Crude Oil Markets Are Not Like 1998

I have been giving a presentation on the future of the oil markets to various people. I am working on converting the presentation to paper. So far, all have appreciated my unique and refreshing insights to the oil markets. I would post my presentation material, but like most of my presentation materials, it is not designed to be a stand-alone document.

In order to find the future price of oil, we need to understand how the market got to where it is now. The presentation starts off with the fundamental question – IF you had forecasted the following fundamental parameters relative to the actual results, where would your price forecast relative to actual results be?

-

World oil demand forecasted too high by 10 million bpd

-

US oil demand forecasted too high by 5 million bpd

-

US crude oil imports forecasted too high by 10 million bpd

-

OPEC world oil supply represented 15% less than anticipated

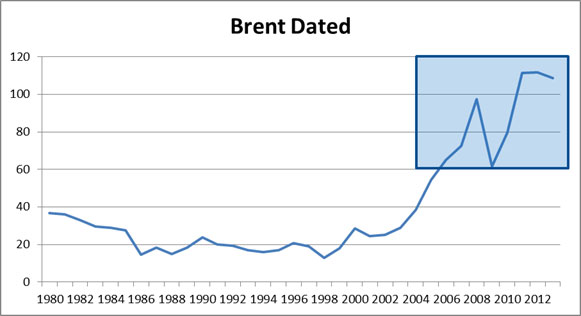

Most rational energy analysts would suggest the price forecast would have been too high given these factors. However, this is far from reality. In 2013, the average price of Brent was $111/bbl. The EIA Annual Energy Outlook in 2002 high price outlook forecasted $40/bbl. All other analyst, including myself, would have been ridiculed to show prices above $50/bbl for 2013 – (less than 10 years out). Four years later in 2006, there was only a slight improvement in the forecast. The EIA high case now showed $80/bbl for 2013. At the time, I had forecast subscriptions from PIRA, CERA, and WoodMac. None of them had a forecast for 2013 – less than a decade out – remotely close to the actualization of $111/bbl other than CERA extreme scenarios with a range of $110-$30/bbl (any use when the range is that wide?).

I hate being wrong and vehemently detest being wrong without knowing why. It would seem the market has conveniently reset their forecast and have accepted this new price paradigm without really finding some fundamental rational to this new price level. Many will bring up geopolitical risk and supply disruptions – but all the supply disruptions would not amount to being wrong by 10 million bpd. Then the next excuse is cost of production being higher. I think this is more a symptom rather than a cause for being too low in the forecast. Another reason mentioned is increase trading in oil, but once I again I feel it to be a symptom not a root cause.

In my presentation and my future paper, I delve into the reasons used to rationalize how we got where we are. On a high level, the reasons investigated beyond the typical fundamental supply/demand country analysis are Monetary Policy and the shift in the demand elasticity curve. Finally, I will also address why this is not 1998 for which I have first-hand experience given my 15 minutes of fame was all used up that year (Front Page USA Today and other). Please contact me if you are interested in me presenting to your team this unique and refreshing view on the oil markets from a pundit who was in the trenches in 1998 and made the call for the collapse.

Your Used All My Fame Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: http://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

“In the future, everyone will be world-famous for 15 minutes” Andy Warhol

Crude Oil Collapse?

A sustained collapse of crude oil is too early to call. This is speaking from the one who is not shy to call crude oil collapse – Front Page USA Today March 10, 1998. The dynamics are different than it was back in 1998. Right now we are entering a shoulder period of oil demand where you have reduced driving and limited oil demand for heating purpose. Add to this the global economic concerns; you have the perfect recipe for driving the oil prices down. The key difference from 1998, which still has limited discussions from oil pundits, is monetary policy. I noted this concern back in 2012 in my CERAWeek 2012 summary. There is a fine balance between correlation and causation. The strengthening of the US dollar of recent is occurring simultaneously with a fall in oil prices. In 1998, the US dollar index was much higher than it is now and was not declining during the collapse.

The monetary strength of US dollars is important as the buying and selling of crude oil is typically done in US dollars. Therefore the ability to buy global widgets, if you are a producer, will be a function of where the currency is going. The OPEC members are seeing a loss in revenue as crude oil falls, but their ability to purchase the same amount of widgets is being buffered with a strengthening US dollar.

