Effective Power Hedging – Demonstrated Using PMA

Whether you are a buyer, or seller, of power, an effective hedging program will save you from a ton of headaches, and questions. Power markets are the most volatile commodity given their dependence on various other commodities, the instantaneous nature of power, and the very limited ability for power to be stored in significant volumes. The primary purpose of hedging is to create a more predictable set of cash flow in order to run your business more effectively. An effective hedging program doesn’t leave significant money on the table, nor does it make significant money. If you really think you can make money from hedging, than you are trading, not hedging. Trading can be an effective business proposition, but it requires a lot more than hedging in terms of governance, infrastructure, and analytics.

Hedging can be relatively simple given that the goal is to assure more predictable cash flows, and not to make money. In hedging, the governance requirements are about monitoring and making sure a methodology is employed which has demonstrated the ability to be an accurate predictor in the past. Any significant variations in the past analysis should be flagged and addressed in the analytics. The infrastructure for hedging can be quite simple by employing a product such as Power Market Analysis (PMA) from All Energy Consulting. PMA can be used to create the timing signals and levels at which to purchase, or sell, power.

The analytics piece is the beginning, and the end, of developing an effective hedging program. The purpose of analytics is to develop an effective system to signal purchases, or sales, and execution volumes over time. The system should not try to guess, or time, the optimum purchase time, but scale into the hedge volume based upon signals. Initially it will take several iterations of back casting to the past to produce an effective methodology to achieve intended goals while meeting an organization’s stated requirements (risk tolerance, budget, etc.).

A simple mathematical approach of developing a hedge typically doesn’t take into account weather-based fundamental market movements and the resulting commodity price changes. PMA increases the robustness of any hedge process by producing a unique set of outcomes that show the risk and reward potential of locking in prices ahead of time. A simple concept of integrating PMA is to execute a hedge when the risk and reward profiles are asymmetrical. PMA, in its non-customized form, runs a relatively high power, and a low power price, scenario for all power markets in North America. The PMA model output provides the low, and high, expectations of power prices in the future. The model does not predict commodity prices, but uses forward markets for the implied forecast of the future. Given that you use the forwards markets to execute your hedges, it is only appropriate to use the commodity prices from these same markets.

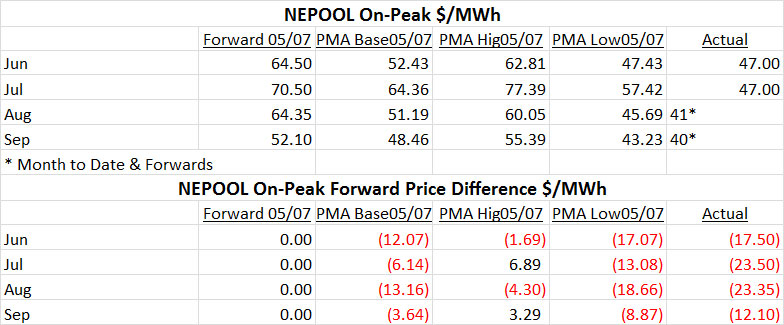

In the table below, we present actual results published May 8th 2014. The results are due to the gas and coal forwards of May 7th. The table shows that the forward curve on May 7th for NEPOOL On-Peak trading is above $60/MWh for most of the summer months. The PMA model runs indicate a much lower price outlook, with only July and September possibly being higher (in the high power price case) as compared to the forward curve. Even if July were to achieve the high case, an increase of $6.89/MWh is being risked for a potential drop of $13.08/MWh. This is an asymmetrical risk-reward profile which should signal some volume of hedging, if one was a seller of power (owner of a generation asset). If one was a consumer of power, this would indicate to limit the hedge volume. In the end, this summer has been extremely mild. Buyers of the forward curve have had an agonizing summer, losing nearly $20/MWh for the summer. Sellers are somewhat relieved. PMA does not predict weather, but the low and high cases do represent extreme weather events impact on price levels. The model does not predict that it was going to be a mild summer, but it does show the forward curve has a significant premium relative to the potential outcomes. In this simple example, the May 8th report indicated a signal to lock in some of the power for the summer if you were a plant owner. If you were a power consumer, it signals to minimize, or not purchase, summer power as the exposure to higher prices is limited.

The signal is only one part of a complete hedging program. In order to design a comprehensive hedging program, you need to incorporate your specific situation in terms of expected shape of energy requirements, volatility tolerance, and budget. With this knowledge, one can then incorporate a volume of purchase, or sales, with the signal. All Energy Consulting can help you create an effective hedging program that minimizes your earnings volatility and reduces risk by employing an unemotional, analytical rigorous process based upon PMA.

Please do consider All Energy Consulting to help you design a headache free – no regrets hedging program, whether you are a buyer, or seller of power.

Your Energy Consultant,

David

David K. Bellman ([email protected]) 614-356-0484