Summer 2014 Outlook – Power, Gas, Coal, and Generation Fleets!

Over 90 graphs and 79 pages of hard-hitting analysis. This report does not regurgitate what you already know. Executive summary along with some graphs are presented below.

Though the report is 79 pages, it is still only a small fraction of what we could present. We are able to build off this analysis to produce any custom view or further analysis that is directly your concern. The power markets touch many, from traders, energy managers, fuel buyers, plant operators, government officials to fuel producers and many more. We have the ability to help you better understand the market by explaining what has happened and how the future can unfold and what you can do to prepare for that future.

The report is free to PMA Prime Members. Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. PMA Prime members can expect to get 4 quality in-depth reports a year along with other smaller insight reports each month. As an introductory price we are offering the report for $10K or $5K for one section.

A free version is available. Given our introduction into the market, the difference in the free version is limited. Free version is lower resolution and some parts are redacted.

Thoroughly analyzing the power markets can offer something for everyone given how much power touches everyone’s life. As demonstration of breadth, in the Summer 2014 report, we created a company fleet view. This would add valuable insights to investors in the utility industry.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Executive Summary

Summer of 2014 will differ from previous years as a result of one of the coldest winters in decades. The weather will continue to play a key role in how the summer unfolds. An in-depth and rigorous analysis is done on fuel consumption, power prices, and the top 10 utilities generation fleet. Power Market Analysis (PMA) processed 19 different potential sensitivities that could impact the power markets and presents key findings from those runs.

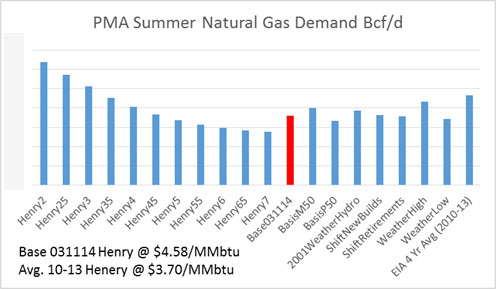

Gas demand is the most sensitive variable being easily impacted by elements such as changing commodity prices to weather. With the current forward curve of Henry Hub, prices this year will increase +23%, relative to 2013. This price change will significantly reduce gas demand in the power sector, assuming normal weather. Coincidently, the base case is showing a 23% drop in summer power gas demand compared to the four year average. The recent EIA Short Term Energy Outlook (STEO) is not anticipating much drop in power demand in 2014 relative to 2013. In order for that to happen, there are several changes in key variables needed, in some cases by themselves or in combination with other variables, to mitigate the gas demand drop in the power sector compared to 2013. An unusually warm span of weather can make up for the drop in gas, but this would have to be even warmer than the record setting summers of recent. The Western drought could impact the gas demand in the sector by almost 7% if the drought was similar to that in 2001. A price drop of almost $1/MMbtu could produce no drop in demand from the power sector. In addition, a further decline in negative basis could also add to gas demand. All this is displayed in the analysis below.

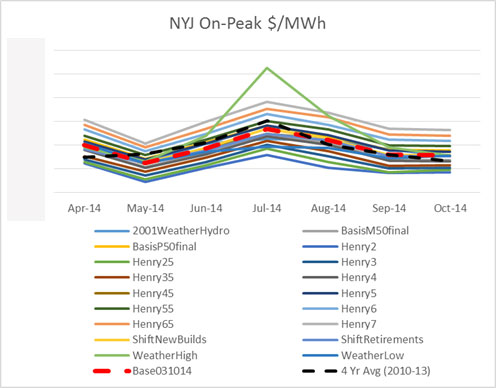

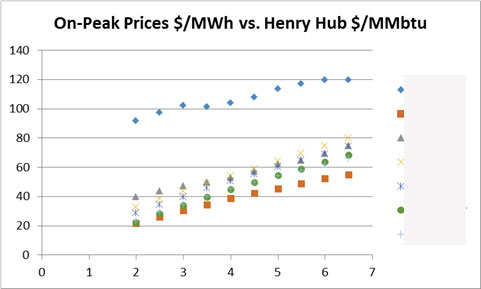

Power prices across the US will perform differently depending on the existing infrastructure and current generation fleet. There are areas which are very sensitive and can easily experience significant prices spikes – NY and ERCOT. Many areas are directly tied to natural gas prices. Other areas are showing little impact to power prices even if gas prices were to fall. There are usually trading arbitrages in power markets as the ability for the market to efficiently compute all possible changes is limited. Power market analysis requires a platitude of skill sets which then must be combined and deciphered to produce a cohesive picture. Many times, by the time the process is complete, the market has moved on. PMA subscribers get fresh daily runs, so whenever the market shifts, PMA is there with a snapshot of possible scenarios. The various power markets have their own characteristics. This can be seen in the analysis below.

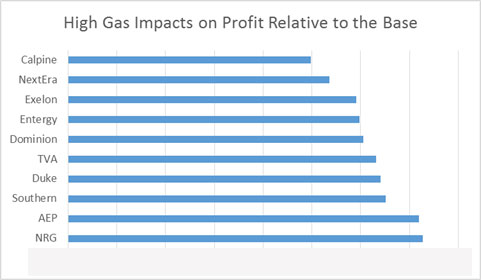

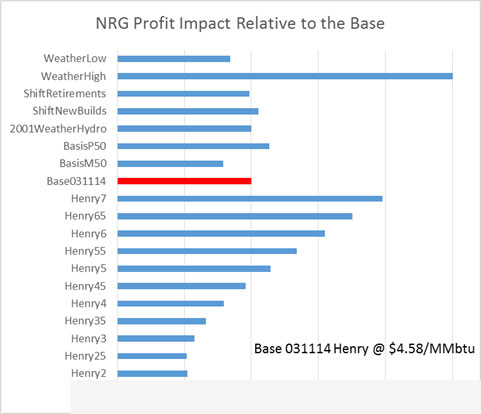

The top ten utilities fleet, by size of generation capacity, was reviewed under the various 19 cases. A proxy calculation was made on how the fleet could be impacted from the base case. Some fleets were much less risk averse to changes in the market. Whereas others could see a devastating profitability change if certain sensitivities come to fruition. All fleets would like to see a warmer than usual summer, but NRG and Calpine fleet can hit the lottery if this were to happen. There are many business strategies that can be designed once the knowledge is made on what makes the fleet “tick”. More company fleets are available upon request.

The Summer 2014 PMA analysis demonstrates the vastness of analytical capability and information available if power market analysis is well thought out and performed. PMA is designed for flexibility to offer multi-faceted views of the power market. There is so much more available in terms of reporting. If you would like additional information from these runs please contact us at [email protected] or at 614-356-0484. Also customized cases can be done for a fee.

Sample Figures: