Shale Gas Bashing Gone Wrong

There are some very poor “journalism/reporting” on the internet. Businessinsider.com seems to be getting worse. I give them credit for being good entertainment at times. I usually just laugh and scoff at the poor articles and move on. However this latest attempt of journalism/reporting hit home with me – 12 Reasons The American Energy Boom Is Totally Overrated . I didnt read Michael Levi’s book that may have sparked this. I believe Michael would have been more logical and less sensational than BI, given I do follow Michael’s work.

The biggest oversight is the fact the low natural gas price over the last few years have allowed the population to have much more disposable income. This is very simple math as I showed in my previous blog I did last year in January. In that blog, I showed at least a savings of $193 billion dollars. Adding 2012 figures into the analysis total savings are now $283 billion. One needs to remember energy is just a MEANS to an end. Having energy by itself is worthless. Therefore anything to reduce the cost of the means adds directly to the benefit of society.

Let me go graph by graph and refute and/or elaborate where they should have.

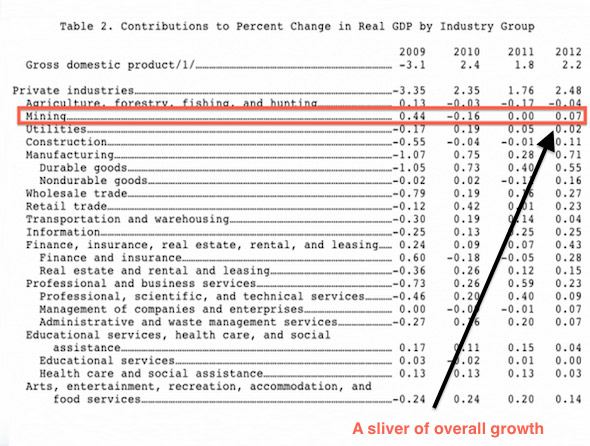

BI:“According to the BEA, the U.S. mining sector, which includes oil and gas production, contributed a measly 7/100ths of a point to the 2.2 GDP growth we saw in 2012”. Please don’t just focus on what they are highlighting, but notice the largest item of growth is manufacturing. Having lower cost power and more disposable income allows this gain.

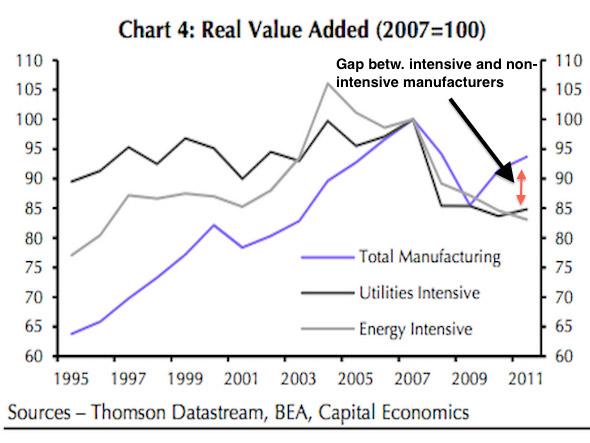

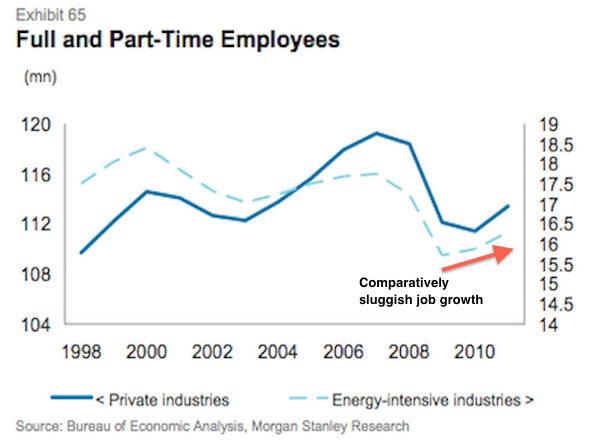

BI: “Energy intensive industries are adding about 10% less value than all manufacturers.” Energy intensive industries take many years to develop due to their large capital investments needed. It is not reasonable to expect the uptick in the energy intensive sectors first. As pointed out in my blog my first year point of shale impact started in 2008. The graph above shows only to 2011 – hardly any time for people to believe and put billions into a project requiring low gas prices.