The global race to negative currency continues as the US experience documented that a printing of currency can actually lead to recovery. Now with the US stock market heading down, will the US policy of leaving no investor behind force another round of the very successful quantitative easing (sarcasm – see my article on Quantitative Easing and Climate Change)? If we do see a FED reaction to the strengthening of the dollar, I suspect we will see a rise in oil prices as a natural rebalance or in the form OPEC reacting to a drop in widget purchase capability.

Clearly, fundamentals of supply and demand of crude oil should and will dominate the crude oil price. But, I believe monetary policy deserves some more discussions as a strong influence to oil pricing. The supply /demand trend does show potential for a significant weakening, but it is not the best time to do ones balance as fall and spring season can result in wild oil demand swing. The oil markets given the growth of various alternatives of fuels (e.g. electric, ethanol, natural gas) will result in increasing demand volatility producing significant inter-year price swings. Storage will increase in value as selling in shoulder months will likely worsen in price versus peak periods of oil demand.

Planning to be in Houston the week of the 27th. Please let me know if you are interested to discuss the energy markets- send me an email and we can schedule a time to meet – [email protected]

Your Keeping an Eye on the Oil Markets Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: http://allenergyconsulting.com/blog/category/market-insights/

Condensate Economics Explained

Introduction

As discussed in my previous article, the Oil & Gas Industry, producers in particular, are trying to export condensates. The industry has recently gotten some exemptions, and perhaps this may lead to more. As noted in the previous article, this may not be the best policy decision for the US economy. Constraining exports will allow the entrepreneurs and innovators to find ways to use the feedstock more effectively domestically. This will then create better economic multipliers versus shipping out the feedstock. The restrictions do put an additional downward price pressure on the producers, forcing them to sell at more of a discount in order for the US refiners to take the condensate. However, the condensate will be sold at discount regardless of the export rule as explained in more detail below.

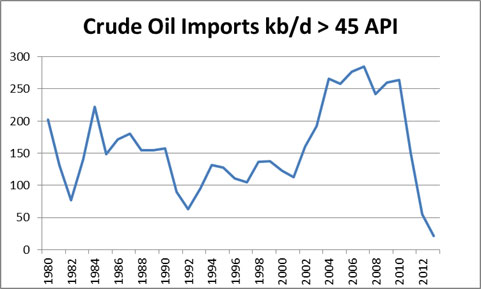

The producers believe they can sell the feedstock more effectively in the global market. This is yet to be proven. Overall Condensate is not very valuable in terms of product yield relative to most crude oil. The US has already displaced a significant volume of international condensates which was being imported to the US as seen in the figure below.

A large percentage of imports above 45 API are condensate. The dramatic drop off is due to the explosion of condensate in the US from fracking, thereby displacing the imports that were coming to the US. Wherever condensate goes, it will still have to compete on global basis plus shipping and the poor product yield. In fact, condensates yield a lot more gasoline than diesel and jet when refined. Diesel is the primary product in the rest of the world compared to the US, which is mainly gasoline.

There is lack of economic pricing discussion on condensate, including my previous piece. This time I will present the economics of condensate to prove the points that condensate exports will not likely result in economic gain for the US. The very first thing is to understand basic refining economics. I am working on a new multi-client product – Oil Market Analysis (OMA). The first part of OMA will involve an oil refining index model. This daily product will track and calculate the value of various crude oils through various refining configurations. I am using the initial results from the model for this discussion.

Analysis

There are three major configurations for refining – hydroskimming, cracking, and coking. Each of them is progressively more advanced and costly. Advancements come in two forms

1. Increasing yield of products vs. residual product

2. Increasing capability to process heavier and more complex crude.

A good presentation on the various configurations can be found from Statoil. From their presentation, they expected increasing complexity requirements from refineries. The US refineries also believed this, and as a result have caused this predicament – too much condensate without an optimal home.

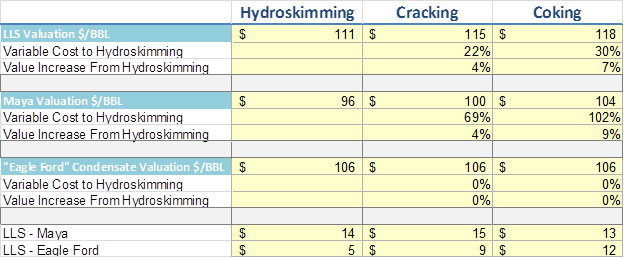

Running OMA refining model for the USGC Light Louisiana Sweet (LLS), Maya (Mexico Heavy Crude Oil), and Eagle Ford Condensate shows the following result in each configuration using the average USGC 2013 prices for Gasoline, iso & normal Butane, Jet, Propane, Diesel, Naphtha, Residual Fuel Oil, and Petroleum Coke. The value is essentially the revenue minus the variable cost obtain per barrel of feedstock. If LLS was processed in a cracking refinery, in the USGC they could expect $115/bbl of revenue per barrel. LLS averaged $106/bbl in 2013 – therefore a USGC refiner running LLS should have produced a margin of $9/bbl. This is not weighted nor optimized. An optimized refiner should have been able to extract more margin through better inventory management, purchasing, and offering a broader product suite.

