Gas Storage Model – Predicting $1/mmbtu Weather Risk

A new tool is added to the PMA package – an interactive gas storage model. The gas storage model value lies in the set of 35+ pre-set runs for the power sector enabling the user to create their own version of the future without having to wait. AEC specialty lies in the power modeling world. With this in mind the model allows users to change their assumptions in the other areas of the gas balance (e.g. production, imports, demand outside power sector, etc.).

A demo version is available http://allenergyconsulting.com/Data/DemoGasStorage.php . The demo gives the user all the capabilities other than changing the prices for Henry hub in the months of Jun-October. An example of using the tool is described below.

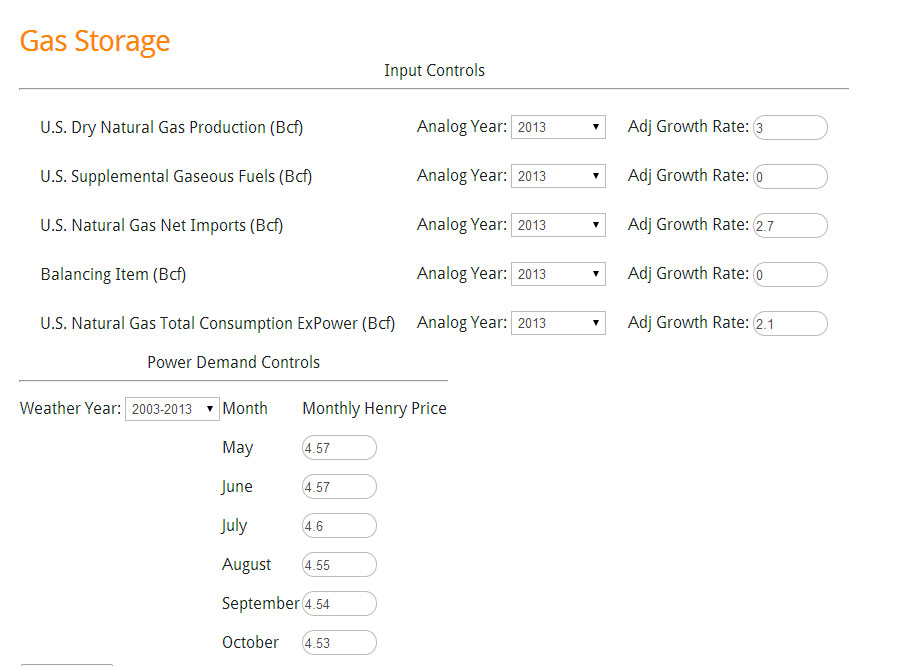

Recently the EIA did their own analysis of the end of summer inventory. In their analysis, they conclude ending storage level will be 3.4 TCF lower than the 5 year average of 3.8 TCF. To test our model, we used their assumptions outside the power sector. EIA assumed production only grew 3% from 2013. To put that into perspective, the 5 year average is closer to 3.8% and this was during very low price signals. EIA used imports that are much higher than the recent trend with an increase of 2.7%. 5 year average imports have declined by 15%. We also incorporated their price forecast – see below image.

Gas Storage Model Input (Click to Enlarge)

