US Refining Margin Outlook Sept. 2012

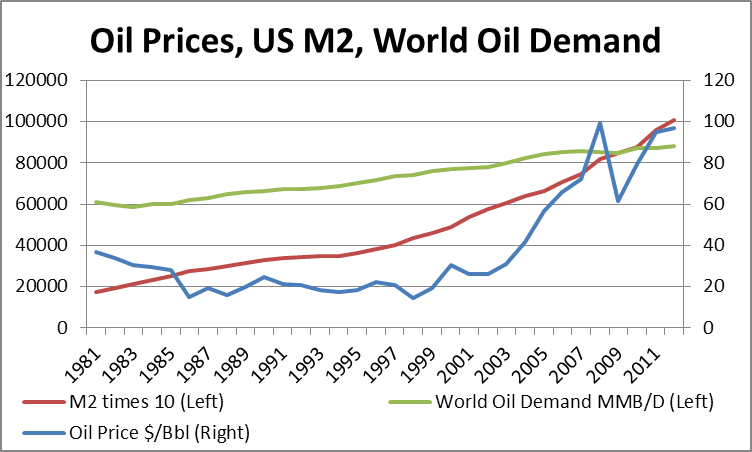

The refining outlook has been impacted by two major fundamental changes in the crude oil market. The first major change is the new crude oil price regime, driven by increase demand from Asia and partially due to global monetary policy from central banks. In relative short time, crude oil markets have moved into the $100/bbl environment. From the 80’s to 2000 prices stayed in the range of $20-40/bbl.

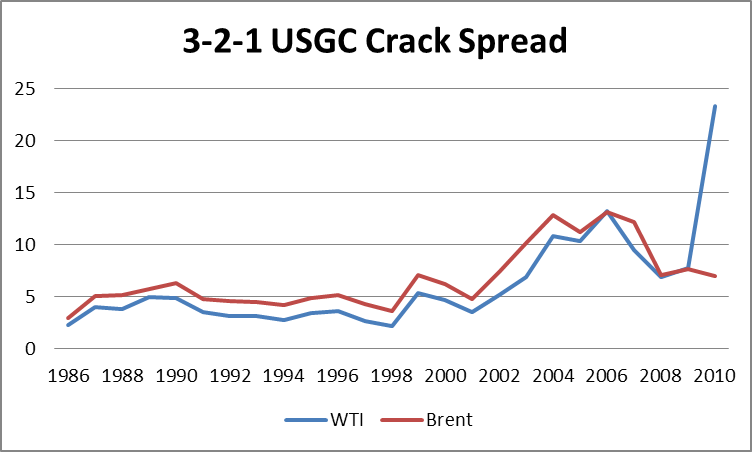

Since 2003 oil prices continued to climb and only very recently have settled into a range $80-100/bbl. Given the much higher crude oil prices, refining margins seen in the 80’s to 2000 will likely not be comparable on an absolute basis. On an absolute basis the current margins would be deemed as historical by multiple factors.

A certain amount of the WTI crack spread can be attributed to the current disconnect between WTI and the USGC, which represents the product part of the spread. The difference in the WTI crack spread can be attributed to the region – Cushing, Oklahoma – existing infrastructure. The WTI – Brent Spread is producing a historical discount to Brent. This is translated to the WTI – LLS spread, to a lesser extent.

However, this spread is not likely to exist for a substantial amount of time since the arbitrage to move oil to the USGC can easily be solved/monetized through investments in pipeline. This is already being seen in the reversal of the Seaway pipeline which will increase flows from Cushing to Gulf Coast from 150,000 bpd to 400,000 in 2013. In addition, there are several other discussions from the TransCanada Gulf Coast project.

