Oil Market Doomsayer & OPEC Bashers –Not Putting the Money Up

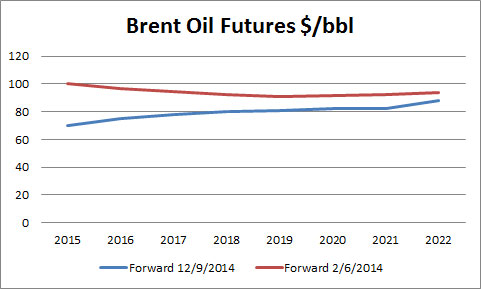

Over the past week, there were so many pundits noting the poor decision by OPEC and that the market will continue to spiral down. As I worked on refreshing my oil price forecast given this market change, the remarkable difference is that there is not much difference in the forward curve. Yes we have a near term capitulation, but extending further into the curve the drop becomes much less. By 2020 the difference can be attributed to the rising dollar valuation.

No doubt, the forward markets are poor predictors of actual results, but they do represent a financial view now. The numerous pessimistic pundits must not be persuasive enough to those with money in hand. As I tried to relay in my previous writing on the oil markets, this is a timing issue. There is little doubt oil demand will grow at some point as population and improvements in standard of living are expected to grow (unless someone believes in Armageddon).

The current situation was inevitable as demand growth was not meeting the supply growth as noted in my previous article. However, in the end, as all fundamental analysts will point out, supply and demand always meet. The price will take care of this convergence.

Oil production will change its path. Oil & Gas companies will take the time to be more efficient and less wasteful versus focusing on the next barrel to be produced. This mitigates some of the decline expectations, but all it will take is a slowing of investment at a shale play to see the production profile change within a year or two.

Oil demand will also change its path. The consumer will consider oil prices to be low given their conditioning of $100/bbl markets. I expect SUV sales to rise as they have done in the past when oil prices dip. The developing nation is also getting a break and they will take on more demand.

I know many of us are trained now to be immediately responsive given our access to Twitter, Facebook, and other always connected social media devices but this is not how the energy markets operate. Aberrations are inevitable. Energy planners need to consider all the aberration potential from large discoveries to political unrest. In the long run, as a planner, these events eventually produce a net belief of the likely outcome of the supply/demand balance with price playing interference when one gets too overwhelming over another.

In this instance, I think the forward curve is quite rational. The big issues to weigh are:

-

Is there another political unrest around the corner to take a few million b/d off the market (e.g. ISIS, please not another war)? (bullish)

-

Is there enough cost savings in the supply chain to keep the production flowing in the US and Canada at or below current prices? (potentially bearish)

-

When and how long will it take for demand to rebound given a consumer saving of 20-30%? (bullish)

-

Will oil subsidies given to many producing countries citizens end? (bearish)

-

How much and how long can efficiency improvements keep down oil demand – Khazzoom Brookes Postulate? Postulate shows when you improve efficiency of a commodity you end up using it more. (bullish)

-

Will OPEC cave in and try to maintain prices? (depends)

-

Any real carbon reducing initiatives? (bullish – Canadians eh’ – tar sands processing is pretty carbon intensive and expensive)

-

Advancement of US shale capabilities into other countries? (bearish)

We will all have our own opinions on each of these topics and the probabilities of each. As you can see there are still many bullish variables despite all the bearish pundits. Based on the financial markets, they are still bullish on oil and it is not all hot air given their money is at risk.

All Energy Consulting can work with you and your team to create scenarios and play out the market outcomes. We offer unique sets of skills which incorporates the extended reach of energy from oil to electricity. In the end a BTU is a BTU – some are more functional than others.

Your more than hot air Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: http://allenergyconsulting.com/blog/category/market-insights/