The Demise of Coal Overstated

As I noted in my previous blog, I spoke at a power symposium last week. Many of the speakers had concluded coal is dead. The rhetoric is the same on the internet and major publications. People have even spoken to the point to say coal is more expensive than gas. This is sadly far from the truth.

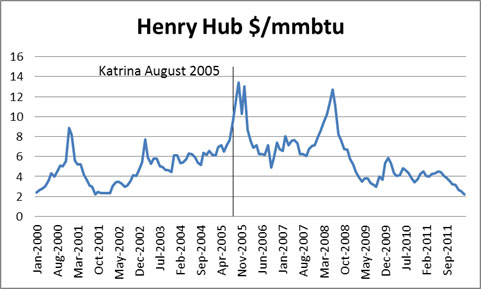

Weather played a key role in the current price predicament for natural gas. One year should never be extrapolated when weather played such a crucial role – case in point look at the price action in natural gas prices after Hurricane Katrina.

It is a true statement for those trading – “Markets can remain irrational longer than you can remain solvent.” You can see it almost took 6 months for Katrina’s price impact to fade. One could look at the current situation as the inverse situation – instead of a hurricane reducing supply you have a mild winter reducing demand. It takes time for fundamentals to rebalance the market. The price rebalancing can take even longer as noted in the irrational markets discussion. The irrational price levels of today’s market are natural gas prices below coal market contracts. Ultimately those contracts will roll off and the negotiations for the coal contracts will come down or no longer cease to exist. Conservatively, I would estimate we are in the fourth month of un-fundamentally low prices. I can foresee continued pressure downward on natural gas prices, but not past this year as long as we revert to normal weather.

For those saying it is over for coal, they are forgetting their game theory rules. For every action there will be a reaction from those most impacted. Coal consumption could potentially drop over 20% this year relative to last year’s consumption. Inversely gas consumption in the power sector could see a rise of over 60% from last year’s consumption. These two actions do not come without consequences/reactions. As I indicated above, I expect coal prices to come down. Inversely, I expect gas prices to rise. It is not if, it is just a matter of when. This combination will allow coal to once again prosper. Coal consumption will not regain its majority spot for generation (>50%) given the environmental policies and the corresponding retirements, but I expect coal will continue to be the top 3 source type of generation for the US for many years to come.

Please do consider All Energy Consulting to help you understand where the markets will be and how best to align your organization to capture the change.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484