Levelized Cost of Electricity (LCOE) Analysis Potentially Misguides You in the Power Markets

Levelized cost of electricity (LCOE) approach is very popular in the financial circles. When I was at American Electic Power (AEP), many of the large financial companies would come and speak with our executives and present LCOE on various technologies. However, the levelized cost method has too much simplicity, giving the presenter and the viewer internal biases. Levelized costing is way too simple and will typically produce results not valid in reality. I will present the case to you in this blog.

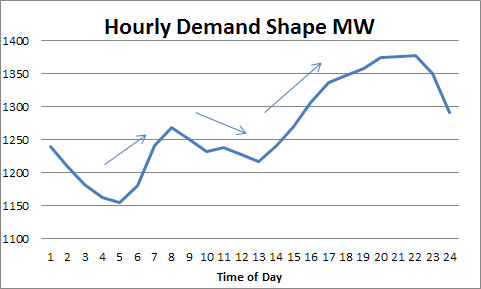

One must understand the reality of power; it is a market of instantaneous nature. There is minimal ability to have inventory unlike other products and commodities. This difference requires a market that trades intra-day and in many places intra-hour as load is not consistent through the day – as seen below for a typical load shape.

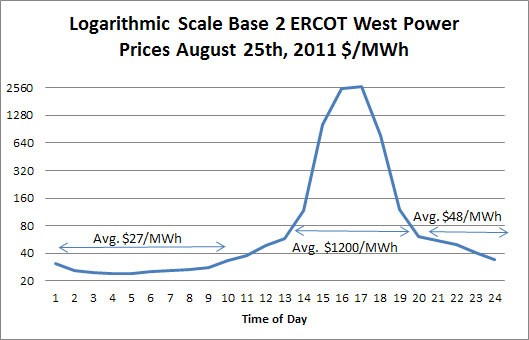

Not only is the load changing, but perhaps the supply to fill in the load could also change within the hour, depending on mechanical issues at each plant, transmission line, or distribution system. In addition with the implementation of wind and solar resources, we are now more dependent on the weather. As we see in our local news, the weatherman struggles; weather can be very unpredictable even just a day out. As result of load and supply availability changes, price swings within a day can be significant. Below is hourly price ERCOT West on August 25th 2011. The prices are so volatile that I had to plot it on a logarithmic scale, so you could see the variations. We had prices go from $24/MWh to $2600/MWh back to $34/MWh within a day. The second important realization is that only a few generation technologies can turn on and off within minutes to an hour. These units will likely have less efficiency than units who take their time to turn on. A fine economic balance is needed. Given the variations and the volatility I would always suggest a portfolio of technologies.

To show the misguided nature of levelized cost analysis, I have developed an excel file capable of dispatching various unit technologies to an hourly price curve for a year. In this example, I am using the actual 2011 ERCOT West hourly price curve. With the price curve and my model, I dispatched the unit. To prove the fallacy of the levelized cost mechanism, the easiest technology to model is the reciprocating engine. Given its ability to turn on and off in minutes and obtain full load heat rate, the reciprocating engine is an ideal candidate for hourly dispatching. With information that I obtained from Wartsila, I used the following design parameters 8 Heat Rate (mmbtu/MWh) for the initial and final hour and $4/MWh variable O&M. This unit either produced 0 MWh or 250 MWh based on whether the unit was economical to run. For the fuel price I used daily henry hub prices minus $0.20/mmbtu to account for the basis issue (Average fuel cost $3.79/mmbtu). Using my model, the unit produced a capacity factor of 30%.

For those interested, I have spent much time and analysis evaluating the Wartsila technology. If you are interested in an independent evaluation of their technology in your portfolio please do contact me. In most cases, I see a large value add in their technology for a resource portfolio, particularly when combined with various wind and solar resources.

Using the publicly available levelized calculator from the NREL, I supplied the same parameters from above plus the following financial condition: 30 year analysis, discount rate of 8%, capital cost $950/kW, fixed O&M $12/kW-yr. Levelized cost analysis concludes a cost of power of $71/MWh. With the average power price in ERCOT West in 2011 of $41/MWh, one may conclude the unit would be unlikely to produce much value in that environment. However, when we look at my model, including the corresponding financials of a reciprocating unit placed in that environment, the plant produces close to $34 million in net revenue in 2011 in power sales alone. Subtracting FOM and firm gas transport, we are still in the $30 million neighborhood. If we place this condition into a cash flow model, with the same economic parameters used in the levelized cost model, the internal rate of return (IRR) of the project over the 30 year period will be around 12%. This is in the environment of the average price of power for the year is $41/MWh versus the levelized cost calculation of $71/MWh. (Of course I am not endorsing that 2011 would be representative of the future, my purpose here is to point out the potential to be misguided by levelized costing. However, if you are interested in seeing various scenarios and forecasts, I would be more than happy to assist).

