Integrated Resource Planning (IRP) Continues to Use Antiquated Methods – Strategist at risk of disallowances

The most popular software for Integrated Resource Planning (IRP) in the US is probably Strategist by Ventyx, who is now part of ABB family. ABB focus is power and automation technologies with revenues of $40 billion. Unfortunately, for Ventyx, software represents a speckle in terms of revenue in the grand scheme of ABB business.

The history of power planning involved numerous methods of short cuts, given the instantaneous nature of power and the lack of processing capabilities in the past. The instantaneous nature continues with power markets being settled hourly, if not sub-hourly, in some markets. Processing power has well advanced forward, following the famous Moore’s law. However, we still see short cuts in software such as Strategist.

In the recent filing done by Public Service of Colorado – parent company Xcel Energy – http://www.dora.state.co.us/pls/efi/efi_p2_v2_demo.show_document?p_dms_document_id=240772&p_session_id=

You will note in the documentation: “The Strategist model represents load for each month with a typical week composed of 168 hours that is then repeated to capture the full load for that month. As a consequence each 168 hour week is individually dispatched to minimize system cost.” A large assumption is being made that a week hourly shape within a month is relatively consistent. This is not a good assumption given the changing of seasons plus just the very nature of weather. Averaging the weeks into a month loses the variability of peaks and troughs. Historically, this was not important when intermittent resources were not so relevant, and computing power was limited.

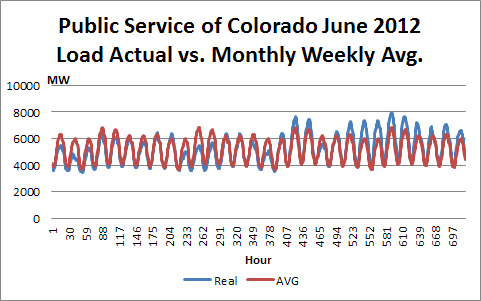

However, times have changed and the process need not be shortcut. Below is the graph of Public Service of Colorado hourly load for the month of June 2012. The graph compares the average weekly line that would be used in a tool like Strategist to the actual hourly data. You can see significant differences in the shape. In fact the peak drops 14% and the minimum load rises 7%.

I currently don’t work for any software company, nor am I being paid to endorse any software product so I can say without a bias, Strategist,in its current form, is a risky software to use in the world of intermittent resources. With cost rising in all areas in the utility business, any misstep can lead to significant disallowances. Also, noted in the same document was an issue of space which limited the software to do a full optimization. “Despite algorithm efficiencies and Company efforts, such as locked expansion plan tails, this particular approach to expansion planning has the potential to eventually build more candidate plans than the data storage capabilities of the software can accommodate.”

This concern came from a result of Strategist design to evaluate the various options. Strategist will calculate all permutations regardless of cost effectiveness. Strategist limits some of the permutations by employing the Bellman Optimization method – no relation to your Energy Consultant but worthy tidbit of knowledge. To a large degree, I concur with this method. You want to see the various permutations since the most likely case to choose from will be a plan that is likely suboptimal in all reasonable scenarios. At the same time, it is also cost effective in all scenarios. If one were to focus on a particular optimal plan, feeling certain about the future would be too much of a gamble given the many moving parts in the energy space. A robust and resilient plan, that can be relatively cost effective in low and high for natural gas price, economy, carbon constraints, etc. world, is the better plan. This resilient/robust plan in each individual outlook of the future will likely be sub-optimal.

An alternative way to produce the robust/resilient plan with limiting the permutations is to go ahead and solve for the optimal plan given a discrete input. Ignore the various permutations. Alter the discrete input/scenario and solve again. In the end, you may generate many optimal plans in the various discrete input/scenario. With the various optimal plans, one could then run the optimal plans in the various discrete inputs/scenarios and see the additional cost of not knowing the future exactly. In addition, one could also create a permutation from the runs and see if it would produce a net benefit in terms of the cost in all the discrete inputs/scenario. The most robust/resilient plan will demonstrate a cost limiting plan in the various discrete input or scenarios employed. One could also test all the plans through a Monte Carlo simulation giving additional analytical rigor to the robustness and resilience of the plan.

I have spent much time thinking about devising ways to enhance and produce robust and resilient resource plans. There is much thought and process that can go into making a plan that would be at the very least considered a CYA plan. Taking short cuts in calculating and processing the power markets given its reliance on more and more intermittent resources should be avoided. Processing power, the value obtained, and the precision available for the various inputs support moving to hourly modeling without shortcuts. Sub-hourly inputs are not precise enough to do long-term planning runs and the benefits will be limited. Strategist could still have its place as an IRP software given that they spend some time upgrading it.

Your Resource Planning Energy Consultant,

614-356-0484

Be wary of Energy articles ….take the time to go an inch deep

I found this article highlighted and posted on several sites – http://www.renewableenergyworld.com/rea/blog/post/2013/09/utility-agrees-their-solar-should-supplant-natural-gas#!

I was not planning to respond to this article posting as I did not want to legitimize the article, but it looks like there are so many comments on it already and that it has spread to many other sites. I think I can, at least, use the article to highlight the fact that many people post them without much substance, and it seems like the public does not mind or care. All you have to do is look an inch deep to see this article is not credible.

This article is clearly bias from the author to the publisher – probably no different than those found on the American Petroleum Institute on Oil & Gas related documents.

The article tries to relay an analytical unbiased rigor – however, that is clearly not the case with just a simple digging of the facts. Mr. Farrell reports the cost of a natural gas power plant which at the very least he links to the report. However, I guess he knows the average reader will not look into it, and it will make him look like he is on top of it. The report is a 2009 California report. IF one just took the time to look at it, the report is not a good document to source from. The natural gas price used in the report for 2013 is $8.28/mmbtu and rising to $12.23 by 2020. For a frame of reference the current forward curve for natural gas is marked at $4.96/mmbtu for 2020. The current fuel price shows a 60% discount from the report he is referring his readers to.

In addition as I have noted many times, Levelized Cost of Electricity (LCOE) needs to be taken with some caution – https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ LCOE gives the person who is doing the calculation many opportunities to introduce bias – from assumed operational performance without incorporating reality.

I understand people will post things likely to their bias, but I do not think we should legitimize articles which lack any analytical rigor. I really did not have to dig far to see the article lacked substance. If Mr. Farrell just focused on the falling solar prices – which is a real, credible and worthy of noting – then, the article could have had some credibility. However, he introduces a comparison which is outdated, only to support an attention getting theme, which holds no credibility, but in fact, misinforms the reader.

Please do consider All Energy Consulting for your energy consulting needs – Market Analysis – Technology Review – Modeling – etc…

Your Unbiased Energy Consultant,

614-356-0484

Power Modeling More Complex than Refining Modeling

With my background in refining modeling, I can say power modeling is more complex than modeling most other markets. The process of producing power is not as complex as refinery production, but the final product pricing and market is significantly more complex. The refining modeling focus is typically on optimizing yield value while changing the crude input quality within the refineries capabilities. The products can be stored and transported to the highest paying markets. With power you just do not have that luxury of storing or even watching where it goes. I will admit there are certainly more dollars in the Oil & Gas world than the power world.

The power market is highly reliant on what the neighboring power plants are doing, and now potentially, your own customers. The other power producers may not be using the same feedstock as you. They also may be operating the plant differently, nonetheless, their actions impact the price and flow of your power in that instant. The amount of information that must be processed in the power markets, to say the least, is voluminous. To do proper power modeling, an hourly model is recommend. If you do not do an hourly calculation you can be misled, for example as in LCOE calculations (https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ )

There are really two types of modeling that one can do. One is to try to understand market pricing and market dynamics, such as coal and gas demand. In this setup, you draw your circle quite large and potentially model the entire N. America, which I have done numerous of times. In this setup you will model over twenty thousand units. The alternative is to model one’s own system for near-term operations or long-term resource planning, or both. The market prices become exogenous inputs to the model. I would caution against this setup in isolation due to the potential impact you may have on the exogenous inputs. However, in most cases, one typically runs a series of exogenous price inputs to capture the variability.

Both alternatives still deal with the commodity inputs and the load forecast, with the latter being the more potent of the two, assuming you use commodity outlooks across a reasonable range. Whether you are trying to understand market fundamentals or your system budget, you will have to deal with significant uncertainties. Market based modeling compounds your uncertainty multiple times. Modeling your own system, you compress a good portion of the uncertainty into the market price. However, you still are left with dealing with policy issues (to Carbon Price or not – Renewable Portfolios – Demand Side Management – etc…). Of the many moving pieces noted in the check list below, most change frequently over time.

Power Modeling Check List

- Load

- Resources and their Fuel Options

- o Coal – by unit, as coal type and transportation is individual (~1300 units)

- o Gas – by unit, as each plant could have multiple fuel pipeline access (~4600 units)

- Resources and their Performance Attributes

- o Uptimes and downtimes

- o Ramp rates

- o Maintenance

- o Cycling

- o Start-Up Cost

- o Minimum Capacity

- o Variable Cost

- o Fixed Cost

- o Emission Rates

- o Secondary Fuels

- o Heat Rate – Heat Rate Minimum and Curves

- o Storage, Recharge and Initial Contents – for battery & pump storage

- o Bidding – fuel adders to multipliers

- o Performance Shapes (Solar & Wind)

- Emission Pricing

- Federal, Regional, and State Policies and Standards (Renewable & Carbon)

I have been power modeling for over 10 years now – both hands on and managing a team. Recently, I have spent two years modeling for a client essentially being their outsourced modeler. The experience has proven to me the viability and value power modeling outsourcing can have. I would not recommend a complete outsourcing, but I can certainly see outsourcing the functionality pieces. As Managing Director of Strategic Planning at AEP, I would have loved to maintain some continuity with my power fundamentals team and my modelers as they left for bigger and better jobs. Each modeler when left to their own devices will devise a custom setup to manage all this information. The new process would likely leave out something or be organized slightly differently. Sometimes you get quite an inexperienced modeler and they leave out some crucial issues in the power model.

Power modeling implementation is not as simple as rolling out a new version of office and should not be treated that way. Even with “out of the box” software implementations from People Soft, Oracle, SAP, CRM, you still need to bring a whole team of consultants to make sure the process gets implemented effectively. Why would you not take the care to make sure your power modeling is implemented effectively? It does not take a whole team of consultants as People Soft, Oracle, SAP, CRM software would, but you should take advantage of experienced professionals. I know some of the software vendors offer implementation help – but just like People Soft, Oracle, SAP, CRM software, it is best to get people who actually do it as a living. The software people are spending their main resources on their software rightly so. Therefore, talent is not necessarily on par to achieve your business needs.

My power modeling offering is here for you to maximize your investment in both software and staffing. To read more about my offering please visit – http://allenergyconsulting.com/2011/11/modeling/

Your Power Modeling Consultant,

614-356-0484