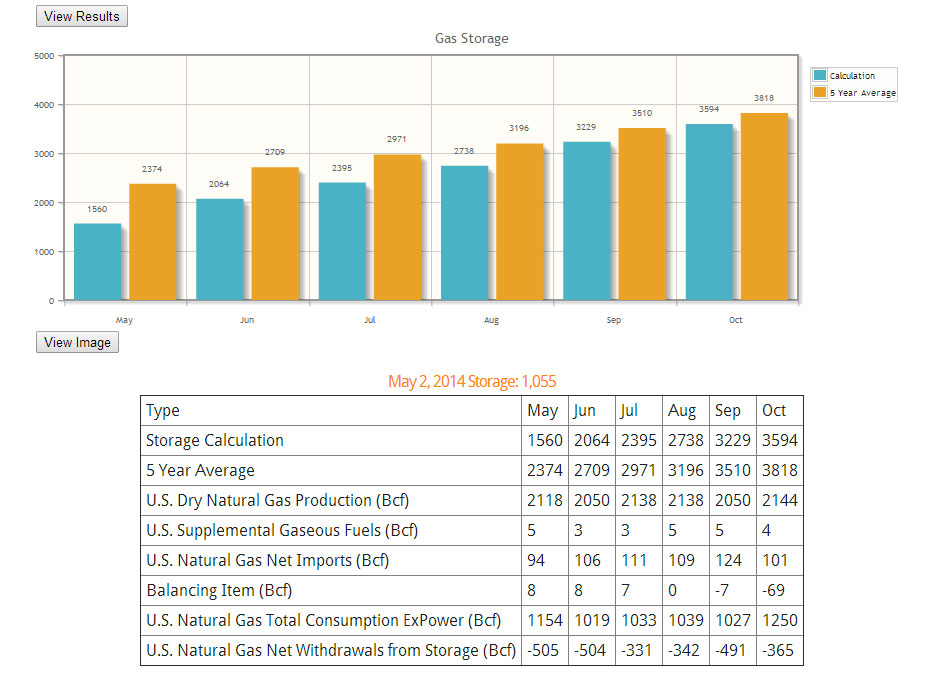

Using the 10 year average weather, our models show the final storage numbers closer to 3.6 TCF using all the assumptions. This was expected given the general under-estimation of the power sector to respond to significant rise in gas prices.

Gas Storage Model Output (Click to Enlarge)

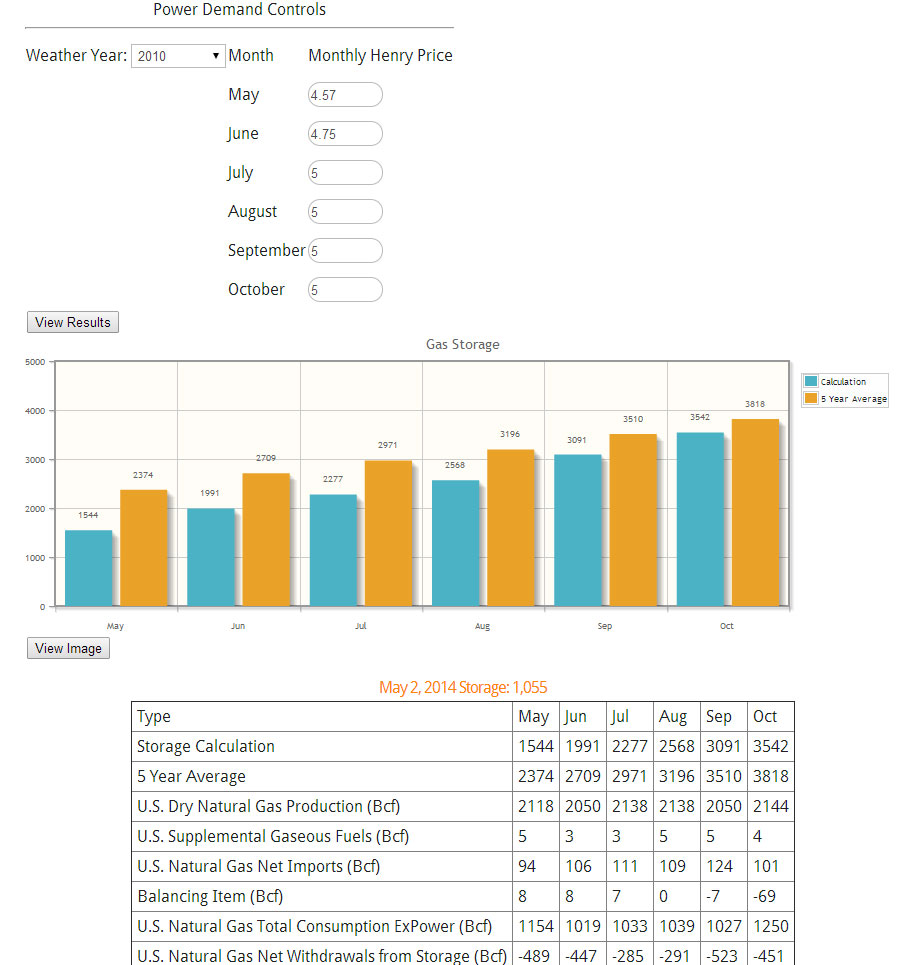

Another use for the model is to create your own gas price forecast by targeting a storage number. As an example, if we changed the weather to be an extremely hot summer, we can change the weather drop down to 2010 per our 10 year weather analysis report.