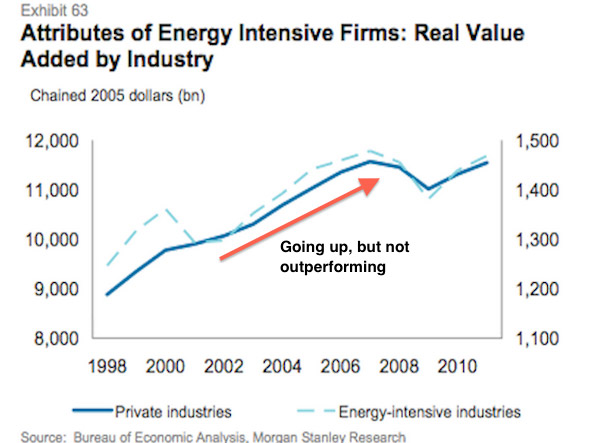

BI: “Relative to the rest of the economy, the energy intensive industries aren’t outperforming.” My response would be similar to the point above. The graphic is even worse since only up to 2010.

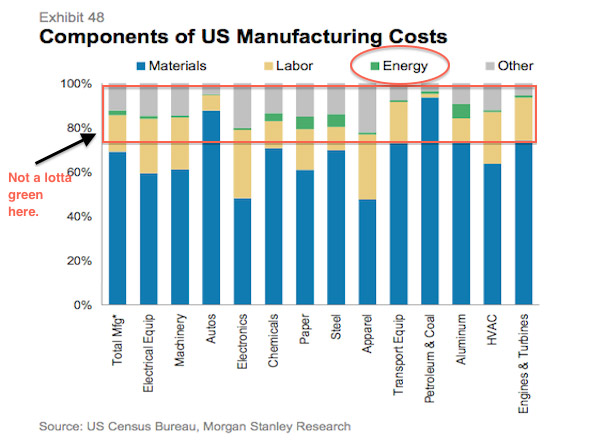

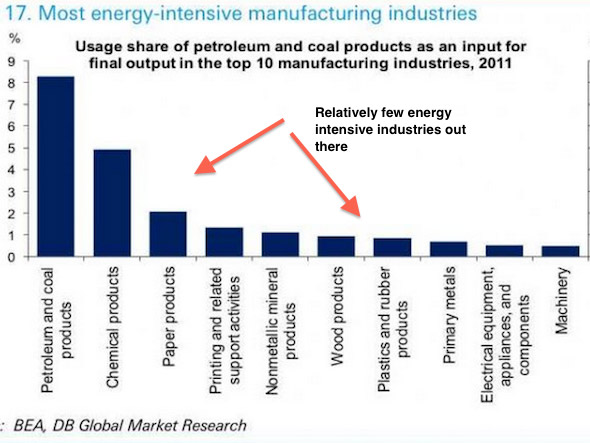

BI: “Energy comprises just a tiny 2% of US of manufacturing costs.” There is a multiplier effect for energy cost in manufacturing. Materials are clearly a large part of manufacturing. How do you think you get materials such as aluminum to make cars? Though Auto, HVAC, Engines, Electronics, Machinery, Transportation, Electrical Equipment shows little energy cost they are highly dependent on the cost of energy per the materials. Materials are not naturally produced as the BI “reporter” would like you to believe.

BI: “And only handful of industries are truly energy intensive.” This is a chicken and egg issue. The reason our economy has shifted to be less energy intensive is because of the cost of energy and labor increased relative to the rest of the world. With sustainable lower energy cost there will be a change in the above profile. This is another failure to think and deduce a wrong conclusion. It takes a certain amount of time before energy intensive industries come back, but they will if we don’t mess it up.

