Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

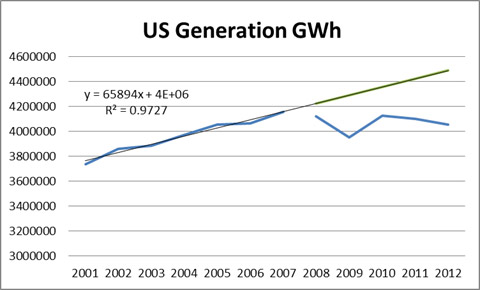

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB