Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

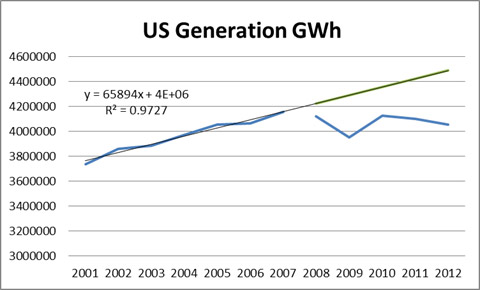

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB

As a consumer I am unable to understand the relationship between load growth and revenue. A can visualize that load growth would translate into both revenue GROWTH and thus Profit GROWTH. I infer from your statement that revenue would decline if there were a constant load. Would you please explain why that might be true?

John its all in the ratemaking process. In the regulated world when a utility does an investment they get cost plus a return on that investment if approved by the commission. The rate structure is the mechanism to get that return. The rate is set based on expected load that will generate that return. In times of economic growth along with load growth there is less scrutiny of projects as requested rate growth is limited due to growing load. When load collapse the utility needs to go in for rate hearing to re-adjust the rate to collect the rates “approved” by the commission. All of the sudden the rate increase of only 1% may now need to be much higher. In addition all of the sudden all projects become more scrutinized.

I have said multiple times the utility sector in the regulated format is just a micro government. This situation is no different than the federal government. When times are good and tax incomes are coming in the government spends more and there is less questions asked. This is the broken part of Keynes economics. Those Keynesians failed to listen to this part of Keynes economic “treaty”. Instead of spending more in good times one should build a surplus/savings/buffer for later. Given that we don’t do this part it becomes a necessary step to reduce spending to greater levels than if one had build a surplus doing the good times. In the case of a utilities, if “pet” projects got a approved versus projects of necessities this exacerbates the situation as those projects given “approved” status legitimately should get a return. Then when a necessary projects do come up and the loads are down and rates already have to rise to make up for the approved projects this may crowd out the necessary project putting reliability at risk as it becomes a political game of keeping rates down.

I tried to simplify it as much as I could. You can sit down and make up an example – it is all math in the end. The investment plus a return must be paid back and it is tied to the consumption of energy. There is some opportunity to game with the system, but the money flow can be followed.

Very well presented. It nice to see this coming from a very reliable source.

Thanks Bill.

I did not publish the answer to this threat as it depends on each utility. Given the experimentation going on in the industry you have a fragmented market structure for many utilities some are partially de-regulated and others are still regulated. The truism from this is that the utility industry better have a well thought out plan else they will be planning for their own demise. I hope to assist these utilities as I can offer a great deal of thought leadership and perspective into how the future may unfold given their various decisions. Many in the space of partial regulation is betting the farm on transmission which I don’t believe is the right strategy.

Best,

David