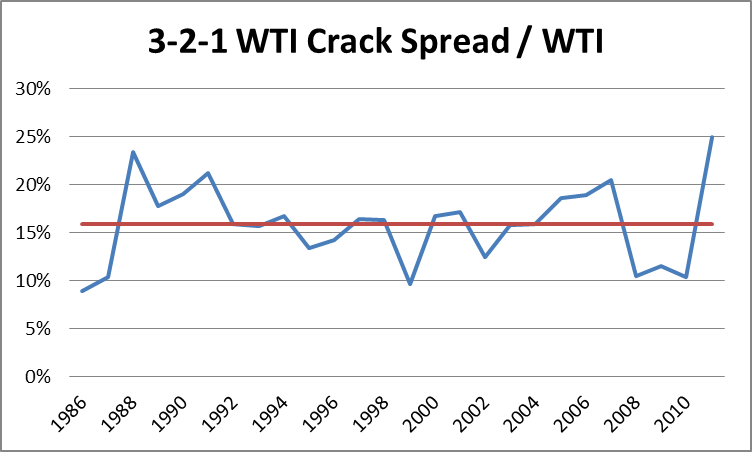

Besides the local issue with WTI, Brent and LLS are still showing a rather high absolute refining margin compared to history. This portion is attributed to the elevated price of oil which is producing a larger absolute refining margin. In economic sense, it is rationale to expect a higher absolute value of return as the cost of the feedstock rises. On a percentage basis of the feedstock, the returns are high now, but are not historically high.

The average percentage of the 3-2-1 WTI Crack Spread / WTI is around 16% from 1986 to 2011. The future should be expected to be around that level with perhaps a chance for it be slightly higher. The rationale for this is the increase level in crude oil prices increases the carrying cost relative to a lower crude oil market. In addition, the higher crude oil price has led to higher volatility. Both of these issues add additional cost that will likely be passed on in the market. In a $100/bbl crude oil market, a sustainable 3-2-1 crack spread for WTI should be around $16/bbl.

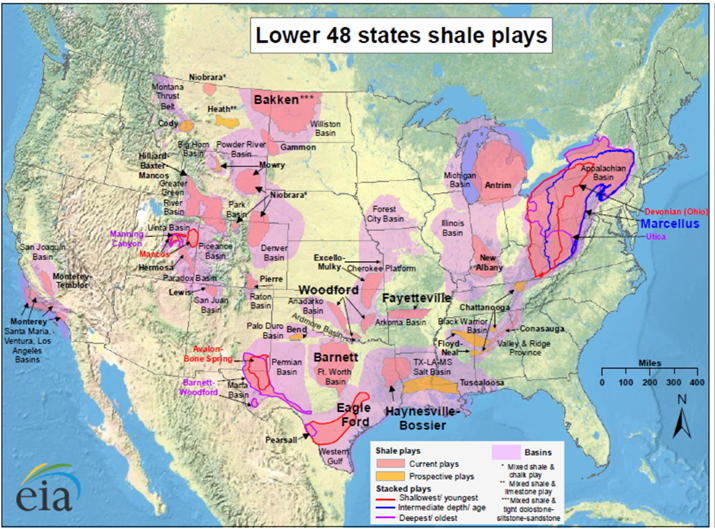

The next major fundamental impact for refining margins comes from the shale gas revolution. As noted by several oil analysts, shale gas has and will continue to significantly alter the energy space. The various shale gas areas are shown in the map below.

Besides the natural gas production, shale gas has added significant volumes of liquids as the shale gas technology led to an increase in extractions of natural gas liquids. The desire for more liquids is due to circular loop. In a circular fashion, the increase in natural gas production led to a lower value in gas, but with oil markets being strong the spread between oil and natural gas is the highest since 1950’s. This has led to increase focus on liquids rich shale gas plays.

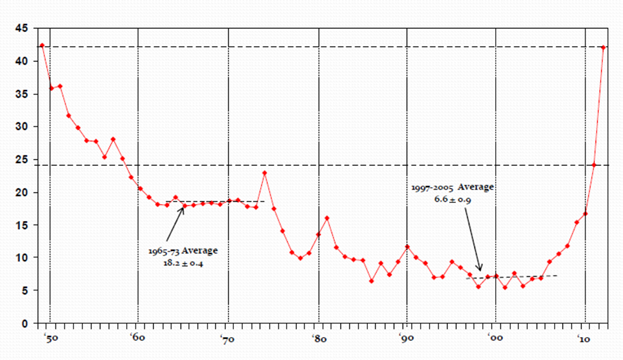

US Oil price divided by Natural Gas Price

The drive for shale gas is currently been driven by the liquid value. Natural gas plays by themselves are not very economic with the current natural gas price. However adding the liquids economics justify some of the decisions to continue to develop gas fields – see figure below.

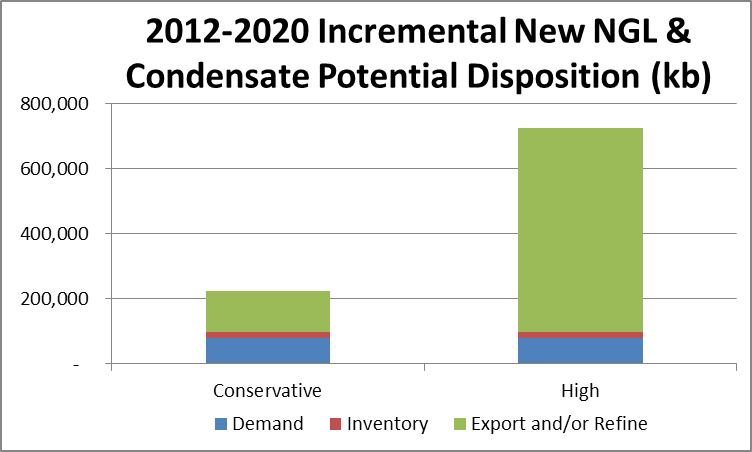

Based on the various USGS surveys and production trends, the liquids from shale gas should amount to an additional 400,000-2,200,000 bpd by 2020 with most of that volume needing to be exported or refined. A recent Morgan Stanley report evaluated the Eagle Ford and expects over 600,000 bpd of oil production by 2013 versus the current level of 170,000 bpd. Currently the Energy Policy and Conservation Act of 1975 (P.L. 94-163, EPCA) directs the President to restrict the export of crude oil. This will put pressure on US condensate prices and giving price advantages to US facilities that can process the condensate.

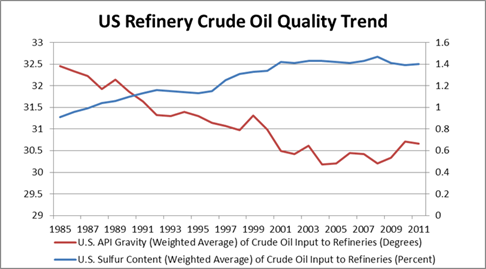

The volume of liquids from the shale gas play is not significant to change the overall oil markets over the next few years. However the volume is significant in terms of the impact on the quality differential. All of the liquids from shale gas represent a category of light sweet oil – API >40 and Sulfur <1%. This has caused a dramatic shift in the oil paradigm. For the greater part of the last two decades it was common theme to consider the crude oil slate to become heavier and higher sulfur. This caused the refinery industry to believe a successful refinery is one with size and technology in order to convert the heavier crude oil. The light-heavy differential was expected to widen significantly putting simple refineries out of business. However shale gas revolution with its exclusive light liquids is reversing that trend in the US.

The impact of the lighter crude oil will be bringing a simple refinery back into positive economics. In addition, without the large spread in light-heavy crude oils, highly complex refineries can actually be put in negative economics given their high variable cost. This is partially responsible for the Aruba and Hovensa refineries closing down. Both of those facilities are designed to convert heavy crudes from Latin. America. In addition, those refineries are dependent on oil for its energy whereas all the gulf coast refineries can rely on natural gas.

The impact of the liquids can be directly seen in the drop of imports from light oil greater than API 45. Beginning in 2011, the imports of crude oil greater than 45.1 API fell by over 100 kbd.

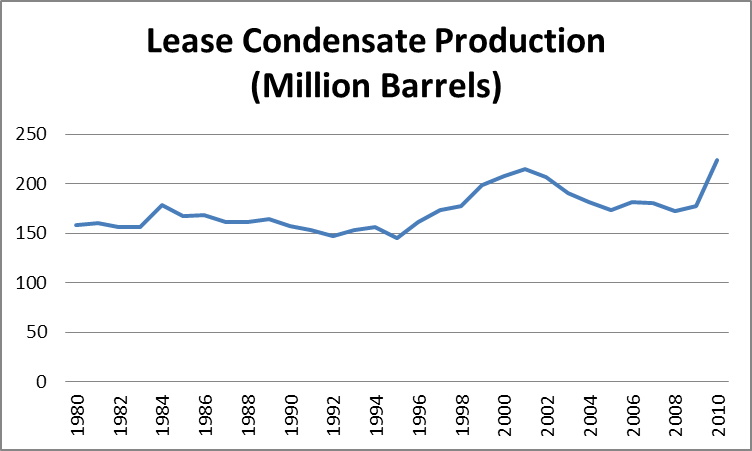

This drop coincides with the increasing domestic production of lease condensates. Lease condensates as defined by the Energy Information Agency (EIA): A mixture consisting primarily of hydrocarbons heavier than pentanes that is recovered as a liquid from natural gas in lease separation facilities. This category excludes natural gas plant liquids, such as butane and propane, which are recovered at downstream natural gas processing plants or facilities.

I believe the two fundamental shifts impacting the refining industry, higher crude oil price and increase in lighter feedstock, is sustainable for some time period (5+ years). The US economic solution is fixated on continued quantitative easing. With M2 currently producing the highest correlation for crude oil prices using data since 1981 – R^2 ~0.6 vs. world demand R^2 ~0.5 – high crude oil prices ($80+/bbl) will likely continue into the future years. Shale gas production is not likely to cease, given the high value of oil products and the cost of production being around $3-5/mmbtu on just a natural gas basis. Liquids rich plays will continue to be found and produced. The combination of these fundamental shifts will result in higher absolute refining margins. The recipe for a successful refinery will be modified from size and technology to refineries able to minimize operating cost, given that the complexity advantages have eroded with lighter feedstock.

Higher resolution graphics are available upon request. Presentation with Q and A are also available. Please do consider All Energy Consulting for your energy consulting needs.

Your energy analyst,

David K. Bellman

614-356-0484

Economy Bubble the Student Loan Market

I typically like to keep the discussion directly related to energy on this blog, but economic discussions become inevitable when dealing with energy. I have had the good fortune to sit and talk with many leading economist from Nouriel Roubini (RGE Economics), Mark Zandi (Chief Economist Moodys), and Nariman Behravesh (Chief Economist IHS Global Insights). I had dinner with both Mark and Nariman on different occasions within months of each other late 2008 and early 2009 to discuss my concerns of the next bubble – at that time the focus was on the housing market. I questioned both of them on my concern on the student loan issue. They both scoffed at me and said it was much too small of an issue – perhaps true in that I was early to the issue, but why not solve things before they do become an issue? I have since emailed them with no response on how big it would need to be. Back in April this year it has surpassed both credit card and auto loan debt crossing the $1 trillion dollar mark.

The reason I thought of the student loan was the realization that upper education expense was the last great cost that has been going up since 1970s by over 10%/yr, given that the housing market went pop. If you dig down into it, it really becomes even more “sinister” than the housing market in terms of issuance of loans. There were confirmed stories of migrant workers being issued significant loans ($500K+) to purchase houses. Of course the dream of home ownership was instilled in society; so the desire to have a house was clearly at play. Even though loans perhaps could not be paid, at the very least the banks had the collateral of the home. As the home market was rising, some bankers actually made money on those defaulting. For the consumer, in many cases those who defaulted had an opportunity to declare bankruptcy and move on with their lives. The bankruptcy opportunity is designed to put some responsibility on the loaner to not loan with recklessness, but to do some fiduciary review. However the market regulators allowed shifting of the burden of the loans to multiple institutions including government run entities, removing any need for fiduciary review. Thereby you had a significant increase in demand for housing which would have not been there. Economics 101 states increasing demand leads to increasing prices. However since the loan amounts were allowed to rise to such significant value that a migrant farmer could get a loan for $500+K the housing market went on a multi-year growth spurt. I would be wrong if I also didn’t add the credit derivatives (CD) – obligations (CDO) and swaps (CDS) – played a large role in the explosion. Perhaps a positive side to the student loan market, currently no credit derivatives in the student loan markets that I am aware off. I presume since it cannot be discharged – see below – why have to insure it. The CD instruments certainly speed up the process of the bubble. If it were not for the CD, it would have gone on longer and perhaps at a more gradual pace as seen in the student loan market. Lastly failed regulators, in allowing false documents and misleading robo-signers without significant penalty also led to the bubble. In the housing debacle, we are dealing with grown adults with life experiences.

In the student loan case, you have a young individual being given a loan to study and earn a college degree which is preached since his ability to read is a must have. The person takes the loan, but the loaner does not do any fiduciary review with this individual. A background check on the person’s ability to perform in college in the discipline chosen is not even examined. The ability of the loaner to even payback once that degree is given is not done. Simple checkups during the school year to make sure the student is attending class are not even done. All this work is no more complicated than actuarial work used in the insurance business or evaluating small business loans. The reason for this recklessness is unlike housing loans there are no means to discharge this loans – bankruptcy will not help you. Your wages will be garnished for the rest of your life or until you are able to pay off the loan. (Students taking loans please re-read the last two sentences – the loaner is not your friend). Once again, just like the housing market, “new” demand causes an increase in price. As the colleges continue to get students who are willing to pay more and more; why would they stop the price rise? The students are paying more and more, but really they are just loaning more and more.

A recent article on Zerohedge demonstrates the extent of the bubble as it relates to the housing market and shows how such a key player, Ben Bernanke, in these issues can be so wrong. The graph are very poignant in there is bubble – just when will it pop is the trillion+ dollar question.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider All Energy Consulting for your energy consulting needs.

Your Energy Consultant,

614-356-0484

Solar Tax Breaks – if it were only that simple

Solar tax breaks is the big talk in some parts of the country. A new report published by the US Partnership for Renewable Finance (US PREF), a program of the American Council On Renewable Energy (ACORE), highlights, the extent of campaigning to promote subsidization of the industry. The analysis leaves much room for skepticism and criticism. Before I delve into the depths and details of the report, it would be easy and clean to simply say giving a tax break promotes more tax revenue – trickle down economics. The basis of their analysis is based on trickle down economics which many have justifiably become distrusting given the economic condition of the US with the significant tax breaks over the past decades. The theory is: in lieu of the tax credit, the company would not exist therefore no tax revenue will come from the company. And the theory goes on to say the on-going tax revenue will make up for the initial loss. You can note I did not have to specify an industry. This logic could apply to about everything. The positives about solar versus other industry is possibly it is the gift that keeps on giving via clean energy. There are certainly externalities that exist beyond the product itself.

However the world/US is not that simple to conclude giving tax breaks pays off – particularly when you are running deficits. In affect a credit to any industry in the time the country is running a deficit is certainly at least valued at the interest cost to society. Currently we are fixing our interest rate through monetary policy so the rate is quite low. Secondly the opportunity cost to produce more debt for future growth has a full range of items e.g. autos, homes, roads, etc… Will someone develop a capital allocation model to identify the top 10 investment that would be best for the economy? Personally I don’t know if solar would be in that list in terms of returns for the next 10 years. In the PREF analysis they do show positive returns (though skeptical on results), but I am sure many other industries would tout the same thing if given the chance. Thirdly, the government policies that encourage certain outcomes are typically design and sold as social just expenses – not requiring full economic principles e.g. welfare, tax on cigarettes, home ownership etc… Perhaps we could categorize solar/renewable policies as a social just expense. It would certainly merit it in terms of cleaner energy and potentially long-term value if something were to happen to fossil fuel supply.

