer.

(5) A review of the risk of increased grid congestion due to the anticipated retirement of coal-fired generation capacity and other factors; the ability of distributed generation, including combined heat and power and waste energy recovery, to reduce electric grid congestion; and the potential benefit to all energy consumers resulting from reduced grid congestion;

DKB: The conclusion will reflect how much the utilities influence the committee. Based on my experience, CHP and distributed generation can play a significant part. Not only do they offer energy savings by being close to the demand source and using the heat, which is not used at all at centralized plants, they offer resiliency to the grid and can be used to support the grid in times of need.

(6) An analysis of whether there are alternatives for the development of advanced energy resources as that term is defined in section 4928.01 of the Revised Code;

DKB: There is always room for alternatives and innovation – this is the USA. Governments can play a role in nudging development without overly committing by using price caps such as in SB 310 and SB 221. The fear of transformation only comes from the incumbent who does not want change. A marketplace platform could offer market transparency and a place for end-users and developers to participate in the evolution of the energy industry.

(7) An assessment of the environmental impact of the renewable energy, energy efficiency, and peak demand reduction mandates on reductions of greenhouse gas and fossil fuel emissions;

DKB: Estimation should use a dispatch model to produce these figures since the commitment of the units will likely change particularly if the load curves flatten. A flat load curve is actually to the benefit of the coal units. Ohio is a net exporter of electricity, so bordering states programs will be of significant influence.

(8) A review of payments made by electric distribution utilities to third-party administrators to promote energy efficiency and peak demand reduction programs under the terms of the utilities’ portfolio plans. The review shall include, but shall not be limited to, a complete analysis of all fixed and variable payments made to those administrators since the effective date of S.B. 221 of the 127th General Assembly, jobs created, retained, and impacted, whether those payments outweigh the benefits to ratepayers, and whether those payments should no longer be recovered from ratepayers. The review also shall include a recommendation regarding whether the administrators should submit periodic reports to the Commission documenting the payments received from utilities.

DKB: If they really audited this, I think they will uncover quite a bit of dirt. Once again this is not due to the efficacy of the mission, but to the fact the industry has grown so rapidly and there is just so much money now.

Politics SB 310

Lastly, I want to address the politics of SB 310. Many insiders deem SB 310 as the First Energy Corporation bill. Rumors express a concern that some of these programs were causing a drop in capacity prices in this region. Given that First Energy coal fleet is deregulated, this was a big concern for them. Mathematically, this would occur, but the volumes from SB 221 at this time are too small to have a significant impact. The real drop in capacity prices was a function of the aggregators in other parts in the PJM markets, the MISO imports, and stagnating demand which drove the capacity price down. Dropping of advance technology resource requirements would have only threatened the utilities. No one else would have been detrimentally impacted by having the advance energy resource option given the price caps – unless you think 3 percent is too much to pay for diversification – perhaps 2 percent? I believe Distributed Generation and Cogeneration incentive mechanism provided a threat to the utility that they did not want to risk taking on. SB 310 is a bill to leave no utility behind, but at the cost of potentially stagnating advancement. The keyword is potential – it is possible that nothing would change, but a cost of 3% may have been worth the risk. A positive, I see from SB 310 relative to SB 221 is the dropped responsibility of the commission. They don’t have to understand the potential advance technology. They lose a key oversight piece “For the purpose of this section and as it considers appropriate, the public utilities commission may classify any new technology as such an advanced energy resource or a qualifying renewable energy resource”

Conclusion

In conclusion, the major weaknesses of SB 221 were not improved and the intent of the bill weakened in SB 310. I regret I did not have time nor was asked to review SB 310 before the bill was signed. The impacts of SB 310 will benefit a few. The few are mainly the utilities. It is possible End-users may save some money with SB 310 relative to SB 221, but the savings likely will not amount to much given the potential gains of transforming the energy mix for Ohio to be more resilient and environmentally friendly. The next adaptation to the Ohio energy bill needs to re-introduce the advance technology portion found in SB 221 and create a mechanism for success by increasing the commission’s budget and the development of a clearinghouse platform for advanced technology. Other adaptions include adding a price cap on EE/DSM similar to the alternative energy source option, greater oversight of EE/DSM programs, and fine-tuning the compliance costs to give more flexibility for the commission to modify and utilities to be able to recover some of the alternative compliance payments.