Takeaways

Increasing complexity increases the variable cost of the facility – largely energy cost. The value of increasing complexity is more apparent when the crude oil is heavier. LLS is 66% lighter than Maya. “Eagle Ford” Condensate is about 277% lighter than Maya. Therefor, light crudes such as condensates cannot benefit from the increase complexity.

Refineries do not get much value from processing condensate as seen in the table above. Refiners are likely asking for significant discounts relative to LLS in order to process the condensate. The marginal refinery in the USGC is the cracking refinery. Given this market dynamic, the market should have priced the condensate around a $9/bbl discount to LLS. IF the export market marginal refinery unit is a hydroskimming, then perhaps a $5/bbl discount is possible. Given the shipping cost, the discount to condensate will still likely be greater than $7/bbl, even if exports were allowed. It is possible to create a mixture of heavy crude oil and condensate, thereby creating an optimal blend for cracking refinery to be cost competitive with a coking refinery. This could reduce some of the discount for the condensate. This would be a more sustainable path for delivering maximum value vs. trying to export the condensate. In addition, market forces would likely create a mechanism to capture the condensate discount. Many have turned to splitter projects. I don’t believe splitters would be a sustainable solution. Splitters will just flood the market with more unfinished product,s e.g. Naphtha. Naphtha prices are already under so much pressure. Naphtha eventually will have to be processed to produce finish product.

Conclusion

In the end, exports may reduce the discount to Condensate by a few dollars. Those dollars will not likely show back up as a significant saving for the US consumer. The producers will benefit the most from the ability to export and find market arbitrages. The many that chose to do splitter projects will likely not fare as well as the feedstock discount may not keep up with unfinished product decline in prices. The condensate discount will likely continue to be greater than $7/bbl relative to LLS. There is still room to formulate a better refinery blend and even expand the US refining capability by adding a condensate refinery. (I do know a 80,000 b/d condensate refinery that can be brought back to life for $800 million in 18 month time projected IRR 30+% – email me if you are interested)

Please do consider All Energy Consulting for your refining market analysis. We have many years of practical experience and now offer a dynamic market refinery model. Please email me if you are interested in hearing more about Oil Market Analysis (OMA) – [email protected]

Your Digging Beyond Skin Deep Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: http://allenergyconsulting.com/blog/category/market-insights/

Fact Check – Lifting Oil Export Ban to Create Lower Gasoline Prices – Likely True for Some Time

There is so much material to discuss recently as I try to finish my review of the EPA Clean Power Plan (Paper #1, Paper #2, Paper #3). This morning I saw the solar discussion and now I see this article with one of my former colleague and friend as co-author. The heading was very catchy – “Why the U.S. Needs to Lift the Ban on Oil Exports Surprisingly, this will mean lower gas prices at the pump, and a greater supply of crude in an unstable world.”

They did a great job pointing out the history and facts of the export ban. They also presented the major concern of the oil producers. “…so called tight oil, or “light oil” recovered by hydraulic fracturing and horizontal drilling—is a poor match for refineries in the Midwest and along the Gulf Coast. Refineries have spent more than $100 billion in recent decades reconfiguring their equipment to process heavy, lower-quality imported oil from Canada, Mexico and Venezuela, as well as the new supplies coming from the Gulf of Mexico. They have been able so far to absorb the new light crude but are reaching their limit even as tight production keeps growing. If these reconfigured refineries run more light instead of heavy crude oil, they lose output capacity—and revenue—due to a mismatch of the light oil with their equipment. To make up for the lost revenue, refineries won’t buy the light oil except at a discount, which could run as high as 20%. At that price, oil producers can’t cover the cost of some of the new wells, and cash flows would decline. This means less drilling and lower crude production.”

This same issue was pointed out in my US refining outlook for 2014 done back in February. I will respectfully disagree with the hidden conclusion that eliminating oil exports in the US will be the BEST decision. At the same time, I will agree with their conclusions that there is a possibility that gasoline prices can be reduced by as much as 12 cents a gallon by removing the restriction. The reason for this is not that 12 cents cannot happen but it may not answer the real question that should be posed which is this removal of the ban the best decision over time. The logic that world markets could get immediate relief and an optimized US refining industry would produce a more optimal solution for the world system is reasonable. However this conclusion does not state that it is the best for the US. It does show benefits in a discrete time period. There is a possibility those 12 cents savings disappears over time as demand grows in other markets.

Economics would lead you to rationalize making a finished product is worth more than the raw commodity that made up that product. The difference becomes the margin in applying work. This margin and the value for that creation can be kept in the US if the export ban was continued. There is a solution to the significant light oil discount beyond reconfiguring existing refineries, which made a business decision based on full knowledge of the restriction and the potential landscape shifts. Capital investments can be made in existing facilities, brownfield/refurbishment (I do know a 80,000 b/d condensate refinery that can be brought back to life for $800 million in 18 month time projected IRR 30+% – email me if you are interested), or build a new refinery. They did note the option of new refineries would take time. However, it is this time element which is needed to make business decisions that last decades. Continued certainty of discounts will add to decisions to build/refurbished/retrofit refiners in the US. This will create multiple jobs plus convert the US to potentially being a net exporter. Currently, the US is still net importing around 6 million barrels per day. The Latin America market is growing and it would be the ideal export area for finished products such as gasoline. Given the statement from the article “U.S. gasoline prices are set by global gasoline prices”, as a country you wouldn’t want to be the importer particularly in the scenario when other markets start valuing gasoline much higher. Being a net exporter, you are guaranteeing the local consumer a discount to world market prices per transportation netback calculation.

I will conclude with their statement and append it “Ending the ban would enable the U.S. to benefit significantly more from its oil-production renaissance” in the near-term, however if we could get our act together perhaps there is a chance to revitalize our trade imbalances and become a net exporter and serve the growing markets of L. America by keeping the ban.

By the way, I am a libertarian at heart and many know me to be. However I am a practical libertarian in that I understand a system with limited government intervention is the best, but the world is full of government intervention (e.g. huge oil subsidy to local consumers in the Middle East) therefore it would be foolish to blindly stay 100% with an ideology that the premise of the ideology cannot be created.

Your ever searching for the Truth Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: http://allenergyconsulting.com/blog/category/market-insights/

Refining Outlook Refined for 2014

As I review my last year’s thoughts on refining with updated data, it has caused me to be more bullish on the outlook for refining – which historically is very hard to do. US refining may be entering another golden age – or perhaps it never left, but just took a nap. There will be refiners who benefit more than others. However, the overall market should see additional boost.

What is new or more reaffirming from last year’s review:

- Continued liquids production from the shale plays.

- Crude imports are coming whether we like it or not by rail or by pipeline.

- Continued growth in developing countries.

Shale Play

Shale production continues to beat expectations. I researched over a dozen papers reviewing and analyzing shale decline curves and initial production rates. The amazing outcome is not the technology acceleration, but the ability to learn to use and adapt existing technology is accelerating. Each shale play is unique with an initial set of known. Applying the techniques done in one play to another play generally does not optimize the production. The ability to be creative with the tools and resources available has clearly shown an increase in production. Data is available showing initial production rates to decline curves are improving at wells within existing plays. In addition, the newer plays are seeing even a more accelerated path of improvements than the Bakken.

It is our belief, this will continue leading to more oil production in the US. And this oil production is of the sweet and light crude oil. This very fact is causing the US producers to want to lift the ban on exporting crude oil from the US. As discussed in my previous refining outlook discussion, the US refiners outsmarted themselves and built the wrong refining configuration. All is not lost; they just don’t value the sweet crude as much as the outside world might. At some discount, the oil will be processed and changes will be made in the US refining complex. This discount is driving producers mad and so the hope is with the ability to export. They could find better buyers across the ocean. In the meantime, without the lift in crude oil exports, we should continue to see a feedstock price discount to several refiners. This will cause a drop in finished product prices in the US for the consumer. However, I anticipate the drop in finished product prices to not be as low as the drop in feedstock prices given the export outlet for finished products.