In this case, we had to change the gas prices in order to maintain a 3.5TCF ending inventory. The gas price that solved for this was $5/mmbtu. One can put even more finesse into the forecast by adding more seasonality than what was shown. In addition modifying the non-power demand would be a prudent task.

Gas Storage 2010 Weather Scenario (Click to Enlarge)

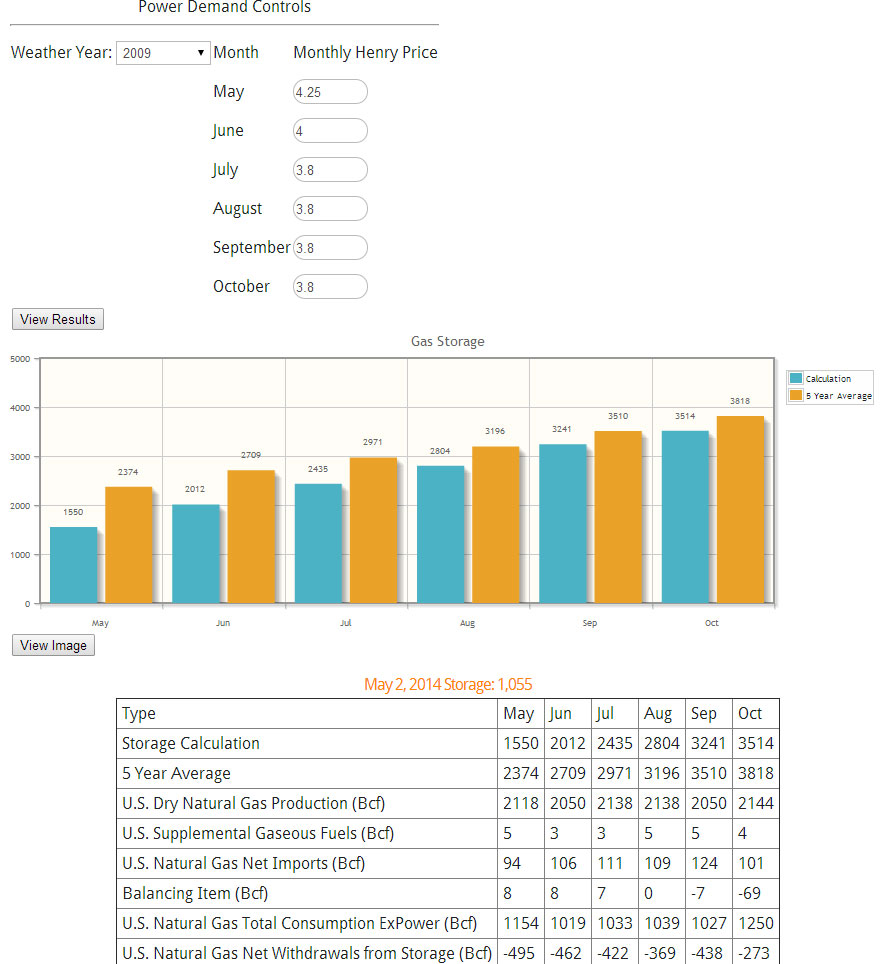

The opposite of 2010 would be 2009 weather. Applying the same technique and target of 3.5 TCF, we get a price level of $3.8/mmbtu.

Gas Storage 2009 Weather Scenario (Click to Enlarge)

Rather quickly, we now understand the weather risk involved in gas can amount to over $1/mmbtu.

The model does require updates since each week there is an update to the storage number. In addition, the relationships were established based on the April 22nd 2014 market prices. We plan to update the relationships monthly. The coming update for the model will include enhanced basis control plus be expanded to cover to the end of March of next year.

Besides the gas model, PMA subscribers get the daily files, and the study files. In addition, prime members receive-at no additional cost reports such as the the Summer 2014 Outlook report and the 10 year weather analysis. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

We are focused not only on supplying answers, but empowering you to find answers.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: http://allenergyconsulting.com/blog/category/market-insights/