Power Market Analysis (PMA)

Subscriber Logon: http//allenergyconsulting.com/Data/Problem:

- Gas forwards are not always aligned with power forwards due to the plethora of variables involved in the power markets from multiple commodities to significant governmental actions on both regionally and federal.

- Analyzing the power markets is a complicated process, but it plays an integral part in companies’ bottom line and the fundamentals in gas and coal markets.

- A better understanding of the power markets can add significant value to trading, hedging, budgeting, commodity fundamentals, planning, and policy lobbying.

- Too many Monday morning quarterbacks in decisions to manage power contracts – clients need support on their decisions.

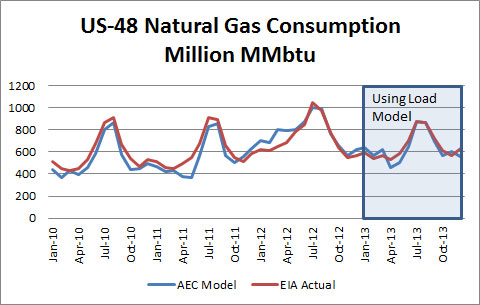

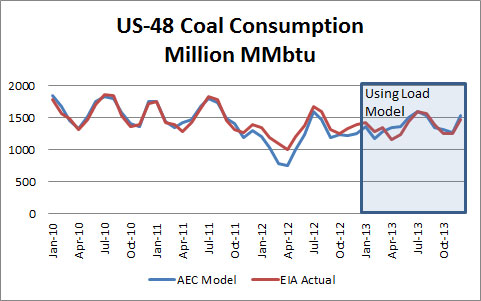

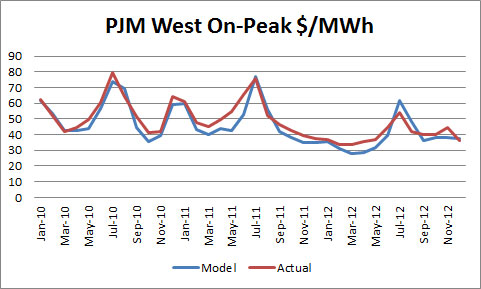

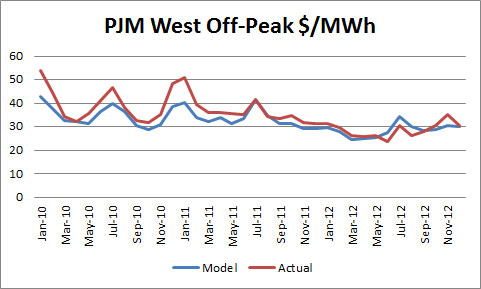

Solution: All Energy Consulting (AEC) is offering an integrated view of the power markets through two different suites of products – Power Market Analysis (PMA) NT and PMA LT. Both products are put together based on numerous years of experience in the power, coal, and gas markets. PMA has been tested to produce valuable insights into the power prices and fuel consumption in the power sector for coal and gas. PMA processing backbone uses the AuroraXMP developed by EPIS. AEC has over 10 years of experience in operating and managing EPIS products. The model is only a portion of the process.

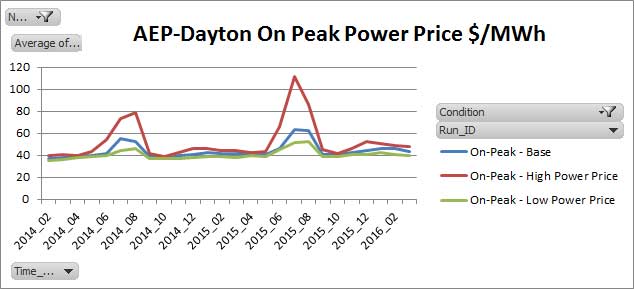

PMA value comes from the rigorous work to setup the model to accurately portray the markets. AEC 18+ year experience in the analyzing the energy markets has enable PMA to substantially improve the efficacy of the model. The entire N. American power grid is modeled. PMA NT will run daily producing monthly forecast cases – base, high power price, low power price, high gas demand, and low gas demand – for all major power pricing hubs for the next 2 years. The base case will be based on a normal weather outlook and a consensus GDP outlook. Due to the near-term nature and the capability to transact in the market, the base inputs represent the forward curves for both gas and coal. The other cases are based on changes in weather, plant operations, and gas prices. Customization of cases is available to subscribers (inputs & outputs).

State by state monthly gas demand from the power sector as well as coal basin demand will be presented. PMA LT is a monthly forecast out to 2035 produced quarterly. Given the long-term outlook, a fundamental gas view point was developed in coordination with RBAC the makers of the GPCM® Natural Gas Market Model. The quarterly outlook will present monthly prices for all major N. American power hubs. In addition, a report will be included to support the outlook. Description of retirement and expected new builds will be detailed in the report. PMA LT subscribers can get access to gas pricing and a report supporting the gas fundamental outlook. Customization of long-term outlook (e.g. Carbon policy) is also available to subscribers. Please call or email David Bellman ([email protected]) 614-356-0484 for further information.

*Many more regions available. PMA processing backbone uses the AuroraXMP developed by EPIS. AEC has over 10 years of experience in operating and managing EPIS products. The model is only a portion of the process. PMA value comes from the rigorous work to setup the model to accurately portray the markets. With PMA you’ll receive access to a daily developed two-year outlook for projected monthly coal and gas consumption by the power sector. In addition, clients interested in power prices will receive projected power prices from across North America. Our model will run daily, incorporating the latest viewpoints from the forward gas and coal markets. The base model will also use AEC’s proprietary load forecasting model to project normal weather conditions. Two sensitivities will be generated along with the base case – high and low power price cases. The high power price case will take the previous 5-year CDD and HDD maximums and apply them appropriately, GDP growth adjusted by 0.5% upwards, Henry Hub forwards will be increased 50 cents per MMbtu, and new builds will be shifted 1 year. The low case is the inverse of the high case. with retirements being shifted a year. These three cases will give you a good perspective on the high and low expectations in the power market.  PMA will also offer additional analysis such as our monthly snapshot into the next month. We will present a range of outcomes as a result of natural gas price change to other pertinent variables.

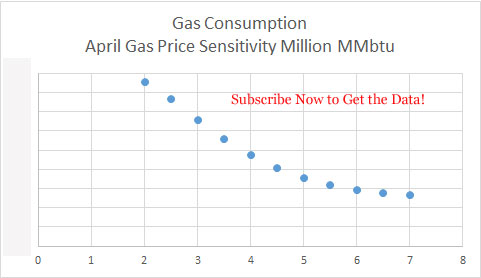

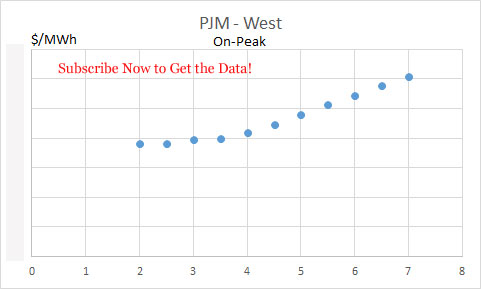

PMA will also offer additional analysis such as our monthly snapshot into the next month. We will present a range of outcomes as a result of natural gas price change to other pertinent variables.

In addition our online interface allows you to quickly see how the market is changing and how different cases compare to each other. With a few clicks you can easily see the difference between cases. In the example below we take a look at the change in gas consumption if weather and hydro capability was like that in 2001.

Customization is available to subscribers. Customization ranges from customizing inputs to outputs. PMA is flexible to allow custom studies to be developed. A subscriber will have access to PMA key metrics which drive the model. These metrics include gas price (henry hub and 32 basis), coal price (6 benchmark), GDP (Total and 8 economic zones), 9 weather zones, and various emission prices.

Custom output is available which includes the ability to produce generator and unit specific information from generation, fuel burn, fuel cost and many more.

Brochure: PMA-NT for Trading and PMA-LT for Planning Please call or email David Bellman ([email protected]) 614-356-0484 for further information.