Crude Imports

Crude imports are coming no matter what you are hearing about the Keystone pipeline issue. The Keystone pipeline encompasses a greater plan which is shown on this website. The project is actually three parts with 2 of three pushing forward as the main Keystone Pipeline still is being debated. Right now, we have 180,000 barrels/day of crude oil moving by rail from Canada to the US. The debate perhaps is really the rail industry supporting the ban on Keystone, because the oil will come, it’s really just how you want it to come here, assuming we still want to maintain free trade with our Canadian friends. This crude oil is more to the liking of the US refining sector. I suspect logic will prevail and the pipeline will move forward and pressure on the US crude oil markets relative to the foreign markets will maintain itself. The forward curve as of 02/06/14 continues to show a very stout spread between Brent – WTI of $14/bbl. Overtime, I suspect that to come back down to perhaps the $5/bbl range. However, I think gone is the convention that on annual basis they will trade in parity.

Non-OECD Oil Demand Growth

Over the last 8 years the OECD region demand dropped nearly 5 million b/d. The US represented nearly half of this drop with half of that drop coming from the push on alternatives fuels mainly ethanol. Ethanol production now stands at 0.9 million b/d. Biodiesel adds another 0.1 million b/d. Even though much is talked about renewable in the power space that there is now significant volumes to be discusses in the petroleum space. As I indicated in the power space reaching a peak consumption one can conclude the same in the oil space for US consumers.

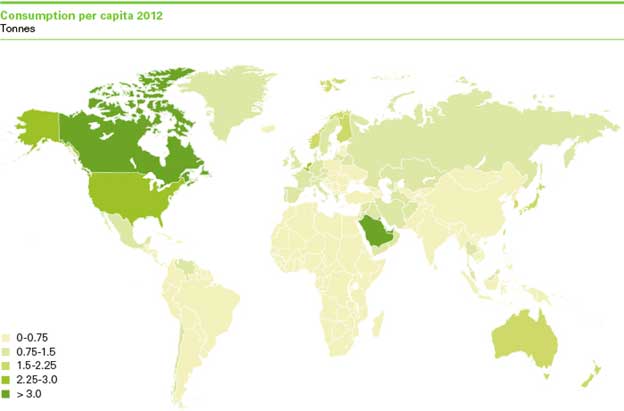

With the entire demand decline in OECD region, one would think prices should have declined versus rising 70% in the US gasoline markets. However, Non-OECD demand grew 9.7 million b/d over that same time period OECD was declining. There is so much more room to grow for non-OECD region. BP shows a graphical view of oil consumption per capita across the world. Even though the US observed a great drop in demand there is still a large gap between the US and the majority of the world.

With those three outlooks solidified, I am optimistic on US refining. Within the sector, there will be winners and losers. I can help the refining sector by offering crude oil evaluation to strategic planning to optimize the above concerns. A fundamental view of crude oil prices and refined products are available.

By the way I do have an opportunity for those interested in a 80,000 bpd condensate refinery in the Caribbean. A detailed cost study along with an economic analysis was done showing an investment need of around $600 million producing 20+% IRR. To build a brand new refinery of this scale would be around $1.2-$1.8 Billion. Please contact me if there is interest in this investment.

Your Continually Refining Energy Consultant,

LNG Export Revisited

LNG exporting discussion is increasing. Clearly the Oil & Gas industry is in favor of the initiative. On the other hand you have the Dow and Alcoa being concerned. Now the environmentalists have stepped in to denounce the plan. As I noted in my previous discussion on this subject last January I was more cautious on the level of exporting in the hopes that we could develop manufacturing and other creative ways of using a cheap and abundant resource. The question is to ask what is best for the country as a whole not to focus on certain questions as will it raise prices. A price rise is not bad in itself.

Since the last year, I have added my perspective by having intellectually challenging conversations with my many energy colleagues and friends. In general, I do agree with the premise that government should not be in the business of picking winners. My Oil & Gas industry friends will use this as instrument to justify their stance to export – not allowing exports you are picking a winning industry. As I noted before I think we should phase in the volume. In addition to staying true to avoid government picking winners – why are my Oil & Gas colleague not supporting my stance on auctioning of the export license in order to phase in the LNG export volume. Going site by site offers some element of picking winners. The US citizens should want to find additional funding for the government versus raising taxes and losing benefits. LNG export volume license would likely bring a decent revenue stream for the government and would avoid “picking” winners. Obviously the company that wins the license will still need to find an approved site along with approved technology which would pass environmental and safety needs.

I am always open to a discussion on merit. Please do send me email or feel free to comment below.

Your Open Thinking Energy Consultant,

614-356-0484

Twitter: AECDKB