What went wrong with the levelized cost approach is the inability to actually be in the real world. Power is much too complex to simplify into a year model. In the example above, which represents real world economics, because of the significant price volatility, 10 days represented over 50% of the plants revenue.

I do believe in simplification versus paralysis analysis, but it has to be in context of the problem. By creating an hourly dispatched model in Excel, I did simplify real life, but not to the point it didn’t mean anything.

Some people feel comfortable using the levelized cost analysis to simply compare alternative technologies. Once again, I believe it will misguide you, probably towards traditional past generating technologies, largely because of the influence of the capacity factor assumed. Many people go back in time to quantify the capacity factor for various technologies, often not considering the environment nor the actual engineered capacity factor. Case in point, at AEP some wanted to use capacity factors of gas units in the teens because many of the units had experienced that or even less. When one put in a low capacity factor for the gas unit while putting in the high capacity factors (65+%) for the coal and nuclear plants the bias is tremendous. The lower historical heat rates were a function of the past market conditions. Obviously the market is changing with increasing load and increasing coal retirements. How will units respond given this changing environment? One will not know using the levelized costing approach. Levelized costing puts the threshold of gas very high relative to the reality of the world in the future. In addition, the capacity factors do not need to be high for units that are flexible because they will mitigate the hours where the units are losing money. However, units such as coal and even combined cycles will have to swallow many hours when the unit is out of the money in order to capture the times the unit is in the money. Another simple example is that solar technology will be generating only in the on-peak hours (unless you are in Alaska during summer times). Looking at the levelized cost of solar will mislead you in how bad the economics of solar is compared to wind, which in most places occur in off-peak periods. Levelized costing generalizes too much of the operations and interactions with the market. In conclusion, the levelized cost analysis is not appropiate to use for the power markets. My suggestion is to model units on an hourly basis incorporating some of the operations reality. I have many years of experience in evaluating various technologies, planning, and developing an integrated resource plan.

If you are looking for some insights and or additional points of view into the future technologies and/or power markets please contact All Energy Consulting.

Your Energy Consultant,

David K. Bellman

614-356-0484

Coal to gas switching or should we say displacement volumes

Coal to gas switching is much talked about this year. Many people like the switching word; but there is a dynamic that is occurring and also the term switching in the power industry, typically refers to units who have dual fuel. The better word is probably displacement – semantics.

There is two parts to the coal to gas displacement – structural and economic. The structural part is quite easy to discuss. The US market typically has required 50%+ of its generation from coal. Assuming no decline in load growth if coal units retire other units would need to fill in that void of generation. This part is the structural part of the displacement. As many have shown there are significant EPA rules which lead to the retirement of coal units. Now with the addition of the economic competition to coal from low gas price that may exacerbate the volume of retirements. Obviously the selection of which coal unit retirement will likely be based on how much that coal unit is used and how economically competitive it is. Those units who still run significantly will either already have the necessary control equipment to meet the EPA rules or it will likely be economically to install those controls. Therefore for a proxy one could look at the coal generation by plant from last year and stack up the capacity and generation. Also if one is savvy, one can also get a proxy cost of generation from each plant.

Now that you have generation stacked with capacity and cost you can do a calculation to calculate the approximate amount of gas generation if X capacity of coal was going to retire. I would not use a Combine Cycle heat rate (7) since some of that generation may be actually at peak times since some of the older coal plants are likely running at those time. In this example I used an 8 heat rate. Summing the data to produce 20GW of capacity retirements, produces 1.3 bcf/d of additional gas demand. Going to 40 GW of capacity retirements we are looking at 2.7 bcf/d. All this is the structural piece. Given the push for green energy the numbers will be lower some of the above number. The surprising perspective for many is that the gas potential in the power sector can be as dependent on the renewable outlook as the coal outlook.

