Ready for March Gas Demand? Duke’s Merchant Coal Plant Value?

All Energy Consulting’s (AEC) latest product offering,Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. Prime subscribers get additional analysis which is demonstrated below. Also demonstrated is the value PMA offers in generating custom reports from the daily runs at minimal cost for our subscribers.

In February, we started examining the hydro impact due to the drought in the West that is occurring now. Our initial findings show natural gas demand changes throughout the year with the most dramatic change in March.

Online Interface Screenshot – 2001 Weather and Hydro Condition Impact on Gas Demand:

Complete chart and data available now for subscribers.

Prices did materially change, but mainly in the West, as expected. As a subscriber you will get the full output and briefing of the run.

Online Interface Screenshot – 2001 Weather and Hydro Condition Impact on Mid-Columbia Power Prices:

2001 Weather/Hydro Run files available online see power prices and fuel consumption.

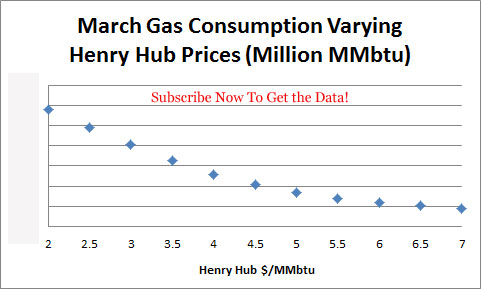

With March right here and now, we decided to investigate March gas demand. Our first analysis examined changing Henry hub prices by 50 cents from $2/mmbtu to $7/mmbtu. *This graph will be generated for the next month gas demand for our prime subscribers in the middle of each month.

Henry Hub Price Iteration Runs:

Complete chart and data available now for subscribers.

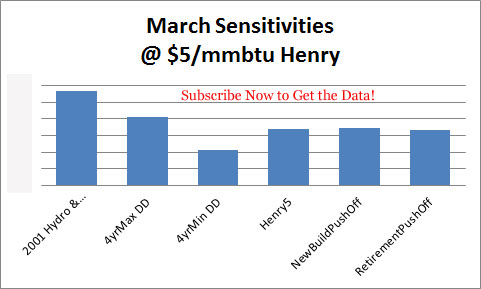

We then examined the various sensitivities at the $5/MMbtu range. From our analysis, it shows that if the hydro and weather aligns with 2001, we could experience a gas demand increase as significant as a dollar drop in Henry Hub prices.

Natural Gas Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

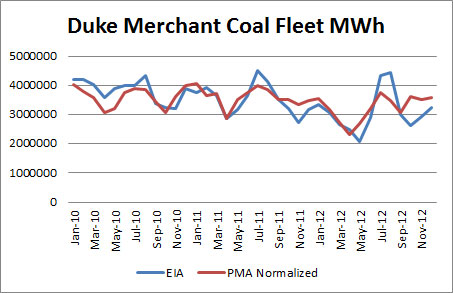

The above analysis is all available to Prime Subscribers each month. In terms of a custom report example, we put together an analysis of the Duke coal assets in the portfolio which is up on the market. Duke is selling this portfolio as whole looking for $2 billion. The coal assets represent the majority of the MWhs produced. In 2010, the coal assets represented 87% of the MWhs for those plants. An example of a custom report request might show how units performed in the model in the past and how they are expected to perform in future.

History of Coal Plants in Duke’s Portfolio MWh:

Based on our quick analysis, without any fine tuning, we can anticipate the Duke units will generate 6% less energy from their 2010-2012 actuals as Beckjord, and a Miami Fort unit is retiring. However, the economics compared to 2010-2012 will improve by 60+% as higher gas prices and regional supply/demand will benefit the units still running.

Future Expectation of Coal Plants in Duke’s Portfolio MWh:

As a subscriber to PMA, the above custom output request would cost you only $2K. In addition, you can expect a 24 hour turn around from request to final output. Output will include all the data behind the graphs.

We would recommend further due diligence if an acquisition was being pursued. AEC can help. Our due diligence efforts would involve reviewing historical performance to evaluate sustainability of the assets, fine tuning our model to accurately reflect cash flow for those assets, and performing long term scenario analysis to understand your risk. As a subscriber, you will get a discount to our consulting fee.

Hopefully, I have demonstrated that PMA can bring you great insights into the power markets at an incredible value. The above analysis can easily payback your investment by helping you make better decisions whether trading, planning, or purchasing assets. PMA will offer a better understanding of the power market from power prices to coal and gas consumption.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

P.S. Send an email to get a free one week trial.