End-users are still left with many other uncertainties including the recent EPA Clean Power Plan to mitigate CO2 emissions. If you are an end-user trying to understand the future of power, I can and will be able to help you navigate through the storm of uncertainty. I have many years of experience in forecasting and developing risk mitigation strategies in the energy industry. I am always up to date in current markets and offer a daily forecast of all North American power hubs. This product is being used by hedge funds and utilities.

Your Enthused and Optimistic Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Assessing the Cost of EPA’s Clean Power Plan

In order to understand the following, one needs to have read the Clean Power Plan and/or read the 3 summaries I put together of the Clean Power Plan (Paper #1, Paper #2, Paper #3). Reading those three will allow you to get an understanding of the areas of cost that I plan to discuss below.

The Clean Power Plan notes the cost metrics in consumer terms: “Under Option 1, average nationwide retail electricity prices are projected to increase by roughly 6 to 7 percent in 2020 relative to the base case, and by roughly 3 percent in 2030 (contiguous U.S.). Average monthly electricity bills are anticipated to increase by roughly 3 percent in 2020, but decline by approximately 9 percent by 2030. This is a result of the increasing penetration of demand-side programs that more than offset increased prices to end users by their expected savings from reduced electricity use.”

In demonstrating the cost metrics in utility terms, they offer a significant amount of disclaimers “The compliance assumptions – and, therefore, the projected compliance costs – set forth in this analysis are illustrative in nature and do not represent the full suite of compliance flexibilities states may ultimately pursue. These illustrative compliance scenarios are designed to reflect, to the extent possible, the scope and the nature of the proposed guidelines. However, there is considerable uncertainty with regards to the precise measures that states will adopt to meet the proposed requirements, because there are considerable flexibilities afforded to the states in developing their state plans.”

The EPA estimated compliance cost states “The EPA projects that the annual incremental compliance cost of Option 1 is estimated to be between $5.5 and $7.5 billion in 2020 and between $7.3 and $8.8 billion (2011$) in 2030, including the costs associated with monitoring, reporting, and recordkeeping (MRR).” The key word in the statement is annual. These costs can be expected each year. The EPA noted this is based on the difference to their base case, but was not explicit in their base case assumptions.

There are significant moving blocks, and the ability to model all of these options take time. In order to speed up the process, I approach the problem focused on the existing fleet and current load projection for 2016. Using 2016 will essentially show the remaining fossil fleet that is likely going to be impacted by the Clean Power Plan. This part of the analysis is centered on BSER 1 & 2 (plant efficiency improvement & redispatching). The targeted CO2 values for each state existing fossil fleet were extracted from the EPA model assuming BSER 3 & 4 (Non-Carbon Generation and Demand Side Efficiency) will deliver as EPA projected. Out of all the blocks, BSER 1 & 2 are the most tied to the market place given their impact is on the existing fleet. The BSER 1 & 2 represents almost 40% of the total rate reduction.

The models I am using are very sophisticated and robust. These models are used to make financial decisions in the current market place for both gas and power markets through the product line – of Power Market Analysis (PMA). The base dispatch model is the AuroraXMP model by EPIS. The entire N. America is being modeled. A significant amount of work was needed to produce a model that is applicable to today’s market.