In terms of the economic portion, this is the very dynamic portion. I have done much work in this arena and have given multiple presentations. This is very dependent on your price outlooks for both gas and coal, particularly on sustainable basis. In addition, time plays a crucial part in the analysis. One has to ask displacement for this week, next month, or next year. Each of those time periods various inputs into a dispatch model must be modified. Also the basis of displacement is being mixed in with natural load growth which in general is being filled in by gas or renewables. Therefore some analysis will say 10 bcf/d of switching will be seen in the next few years, but that includes a load growth which would have occurred regardless. If you are interested in getting some ball park numbers give me a call 614-356-0484 or email me [email protected] and be prepared to tell me the timeline, gas prices, and coal prices.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

Capitalism to Creditism to Green Economy?

Mike Shedlock posted an interesting blog discussing Richard Duncan perception on the end of Capitalism, and the conversion to “creditism”. Mr. Duncan also noted the reversal of the situation is near to impossible, therefore he concludes government should go ahead and borrow and spend money to make the world a better place. Unfortunately, he chooses the recent Green Economy as his choice of government spending pointing out a government solar build out in Nevada would be an ideal project.

Mr. Shedlock argues the issue that government projects never seem to work out as planned. Generally speaking I agree with most of Mr. Shedlock arguments to Mr. Duncan plan. However, I think they both miss the point I have been preaching “Energy is a means to an end.” If the government wants to take the Mr. Duncan suggestions, the most effective way to advance society is to focus on the ends not the means. One can have all the energy in the world, but if you don’t plan on using it in a productive manner that advantage becomes irrelevant. We need to stop with this Green economy concept. We need to think about how we better utilize and use energy in order to produce and manufacture products and services that society can use to better us all. I believe if we do focus on this, naturally, we will produce “greener” energy. However right now we are just fooling ourselves that by making a Green Economy we will be better in the long run. I never have seen a case where if I challenge my means/path it produces a better end.

I am pro-renewables in many ways. The subsidization path, particularly without innovation beyond the engineering sense, will not lead to a better outcome in the long run. I discuss this some more in previous blog.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484

The Demise of Coal Overstated

As I noted in my previous blog, I spoke at a power symposium last week. Many of the speakers had concluded coal is dead. The rhetoric is the same on the internet and major publications. People have even spoken to the point to say coal is more expensive than gas. This is sadly far from the truth.

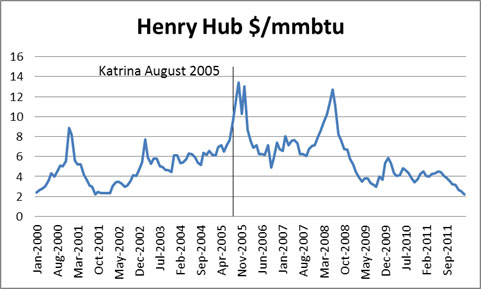

Weather played a key role in the current price predicament for natural gas. One year should never be extrapolated when weather played such a crucial role – case in point look at the price action in natural gas prices after Hurricane Katrina.

It is a true statement for those trading – “Markets can remain irrational longer than you can remain solvent.” You can see it almost took 6 months for Katrina’s price impact to fade. One could look at the current situation as the inverse situation – instead of a hurricane reducing supply you have a mild winter reducing demand. It takes time for fundamentals to rebalance the market. The price rebalancing can take even longer as noted in the irrational markets discussion. The irrational price levels of today’s market are natural gas prices below coal market contracts. Ultimately those contracts will roll off and the negotiations for the coal contracts will come down or no longer cease to exist. Conservatively, I would estimate we are in the fourth month of un-fundamentally low prices. I can foresee continued pressure downward on natural gas prices, but not past this year as long as we revert to normal weather.

For those saying it is over for coal, they are forgetting their game theory rules. For every action there will be a reaction from those most impacted. Coal consumption could potentially drop over 20% this year relative to last year’s consumption. Inversely gas consumption in the power sector could see a rise of over 60% from last year’s consumption. These two actions do not come without consequences/reactions. As I indicated above, I expect coal prices to come down. Inversely, I expect gas prices to rise. It is not if, it is just a matter of when. This combination will allow coal to once again prosper. Coal consumption will not regain its majority spot for generation (>50%) given the environmental policies and the corresponding retirements, but I expect coal will continue to be the top 3 source type of generation for the US for many years to come.

Please do consider All Energy Consulting to help you understand where the markets will be and how best to align your organization to capture the change.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484

Volatility in the Power Markets Inevitable

Last week, I spoke at the Flexible Power Symposium. I will note for my readers that I was rated as one of the highest speakers for the symposium. Many told me first hand, I was the best speaker. Speaking on a stage is natural for me, given my youth background as an aspiring actor. I had the privilege of attending the High School for the Performing Visual Arts in Houston. However, my analytical mind got the best of my aspirations as I looked at my probabilities of success and my required income.

Nonetheless, my talk consisted of laying out the issues confronting the energy markets. I titled my presentation “Unintended Consequences from Good Intentions in the Electric Markets”. As typical of my style of presenting, the slides were much less important than what I had to say. I focused on the three areas on which, as a society ,we should strive for in the electric markets – Renewables, Environmental Policy, and Better Market Design. I made it clear to the audience, I am pro-renewable and environment, but I am also cognizant of the trade-offs. This is probably where I may lose some of you. The externality of the fossil generation is real. The plant is emitting potentially harmful chemicals. However, as in life, there are trade-offs and the corresponding externalities. Extreme environmentalists like to ignore this other side of the equation. Having low cost generation, though more environmentally harmful, offer externality factors of greater expanded use of power which can generate jobs, save lives, and include making society feel better (e.g. comfortable temperature). As I noted in my discussion of the MATS rule by the EPA, our choices to spend for environmental improvements need to be balanced with alternative for use for that capital (financial and human). In addition we really need to understand what our goals are when we plan to spend resources.

Many speakers ahead of me already discussed the variability of renewables in terms of generation. The interesting points in the variability discussions, the wind is hourly whereas the variability of solar is in minutes. In addition, wind is quite spatially consistent. Wind blows simultaneously at the same levels for large regions. Whereas solar can have some balancing effect if there is large regions of solar. I also pointed out the choice of renewables given the higher cost, does take away from the economy as energy is only a means to an end. Many models only consider the wholesale power price, but given renewables are largely done through power purchase agreements (PPA) which are rolled into rates wholesale power prices are less relevant when it pertains to consumer pricing.

Environmental policy already in effect will retire coal units. Many of the coal units support many of the ancillary services: of the electric market – load, following ability, voltage and reactive load support, unit frequency response and system restoration or black start. In a Catch-22, the price signals of each of these services are essentially non-existent due to the large sunk cost in these facilities. There is bound to be a bumpy path as the units get removed from the system and the price signals for investments in these services catch up.

Market design, to regulate or to de-regulate, that is the question. I talked about the pros and cons. Ultimately many markets are already on the path of de-regulation. These markets are bound for market volatility as returns required for investments are higher in de-regulated environment. In addition, high return industries naturally move in business cycles (over to under investments).

In conclusion, given the three areas of renewables: environmental policy, market design, and the future electric markets are bound to see volatile pricing. There will be winners and losers. The losers may be the rate payers as they could see higher prices with less reliability. The winners will be those who have the flexibility and the forethought to skate to where the market will be not where it is now.

Please do consider All Energy Consulting to help you understand where the markets will be and how best to align your organization to capture the change.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

CERAweek 2012 Summary from the Outside

This years CERAweek marks my first year in almost 10 years in not going to CERAweek. I had the privilege to be invited and speak at CERAweek two times. The amazing thing about CERAweek is the shear size. I have seen it grown from the days in the Galleria area to now at the Hilton Convention Center hotel.

One of the values of being at CERAweek, which you cannot get from reading summaries, comes from the time to reacquaint yourself with your fellow energy colleagues. Also, one of things I always marveled at from being at CERAweek is the logistics of the staff to serve meals. When you attend CERAweek, it is not a buffet line – it is a three course meal for lunch and dinner.

In terms of content summary, Platts did a fine job summarizing many key points in their blog. In addition, twitter works out well when you search #CERAweek. The highlights, I believe, were noteworthy:

CERAweek Oil Day:

I have to agree with Iain Conn, group managing director and chief executive of BP’s worldwide refining and marketing group. Mr. Conn said refinery investments will continue happen in the Atlantic Basin, but it will be strategically done. He also specified he expected to see investments in facilities to take the condensates from the shale development and make products. Those who have been reading my blog will note I made that call early February.

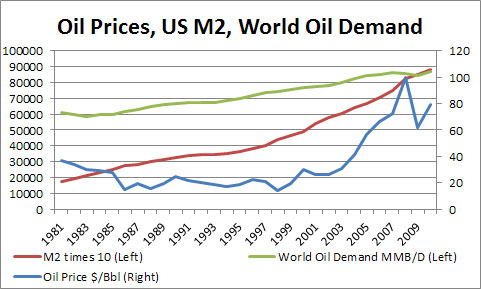

A group made of a good aquiantance Marianne Kuh, Chief Economist ConocoPhillips, and my friend Frank Verrastro, senior vice president and program director at CSIS Energy and National Security Program; noted the high crude oil price is more of a function of actual demand growth, not only political uncertainty of Iran. I do agree with these points, but I still think monetary policy has influenced the price of oil as significantly as demand, if not more.

