Quantifying Power Price Risk

Given our completed summer 2015 analysis and our last power discussions centered in the East, we head West in this example analysis and quantify the risk in Mid-Columbia (Mid-C) power hub on a high level. In order to make an effective decision, one requires knowing more than the fact that higher gas prices, higher load, and lower hydro generation produces higher power prices – but by knowing the extent and the probabilities this leads to effective decision making. Power Market Analysis (PMA) is built to deliver you this knowledge by using AuroraXMP by EPIS and following the fundamentals of power modeling as described in the whitepaper.

Current Mid-C Market

Examining the Mid-C On-Peak power curve, we see some very interesting results. The current forward curve for the summer rises from $22/MWh to $30/MWh by the end of summer. To many, these prices are likely extremely low. However, this is what you get in a hydro based environment with $3/mmbtu gas prices. Based on our preliminary analysis, it would indicate the prices can actually be much lower for many of the summer months. We ran over 60+ simulations for this summer.

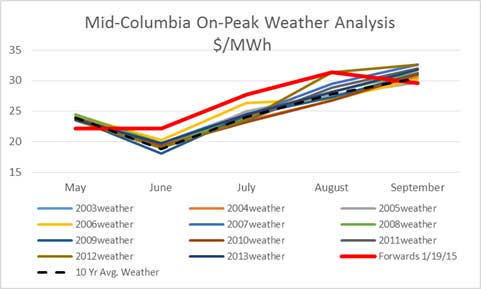

Weather Analysis

To understand weather, we ran the last 11 year actual weather patterns and generated a new load forecast under those parameters. The weather changes in the region over the last 11 years are not that impactful in the summer. The largest standard deviation was in August at less than $2/MWh. This makes sense given the temperate summer weather in the Northwest.

Gas Price Analysis

To understand the impact on gas prices, we changed gas prices from $2.5/mmbtu to $6/mmbtu in 10 cent increments. The graph below displays the results in 50 cents increments. Holding all other variables constant, the changing gas price can have a standard deviation impact of around $8/MWh. The graph indicates the futures market is anticipating a higher heat rate than the model or the power trader’s sense higher gas prices by $0.5/mmbtu either through basis or Henry.

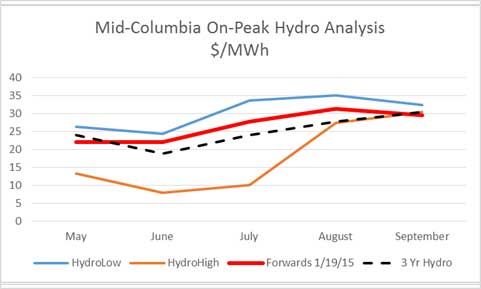

Hydro Analysis

By far, the biggest risk to Mid-C is the hydro conditions. We examined 70 years of hydro conditions and used the 1929 case for the low hydro year and the 1997 case for the high hydro year. The forward curve is likely concerned about a low hydro year given the issues from the past few years. However, the prices can fall significantly if a hydro year similar to 1997 was to occur.

Potential Actionable Items

The use of such analysis is only valuable given your circumstances. The results of this analysis requires understanding you particular situation. At All Energy Consulting, we will collaborate with you to help you make the most effective decision.

End User

If I were an end-user with a good or service which is dependent on energy cost, I would consider locking in September pricing. If usage is low in May and June, it would indicate not locking in power prices those months. Depending on usage and risk tolerance, July and August could be too risky to lock in.

Power Generator

The low gas prices are causing much pain for the bottom line. However if you haven’t hedged that risk already, it may be too late. The declining gas price risk, given the strip currently $3/mmbtu, has a diminishing impact on power price. A 50 cents move up has more impact than a 50 cent move downward. I would monitor the rainfall and start selling some positions in May-July. I would request an Off-Peak analysis to further inform my decision.

Load Serving Entity

Off peak analysis is needed. An overlay of the usage curve along with the on-off peak prices will confirm the need to lock in prices for August and September.

All Energy Consulting can take this type of risk analysis and work with you to apply it to your situation and produced a comprehensive no-regret strategy and implementation plan. We have all the information for your region and can supply you with and even more complete risk analysis. We cover the entire N. American market and produce On-peak and Off-peak prices for all the major hubs. Our near-term simulations can produce a three year projection. We also offer a long-term solution covering the next 30 years.

We add value in your energy buying needs by offering in-depth analysis in order to empower you and make you confident in your energy decisions. Please do consider All Energy Consulting, we help all types of clients from power generators to end-users better understand the energy markets.

Your Looking Out for Your Success Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB