Crude Oil Markets Are Not Like 1998

I have been giving a presentation on the future of the oil markets to various people. I am working on converting the presentation to paper. So far, all have appreciated my unique and refreshing insights to the oil markets. I would post my presentation material, but like most of my presentation materials, it is not designed to be a stand-alone document.

In order to find the future price of oil, we need to understand how the market got to where it is now. The presentation starts off with the fundamental question – IF you had forecasted the following fundamental parameters relative to the actual results, where would your price forecast relative to actual results be?

-

World oil demand forecasted too high by 10 million bpd

-

US oil demand forecasted too high by 5 million bpd

-

US crude oil imports forecasted too high by 10 million bpd

-

OPEC world oil supply represented 15% less than anticipated

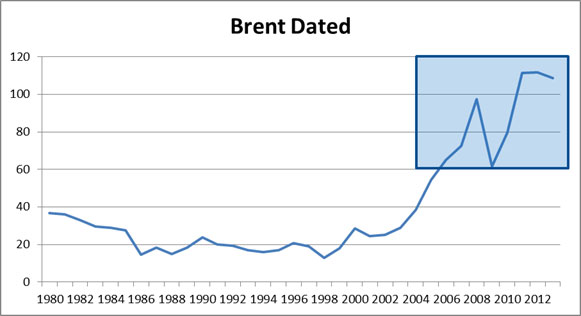

Most rational energy analysts would suggest the price forecast would have been too high given these factors. However, this is far from reality. In 2013, the average price of Brent was $111/bbl. The EIA Annual Energy Outlook in 2002 high price outlook forecasted $40/bbl. All other analyst, including myself, would have been ridiculed to show prices above $50/bbl for 2013 – (less than 10 years out). Four years later in 2006, there was only a slight improvement in the forecast. The EIA high case now showed $80/bbl for 2013. At the time, I had forecast subscriptions from PIRA, CERA, and WoodMac. None of them had a forecast for 2013 – less than a decade out – remotely close to the actualization of $111/bbl other than CERA extreme scenarios with a range of $110-$30/bbl (any use when the range is that wide?).

I hate being wrong and vehemently detest being wrong without knowing why. It would seem the market has conveniently reset their forecast and have accepted this new price paradigm without really finding some fundamental rational to this new price level. Many will bring up geopolitical risk and supply disruptions – but all the supply disruptions would not amount to being wrong by 10 million bpd. Then the next excuse is cost of production being higher. I think this is more a symptom rather than a cause for being too low in the forecast. Another reason mentioned is increase trading in oil, but once I again I feel it to be a symptom not a root cause.

In my presentation and my future paper, I delve into the reasons used to rationalize how we got where we are. On a high level, the reasons investigated beyond the typical fundamental supply/demand country analysis are Monetary Policy and the shift in the demand elasticity curve. Finally, I will also address why this is not 1998 for which I have first-hand experience given my 15 minutes of fame was all used up that year (Front Page USA Today and other). Please contact me if you are interested in me presenting to your team this unique and refreshing view on the oil markets from a pundit who was in the trenches in 1998 and made the call for the collapse.

Your Used All My Fame Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

“In the future, everyone will be world-famous for 15 minutes” Andy Warhol