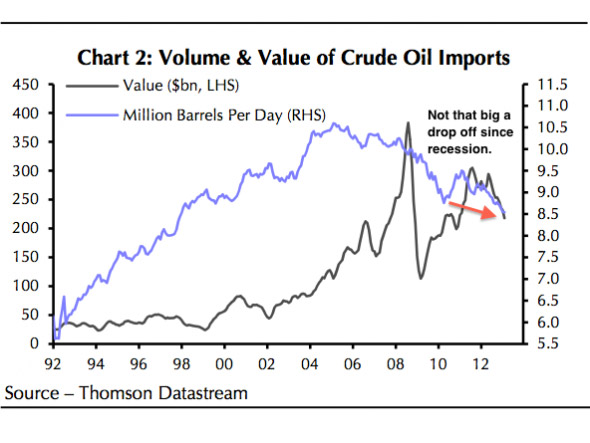

BI: “The volume of petroleum imports have long been declining, and have moved independent of prices.” This is less to do with shale. Shale’s focus is natural gas not oil. The oil decline has more to do with the price of the global oil markets.

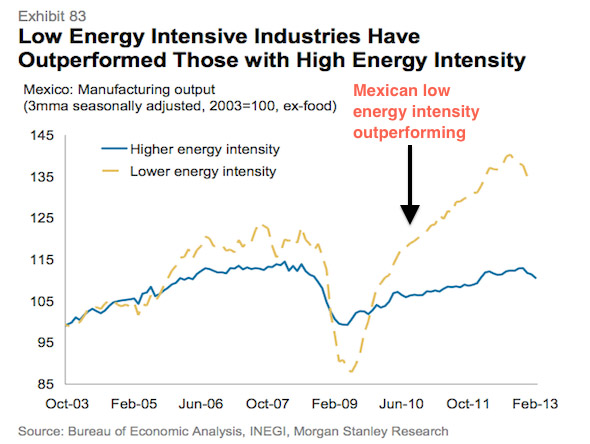

BI: “Mexico has long enjoyed abundant natural gas reserves, but it too hasn’t seen its energy-intensive industries go gangbusters.” Mexico has enjoyed abundant amount of oil also. This has more to do with the political structure and the inefficiencies in their market. Their infrastructure is so bad they import electricity from the US.

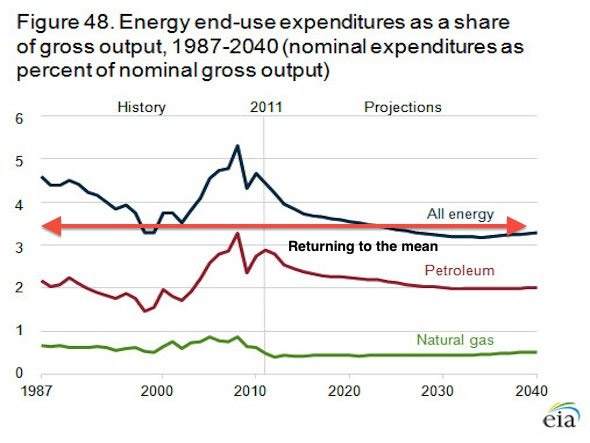

BI: “Energy as a share of gross output has declined to a little over 3%, but it’s almost certainly more a function of oil prices resetting after spiking in 2008.” This is so wrong in so many ways. Half the graph is based on a very poor forecast. The EIA forecast models I have debunked several times on my blog. Just because an agency says something doesn’t make it so, particularly since you can look at their old forecast and see they have a poor track record.