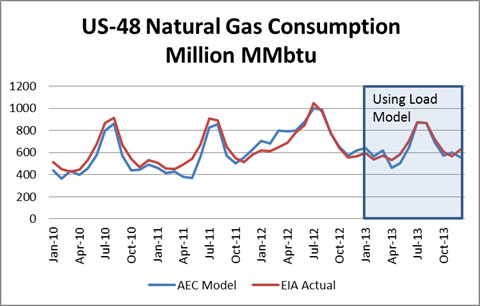

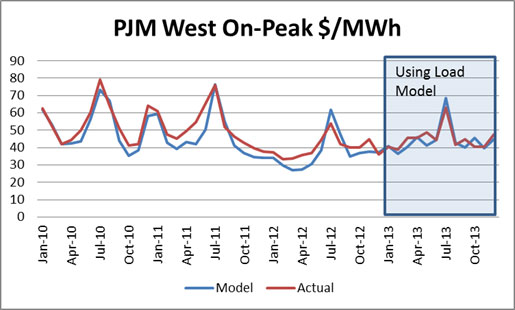

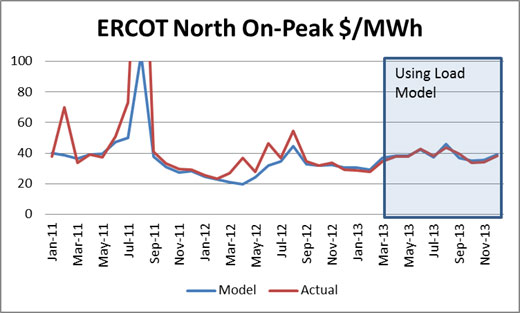

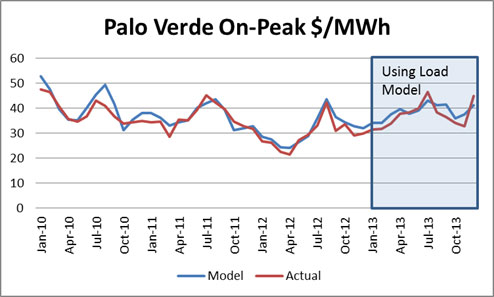

Validation of the model is continually being done. If your consultant is charging to see validations or has not done one in some time I would be skeptical on the results. Below are a few graphs validating my process – many more available per request:

These large models as used by the EPA – EPA used the Integrated Planning Model (IPM), developed by ICF International – I have always been interested in their ability to backcast the actuals on a monthly basis using their forecast methodology. Without first presenting and establishing the model tendency how do you know that the model can forecast? It may not be the model, but the data inputs the user is applying to model which could result in wrong output. Many large models typically make the excuse they are not interested in the daily or monthly changes, but want to show the “high” level impacts. I would be cautious on the ability to calculate economics in the market at that point.

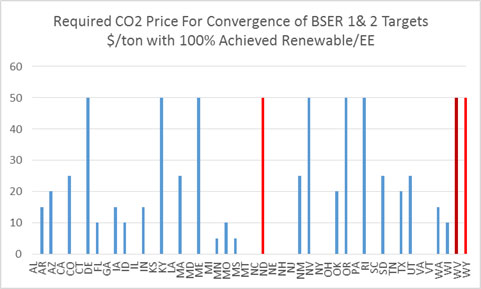

The simulations were all based on the forward curve prices published on June 5th 2014. After around 14 iterations I was able to reach an acceptable convergence to produce the state rates suggested by the EPA through re-dispatching with individual state CO2 price being the variable to target state rates. There were 3 states that could not converge to an acceptable level so I left them at the max of $50/ton. There are 21 states where the price of CO2 was essentially zero – see chart below. Significant renewable and DSM and the retirement of coal units in these states drove them to essentially not have to alter their dispatch to achieve the state targeted CO2 rate.

In addition to EPA “optimize” case, I ran a case with only 60% of the renewable and DSM/EE. This is reasonable case in the sense the EPA guideline for BSER 3 & 4 are based on non-empirical goals (State Renewable Program Goals and Other State Experiences). I discuss the concerns of this method in Paper #3. Nonetheless, I do believe more than half of the expectations can and will be achieved – hence I chose 60%. This obviously dropped the targeted rate with some as low as 60% of the initial targeted rate. In the 60% case there were 6 more states that hit the maximum $50/ton case. There were only 15 states with zero carbon cost – See Charts Below.

Note Illinois did not require any carbon cost in both cases. Ohio actually fared well because the utilities had to burn through many of their coal plants in 2012 even though it was uneconomical, and scheduled retirements in 2014-2016 help achieved the targeted rate. The big question for Ohio is can they achieve their renewable target. I have done a state by state report plus added a feature to be able to extract particular units within the state to inform you. A sample file for Colorado is available. If interested please send me your state(s) interest and the amount you are willing to pay for this highly informative report. Also add a note if you want a particular group of assets evaluated.