To prove my point, I have pulled annual oil prices, M2 money supply, and oil demand since 1981. I have graphed the information below. I also ran regressions on each of the variables to oil price. M2 money supply has a better R^2 with 0.61 vs. 0.48. Together they produce a rather strong correlation for an R^2 of 0.70. Another interesting outcome of this analysis is it shows for the first time the amount of M2 is now greater than 10% of the world demand expressed in millions of barrels/day. This started in 2009 as the FED aggressively moved to “save” the system.

CERAweek Gas Day:

There were several discussions of natural gas vehicles. I think it’s a clear choice for fleets to convert to natural gas. Mass transit vehicles should move towards CNG. There was discussion on a recent article in the Wall Street Journal by Robert McFarlane, served as President Reagan’s national security adviser from 1983-85. In the article Mr. McFarlane talks about methanol vehicles. Speakers at CERAweek disagreed with him largely on the premise of structural issues. I think the more valid concern would be the history and fate of MTBE. From what I have gathered methanol would be more toxic than MTBE. I do disagree in how we handle the MTBE issue – requiring MTBE then banning it. MTBE was a messenger to a problem that is still happening. MTBE gave you a mechanism to trace and track leaking gasoline. By eliminating MTBE you did not solve the real problem.

Apache CEO, Steven Farris, made remarks in regards to supplying utilities with long-term contracts, but with a floating gas price. Once again I have blogged about this before. It would be worthwhile to continue to watch this evolution. Many are trying to emulate coal contracts, but the reason and the value of contracting gas is not the same as it was with coal.

Of course it wouldn’t be gas day without a deluge of shale discussion and fracking concerns. Many speakers talked about transparency and the efficacy of fracking. I will have to agree here that it can be done in a responsible and safe way. It is a matter of regulators to effectively regulate, because there will always be bad actors.

My former consulting company, Purvin & Gertz, who got acquired by IHS had their own session at CERAweek. They spoke about the NGL markets. Once again I did note about the dynamics of what is going on in this market in my previous blogs. This is an exciting area, full of opportunities.

CERAweek Power Day:

For some reason, the day opened with a discussion of nuclear renaissance. I will have to agree with GE CEO Immelt – there has never been or will be a nuclear renaissance in the US. I will add the caveat – unless significant structural changes are made to our electric industry design. This country has cost-effective options whereas other countries do not (e.g. France, Japan, etc…).

I will have to differ with many of Alstoms thoughts. Alstom has been a very vocal and huge supporter of CERAweek for the past few years. They spoke many times during the conferences. I have read that they still are investing heavily in CCS. They believe the focus for clean energy should be on the technology side. Once again in my blogs, I elude to the point it is not the technology that is limiting “clean” energy; it is the business strategy and incentives. They also point out that gas generation should focus on bigger turbines with lower cost. Of course, that sounds ideal, but I think over the next 3 years the value proposition will be for more dynamic turbines versus bigger and efficient. I say this because of the need to serve the intermittent nature of wind.

FERC commission, Philip D. Moeller, discussed the point that the consumer needed to see the real price. I believe he is trying to point out the desire of real-time metering. However I will disagree with this since there are several ways to make pricing more transparent to the consumer. Rate design in itself does not hide the cost of power, since regulation comes with cost recovery. It is the actors behind the rate design that hide the true cost of power – as noted in my previous blog. Real-time pricing will change consumption, but the bulk of the impact could be done by having block metering – on and off-peak hours with no dynamic pricing, but a statement to the consumer. The hours between 7am-10pm will be more expensive than 10pm-7am. This method would come at a fraction of the cost and involve much less complexity. I do understand the value of the “smart” grid that it comes from other forms, such as reliability; but this is not how it is being sold to the consumer.

I couldn’t agree more with CEO and President Bruce Grewcock of Kiewet – “In a lot of jurisdictions, people are going to see rate shock when they see the true costs.” Once again this is not coming from a smart grid realtime perspective, but the fact that there has been an underinvestment by the utilities. Instead of focusing on true needs over the past years, we have focused on projects and mechanism of style (e.g. CCS, IGCC, fuel deferral, smart grid, etc…). Inefficiency in markets will always come back to haunt you.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,