If we were a country without much opportunity for other forms of energy I would see it easily being a top 10 investment. However the US is the land of the bountiful not only in land, but food and energy. We are led to believe we are short on energy. This is not the case. We have chosen to limit the amount of domestic energy use by creating national parks and restricting drilling. These choices are worthwhile choices given the ability to let others pillage their resources at prices which we deem too low to think about pillaging our lands. In addition, because of the abundance and relatively cheap cost of energy, we consume more than we “need”. I am sure if push comes to shove we can consume much less without much change in our happiness. This abundance of energy does put into question the motivation and the desire to advance solar for the benefit for other countries not blessed with our resources. On a global warming basis I certainly can see the value. But as I pointed out in my other articles , society is not ready to plan for the long-term.

In terms of the paper itself, they left out many economic and mathematical concerns. Here are my litanies of concerns: Why no discount rate? At the very least should not be the value of interest? On a nominal basis many investments will payoff in 30 year. Another reason to do it on a real basis is they have energy price escalators all in the realm of inflation. The study basis on generating revenue lies on the premise creating a leasing deal promotes a good tax policy since the leaseholder is seeing taxable revenue. With this logic, the government should promote all types of leasing – why not give tax credits to lease cars. The Excel file shows the assumption that PPA will be signed not only on premium price relative to current market conditions, but the utility would continue to pay additional cost each year via an escalator. Most solar PPA deals I have seen are at fixed cost. Solar does have a fixed cost component (land management, solar cleaning, inverter repair/replace) which will occur over the 30 year period and is missing in their economics.

Let me leave you saying I agree that promotion of solar could produce a long-term value for society. I don’t have all the answers, but I don’t shy from the tough questions. However the article and many people involved in these issues are not talking about all the facts and concerns to make a decision for the best of society for the long haul. Without a complete discussion of the pros and cons, people end up cherry picking information to support their own internal biases which in most cases supports ones self-interest regardless of society value.

I have many years of experience in evaluating various technologies, planning, and developing an integrated resource plan. If you are looking for some insights and or additional points of view into the future technologies and/or power markets please consider contacting All Energy Consulting.

Your Energy Consultant,

614-356-0484

Wind generation footprint and other issues

Wind generation footprint came to my mind as I drove across Indiana. It was amazing to see these structures. Then it started annoying me as I continued to drive through the farmland, seeing them over and over. Initially, I was thinking it was a unique and impressive structure, but if I had to see that all the time it would not be so impressive. I actually started missing the skyline.

I know one can build a 200MW gas plant in about 10 acres. In order to build the same 200MW for a wind farm you would need 12,000 acres – just about 60 acres per MW. If we assume it was built evenly, it would take almost 19 miles of driving parallel to the wind farm before your eyes could take a break. Whereas the gas plants, you can drive by it in fraction of the time and potentially not even know it.

Then I started to think about the farmers, since most of the blades were on farmland. Did these farmers get properly compensated? Did the farmers get compensated for loss of crop yield due to compaction of the soil as install and maintenance will likely cause long-term compaction? Did they account for their inability to do aerial spraying? I see there are reports of positive aspects of wind. They say they can increase the ambient lower temperature which could lead to greater crop yield.

I am not writing to bash wind generation, but only to point out to many of the proponents of wind that there are some reasonable objections. In addition, as with most things, there are pros and cons. The extent of development can only go so far when the technology does have cons. Too many studies conclude significant renewables can be developed without balancing some of the real issues that will limit renewables. A balance portfolio of generation will likely be the outcome with each area balancing out their level of pros and cons.

At All Energy Consulting we can help you run and model your resource options/plans to balance those pros and cons. We can either offer a third-party assessment or help design and build you a process plan for which you can manage yourself.

Your Energy Consultant,

614-356-0484

Adaptation will happen as the climate changes

The key sentence with keywords bolded from my previous discussion of climate change is “statistical odd that climate change is real, and that it could have significant impact to society.” I leave room for doubt as many things cannot be modeled. Simple things such as predicting cloud formation is still not understood. Given simple things cannot be understood one could surely extrapolate, perhaps more complicated feedbacks are not incorporated appropriately in many climate models. A recent discovery in the arctic articulates this issue.

The article points out a new massive discovery of phytoplankton in the arctic. In addition they note the following: “…it could explain how the ocean has been absorbing larger quantities of carbon dioxide (CO2) from the atmosphere than data could verify, the researchers suggest.” This bio-feedback from higher CO2 contents demonstrates how the earth/nature will adapt to changes. There are other bio-feedbacks that have been demonstrated. Scientists have noted that certain plants are becoming more dominant as CO2 content in the atmosphere increases. This would make Darwinian sense in the fact if the environment is changing those creatures/plants that would prefer easier access to CO2 will be more dominant as more CO2 is available in the atmosphere. Duke demonstrated this bio-feedback with poison ivy being the beneficial plant.

These types of bio-feedback are not all captured in the various climate models. There are so many areas we do not fully understand or can comprehend. However on a risk adjusted basis, I will stick with my premise that there is a statistical odd that the models are showing a possibility of unintended consequences of our emissions of CO2. As I concluded in the previous blog, we will likely have to adapt due to societies focus on Carpe Diem.

At All Energy Consulting we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant,

David K. Bellman

614-356-0484

Hedging Pitfalls

A timely article related to my recent blog on hedging came out two days ago in regards to Ft. Lauderdale evaluating hedging their fuel exposure. There are some positive and alarming statements from the article. Clearly the city can better plan and manage their finances with a steady price of energy. Below are the postitive statements:

City Manager Lee Feldman correctly noted “What I’m looking at is budget certainty,” Feldman said. “When we start budgeting, we don’t want to artificially inflate our budget to make sure we have enough money in our fuel budget to protect against price increases.” Mayor Jack Seiler makes a correct statement about hedging “We’re not in the business of playing the market,” Seiler said. “The problem we have is you have such a fluctuation in gas prices.”

So far everything above is reasonable and perfect for a hedging program. The alarming parts are below:

“Palm Bay accumulated almost $600,000 in savings during the three years the program was in place, said John Cady, the city’s fleet services division manager.”

The word of savings is not correct in the context of the hedge program. It is true the hedge saved you, but I think the important stress needs to be budget and planning certainty. Because it could have been easily $600,000 in extra cost.

Another concerning statement “”That’s why you want to have somebody on your team, basically an adviser in the fuel market, telling you now’s the time to place your hedge and now’s the time not to,” Feldman said.”

Once again this leads you off the track of the prime reason, which is budget certainty and planning. If you believe someone can advise you of better timing – which I don’t doubt – then you now want to have your cake and eat it to. You want to speculate and make sure your budget certainty also makes you good money. The best method for a pure hedge program is not timing the markets via the advice of a person, but to develop a systematic method of building the hedge. I do believe in good trading, but I don’t think you want to be an active player in the trading markets as a city, when you prime goal is budget certainty for better planning. A trader’s goal is to make money. The risk reward profiles are much different. I would advise someone in the energy business of that route, but not an entity, not staffed or experienced in the energy world.

A systematic method allows all stakeholders to remove any concerns of manipulation and/or risk taking. As I pointed out in the previous blog, I have many years in the trading environment along with the corporate planning environment. My group at AEP was instrumental in designing the first approved hedging program by the public utility commission for our supply chains consumption of on-road diesel and gasoline. At All Energy Consulting we understand the energy markets and can effectively navigate you in deciding and designing a hedging program for the various energy commodities.

Your Energy Consultant,

614-356-0484