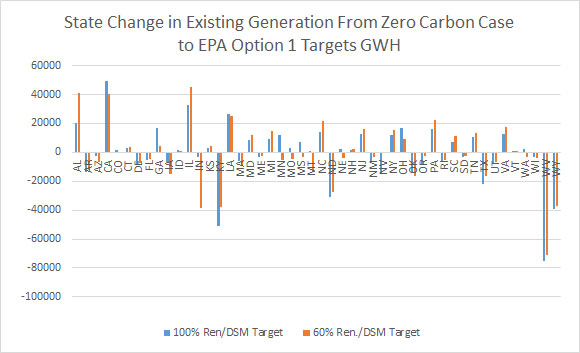

The runs did produce a list of winners and losers in terms of existing power plants. As an existing power plant you want to be in Illinois, Alabama, and California not Kentucky, Indiana, or West Virginia – See Chart Below

In theory, the quantification of just BSER 1&2 cost would be below the actual cost of the total Clean Power Plan. The other parts of the program involved new creation. In most cases, an existing already paid for resource cannot be economically challenged from new items including many DSM programs. The 2016 run already retires many of the uneconomical units. The below chart shows the impact of wholesale power prices as a result of “forcing” redispatching to achieve target.

Wholesale power prices increase 20% in the 100% BSER 3&4 case and in the 60% BSER 3 & 4 case almost 40%. The way power prices are set, the marginal unit sets the price for all units in a given hour. Therefore, even if you bid into the system at $5/MWh, if the marginal unit (the last MW to fill the required electric demand of the system) is $100/MWh, you will get $100/MWh. In a regulated framework, this is less important since the structure is built on cost and depending on if there are outside shareholder additional returns (8-15%). Given the EPA statement, “retail electricity prices are projected to increase by roughly 6 to 7 percent in 2020 relative to the base case” & “Projected wholesale electricity price increases over the same period were less than seven percent”, I am not sure they are appreciating the deregulation impact. The 7% does align with comparing my fuel cost from the increases seen in the various cases. However, I did not change the fuel prices even though EPA analysis did show this would likely happen – increase gas price and lower coal price. The cost world is generally gone in the generation space. Generators below the marginal power plant will keep all the gains vs. being satisfied with a cost basis. The box on de-regulation is open and not likely to come back.

Energy revenue for the entire system went up $130 Billion in 100% BSER 3 & 4 and $243 Billion in 60% BSER 3 & 4. There are still systems that are fully integrated therefore will not capitalize on the opportunity to charge more to the customer. There is no doubt the cost of the power price impact will be much greater than noted by EPA.

As pointed out several times, this is the piece involved in the existing fleet which is an integral part in achieving EPA Clean Power Plan CO2 rate targets.

There are several points made by the EPA alluding to cost being reduced due to energy efficiency – “Average monthly electricity bills are anticipated to increase by roughly 3 percent in 2020, but decline by approximately 9 percent by 2030. This is a result of the increasing penetration of demand-side programs that more than offset increased prices to end users by their expected savings from reduced electricity use.” This is true for some, but not all. The other half of the system (transmission & distribution) is still regulated. The programs are not free. They do cost money and must be paid for. The local distribution company can save when you are efficient in not causing large capacity payments and/or limiting inopportune times of buying power (high demand periods). This has been known for many years. As users become more efficient the regulated group still is promised the cost of operation. The only means of collecting the cost is charging users of electricity. As usage goes down, the cost collection goes down. Therefore, rates go up to compensate. The issue will become creating balance programs so that the wealthier who can afford the programs do not cause the rest of society to pay more. The regulated world is a zero sum game even more so without the generation piece.

It is easy to calculate the cost of the renewable piece. I have a state by state sheet showing the various targets set forth and calculating the cost using conservative estimates on the cost of wind and its performance. The renewable piece will be easily $200 Billion which comes out to be $11 billion a year. This makes this statement very confusing “The EPA projects that the annual incremental compliance cost of Option 1 is estimated to be between $5.5 and $7.5 billion in 2020 and between $7.3 and $8.8 billion (2011$) in 2030” Perhaps the rationale for difference is the base will already have that cost built in. However, with low gas prices and a lack of incentive, such as a carbon price, I don’t believe the renewable levels would be achieved to the extent the EPA is targeting. Even half the difference still shows the capital cost to be low. The DSM/EE programs do cost money. The higher power prices will cost the local distribution companies more and the generators who are left to compete are not going to send a bill that is cost plus.

Though the cost is higher than EPA projects, the benefits may still be there. In the next and final synopsis on the Clean Power Plan, we will review the benefits.

As noted previously, I have spent significant hours analyzing and modeling the Clean Power Plan Act with no payment from any source for this effort. The big driver in taking on this task is my personal intellectual interest. There is hope I can monetize some of my work. I do have the state by state report which I am hoping will be of interest – State of Colorado sample. Plus I can do a fleet analysis if you want to know how your assets will perform in this new world. I can also assist in developing a strategy to not only survive but to capitalize – where there is change there is opportunity.

Please do consider me for your energy consulting needs.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

#3 Clean Power Plan Assessment

Let me note a couple points of reflections from my last review of the Clean Power Plan before I proceed with the next portion of the plan. The choices made by human civilization over time typically revolved around resources. Certain groups became experts at their region and learned how to extract and use their resources (e.g. Coastline habitats typically became expert fisherman and trades people). The US unlike many other nations is a large conglomerate of vast and different regions. For the most part, the US respected the states’ rights, and each state grew to maximize their resources without much force to do it one cerain way. Renewable generation is not a universal accessible. There are regions that clearly will have better performance in certain renewable generation (e.g. Solar – Arizona, Wind – West Texas, etc…). The EPA tried to balance that by using the state RPS programs. However, the state RPS programs became a political tool rather rooted in economics and science. To substantiate that point, many RPS programs offer an escape clause (e.g. Alternative Compliance Payment) so the politicians can take credit for promoting without having necessarily to commit. This made it much easier for some to pick catch phrase policy such as 20 by 20 (20% renewable by 2020).

To have solar mandates greater than states such as Arizona, in the end, offers a huge subsidy to those states with high solar intensity. Natural economic evolution would produce solar cost savings and technology improvements driven from states such as Arizona, which would then roll those gains into less sunny states. Arizona 2012 average retail rate ranks 19 out of the 50 states at 9.71 cents/kWh. The top state is Hawaii – another very sunny state who is limited in resources and whose rate averages 31.59 cents/kWh. If solar was so easy and economical, these states would be far ahead of their current levels – Hawaii less than 0.5% and Arizona slightly under 2% as percentage of total energy in 2013. Obviously, there are some economic advantages of being able to build and design effective solar technology to export to areas of need. To extract this value, it does not necessarily require the host state to have policies exceeding other states. A difference of 10% capacity factor (12% to 22%) can produce a swing of over 10 cents/kWh. I mentioned all this to point out the concern that EPA used the state RPS program as their guide to the level of renewable. However the economics and science to these RPS programs may not be reality, as politics can defy reality.

The final recommended Best System of Emission Reduction (BSER) from the EPA in the Clean Power Plan is “4. Reducing emissions from affected EGUs in the amount that results from the use of demand-side energy efficiency that reduces the amount of generation required.” This is the 3rd most impactful out of the 4 programs in terms of reducing CO2 rates.

I have worked and reviewed many demand-side energy efficiency programs. I had the opportunity to work with the Northwest Power and Conservation Council (NWPCC) and review their data, which is impressive. Demand-side energy efficiency programs should be evaluated as a resource. I have helped many utilities in enabling their power models to do this. Unlike the other 3 BSER, this one is very dependent on human behavior, and because of that, much more detail and thought needs to be examined. EPA did not go into detail. “We have not assumed any particular type of demand-side energy efficiency policy.”

The issue with demand-side energy efficiency program can be summed up with EPA’s own words “Regardless of how the energy savings of an energy efficiency measure are determined, all energy savings values are estimates of savings and not directly measured” EPA spent much time talking about evaluation, measurement, and verification (EM&V) industry given the reliance on estimates. The problem I have noticed here is we have an industry that has grown significantly from $1.6 billion in 2006 to $5.9 billion in 2011 and projected to be over $8 billion per the American Council for an Energy-Efficient Economy. As with all industry that grows that quickly there will be growing pains. The first one that comes to mind is that there are certain companies who are in all three spaces, Evaluation, Measurement, and Verification. You can see there are many companies who evaluate in one state and verify in another. This should be unacceptable practice and the commissions need better oversight of these companies. Too many incentives exist to support the ever growing DSM-EE industrial complex regardless of actual results when this happens. It is important that there are checks and balances in the EMV space to minimize these practices.