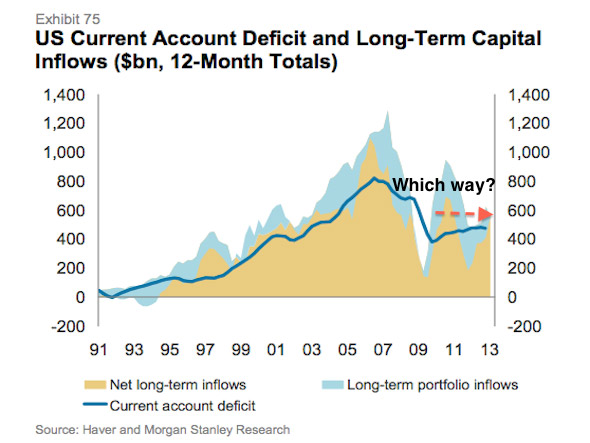

BI: “America’s current account deficit is narrowing, but Morgan Stanley says it’s unclear whether energy will have a material impact on this.” I don’t see this supporting the stance that shale is not impactful. In addition the own statement of “unclear” they should have left it out of the analysis.

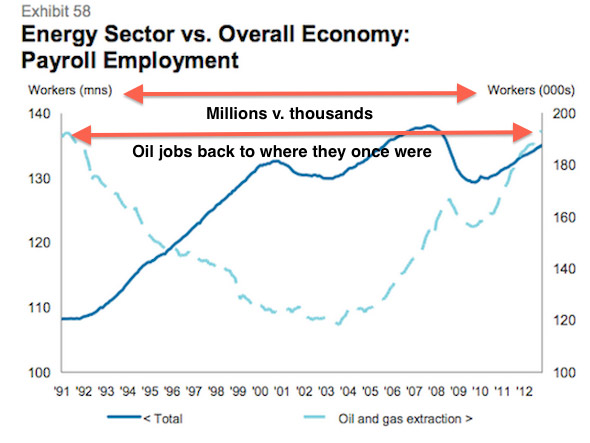

BI: “Employment in the oil and gas industry is less than 1% of the national total, according to Morgan Stanley.” Employment in the oil and gas industry is not the target. As noted energy is a means to an end. You use energy because it allows you to do something. The cheaper the energy the more things get created.

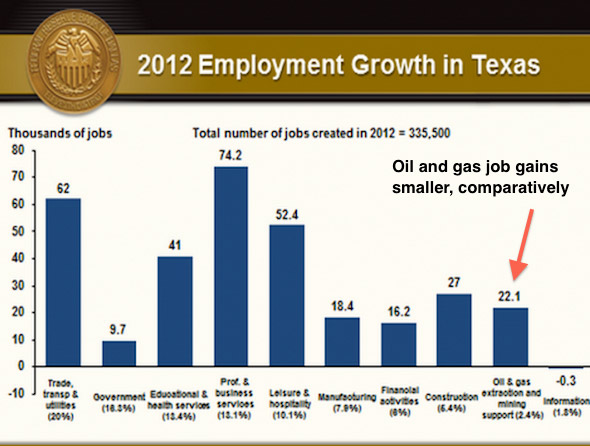

BI: “Even in Texas, the oil and gas industry and its support services constituted just 6.5% of all jobs.” Why would you want a sector who only allows you to do something be the major portion of your economy? Energy is creator of jobs which should be focused in the use of energy not the finding or developing.

BI: “Employment in energy intensive industries has picked up, but the rate trails that of the rest of the economy.” As I pointed out in many points above, the energy intensive industry takes time to develop given the billions required. A new steel or chemical plant is not cheap. They are assets which will last decades. Making an investment decision takes time to build a sustained belief in lower natural gas price – just few years back gas was forecasted to $8+/mmbtu. The shale revolution is only in its 4th year.

Very funny the next article in BI after this shale article is the SOLAR BOOM! Well, I bet they will discuss how many jobs are created. Once again having an energy source which requires lots of manpower is not something to strive for. Having employment in using energy by creating something to better society should be the goal.

This was a very poor article by BusinessInsider. I hope Henry Blodget does a better job screening. My appreciation for BI has dropped over the past year. The page creation machine will eventually get you if you don’t manage your quality.

Energy is a means to an end. The shale revolution is advantageous to the US if we let it be. I believe carefully constructed regulation and enforcement should be implemented to constrain the bad actors, but we should not villianized a whole sector out of ignorance.

Your Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.