The goals set forth by EPA are done so by assuming a best practice standard for each state and then targeting that rate. “For the best practices scenario, we have therefore estimated that each state’s annual incremental savings rate increases from its 2012 annual saving rate to a rate of 1.5 percent over a period of years starting in 2017.” I am sure this is conservative for many states, but at the same time I expect just as many, if not more states, to have a much harder time hitting target. Based on their spreadsheet, by 2030, demand-side energy efficiency programs will total 380,569,493 MWh. To put that number in perspective, this is more energy used by the state of Texas, state of California, or the United Kingdom. Using the average retail rate of electricity of 9.9 cents/kWh – this would amount to over $38 billion dollars a year “wasted” by society. It is an astronomical number to imagine that society would be that inefficient on a business as usual path.

It is true, that as whole, there are energy savings that an individual consumer could not realize or value without a collective saving mechanism. The difference can typically be traced down to the value of capital and the fact that a personal decision is not always economically rationale as other factors such as feeling good, to peer pressure, are very hard to economically quantify. In these cases, programs can be developed to add more value to savings to even nudging the consumer to act good for the whole.

The extrapolation from one state to another state needs to be carefully balanced given the human connection to these programs. As I noted before, DSM is a detailed process since it focuses in on what your customer uses energy for. If your customer uses heat pumps to stay warm as their primary energy usage, implementing a large light bulb program will only get you so far compare to places like California. As weather becomes more temperate, it is easier to modify behavior since human life is not harmed. However in extreme cold or heat, energy efficiency becomes limited. The successful California experience in energy efficiency just cannot be extrapolated one for one to other states.

Programs do naturally have a natural end life. As a simple example, consider the conversion of lighting. It eventually ends. In fact, the big gains end quite soon, as you think about where and how you use lighting. Eventually the incremental lighting updates occur in less used areas such as garages to closets. The initial lighting change will be in the most used area, but the incremental change much less so. An extrapolation of those impacts needs to be carefully considered. Many EMV companies understand this so it is worrisome to extrapolate savings for so many years.

Let me pause here before I go into a can of worms in dealing with cost and benefit.

If you need help in designing and modeling your DSM programs I can help you. In addition if you need a third party to help discuss with regulators and commission your decision criteria for DSM, I can also assist in this.

Policy discussions can be beneficial when coming from a factual context without significant biases or agenda. There is no doubt in my mind policy can be an effective tool in producing positive societal benefits – it is all in the design, implementation, and regulation.

Please contact us 614-356-0484 or[email protected]

Your Inspired Energy Consultant,

David

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

#2 Clean Power Plan Assessment – Market & Engineering Perspective

Before I continue with my assessment of the Clean Power Plan, I want to reflect and comment on what I have discussed in the first post. Let me make this clear, there is NO congressional action needed to make this happen. This is all being done through the Clean Air Act.

The fact that EPA is using a rate based mechanism does not preclude it from hitting a ton reduction given this is being applied to the existing fleet. Plus, they are limiting the new plant options. The only way to exceed the tonnage barrier is to add to the denominator of the rate (lb/MWh). Energy efficiency programs (EE) and renewables can be counted to the MWh. The limits they proposed from their Excel spreadsheet are based on very aggressive and large reduction-given they are starting with the 2012 lowest gas to coal price spread. (as noted in the previous discussion) Then, they modify the coal to be more efficient plus re-dispatch more gas and then adding Nuclear, Renewable, and EE/DSM efforts to the denominator to produce state by state CO2 rate lb/MWh. Because this calculation is only on existing units, it is not likely to be able to increase significant volume of CO2 from those plants as some discuss. The rate will be highly dependent on being able to achieve and/or over achieve the Nuclear, Renewable, and DSM/EE efforts as they calculated. This leaves room for total tons of the entire fleet (new and old) to be greater, but this will not come from the existing fleet. Also, given the renewable and DSM are quite high targets, the tonnage level will not likely exceed to what they are targeting-which is “Nationwide, by 2030, this rule would achieve CO2 emission reductions from the power sector of approximately 30 percent from CO2 emission levels in 2005.”

This is a perfect transition to continue with the assessment of the Clean Power Plan. The next BSER and the most impactful block is “Reducing emissions from affected EGUs in the amount that results from substituting generation at those EGUs with expanded low- or zero-carbon generation.”

In this section, they discussed the role of nuclear. This is the smallest impact, even less than the coal unit efficiency improvement. Adding CO2 cost will likely keep many of the nuclear fleet from retiring. The re-license cost has grown for nuclear fleet given all the recent issues with nuclear. Some estimates show cost to re-license greater than 4X the cost of a brand new gas plant. Given the limited impact of nuclear, I will limit the discussion and move on to the largest piece of the puzzle, Renewable.

EPA is focused on wind and solar renewable. They note they left out biomass. The renewable piece is a tale of two calculations. The effects of the option 1 BSER, according to the EPA IPM results, are minimal on the actual renewable capacity. Less than 10% change in capacity was observed from the base to option 1. Producing a CO2 price should certainly incentivize more renewable and nuclear generation. On an annualized basis, non-hydro renewable generation is growing 2% a year. This certainly seems to be reasonable-if not conservative-given the last ten years has seen double digit growth in renewable generation. However, there is a big difference in the IPM file and the Excel spreadsheet. In the Excel spreadsheet, renewable generation is shown as almost 50% higher than the IPM option1 case. I am not sure what to make of the difference. In the spreadsheet case, it is still not unreasonable to assume a 4% growth in renewable generation in a year. This would require artificial support which could be in the form of Renewable Energy Credits (REC), CO2 price, and/or tax credits. In terms of incremental cost over the IPM model, if we assume the difference in MWh, the associated capacity factor of 0.3, and the capital cost for renewable of ~$2000/kW this calculates 63 GW at cost of $127 Billion.

My concern is more in the distribution of the renewable versus the total. EPA initially examined the renewable potential by 6 regions. In their own words: “EPA estimated the aggregate target level of RE generation in each of the six regions assuming that all states within each region can achieve the RE performance represented by an average of RPS requirements in states within that region that have adopted such requirements. For this purpose, EPA averaged the existing RPS percentage requirements that will be applicable in 2020 and multiplied that average percentage by the total 2012 generation for the region. We also computed each state’s maximum RE generation target in the best practices scenario as its own 2012 generation multiplied by that average percentage. (For some states that already have RPS requirements in place, these amounts are less than their RPS targets for 2030.) For each region we then computed the regional growth factor necessary to increase regional RE generation from the regional starting level to the regional target through investment in new RE capacity, assuming that the new investment begins in 2017, the year following the initial state plan submission deadline,153 and continues through 2029. This regional growth factor is the growth factor used for each state in that region to develop the best practices scenario. Finally, we developed the annual RE generation levels for each state. To do this, we applied the appropriate regional growth factor to that state’s initial RE generation level, starting in 2017, but stopping at the point when additional growth would cause total RE generation for the state to exceed the state’s maximum RE generation target.”

This all makes sense until you think about the market perspective and the actual reality of this approach. Historically, the areas with the greatest renewable development generally have two characteristics – high power price and/or an abundance renewable generation opportunity. The barrier to jump to alternative power source was minimal, such as the case in California compared to states with low power prices Kentucky and West Virginia. These states with much lower prices will have a greater impact in moving to a more renewable system. Their economy is not centered on high power prices. The jump to this higher value will be significant. West Virginia growth in renewable is 1000+%. In West Virginia’s case, EPA is asking the state to invest in a more expensive, but cleaner power source. If we assume the same assumption above, then WV’s needs ~3.6 GW of wind capacity with a total cost of $7 billion dollars. If we spread the cost with West Virginia retail sales over the next 20 years it would still cause a rate impact of 14%. I did a state by state analysis on this renewable piece – if you are interested email me[email protected]

Let me pause here for further digestion before moving onto the EE/DSM portion of the plan.

We can help the policy discussion in terms of running independent assessment and helping develop strategies to best plan for the future.

Please contact us 614-356-0484 or[email protected]

Your Inspired Energy Consultant,

David

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/