Refining in the 21st Century Part 1 Cont’d

“He who can no longer pause to wonder and stand rapt in awe, is as good as dead; his eyes are closed.” Albert Einstein

I am sorry for those anxiously awaiting the continuation of Refining in the 21st century. I have been very busy for which I am very grateful for. I hope you have taken the time to reflect on what was discussed in the previous blog. A pause goes a long way in allowing us to process. Without further ado…..Part 1 cont’d.

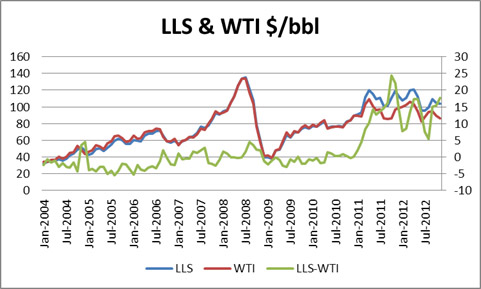

Now that the new paradigm has been set for oil, there are many inter-relationship that have changed. Of recent ,the EIA has shifted its reference fuel to Brent. This is a very reasonable shift as the center of demand is no longer the US but the growing Asia region. As an aside note, all the years I was at Purvin & Gertz, we never really believed WTI represented an appropriate benchmark for USGC. The better benchmark was LLS. However the financial market was too fixed to WTI to be able to change the benchmark. Currently you can see the reason why WTI can fail as a USGC benchmark. With the spread to LLS blowing up as pressure from Canada and shale oil have practically filled the center of the US; and with limited access to the USGC from Cushing WTI, it has decoupled to say the least against LLS – see chart below.

In the long run, this is one of the less costly economic arbitrages to solve via pipelines. In fact there is a pipeline reversal occurring this year along with an expansion. However the future markets continue to show a large spread with 2014 spread still above $5/bbl. A pipeline from Cushing to USGC should be able to produce reasonable economic return for $2/bbl with the past demonstrating much less.

Also many don’t understand a very important policy choice, that the Energy Policy and Conservation Act 1075 (P.L. 94-163, ECPA) which directs the President to restrict the export of crude oil. The US is in a very unique position given the shale revolution not only increased natural gas production, but also significant liquids production. This policy decision should lead to some strong US refining outlooks.

When we examine the refining world as I discussed previously, it is very highly dependent on the feedstock. There is so much to cover in understanding refining economics that I will write this section requiring some basic understanding of refining. Basics include crude oil quality and the difference between hydroskimming, cracker, and coker. Also an understanding of why refiners chose various crudes. I have spent days teaching the basics to clients who are brand new in the refining business. In fact one of my first international task was a course on refining to PDVSA. I have built some of the most sophisticated models for crude evaluations for both buying and selling. I believe the Kuwait Petroleum Company still uses the model we worked up for them at Purvin & Gertz. Nonetheless refining is not a simple discussion without some basic understanding.

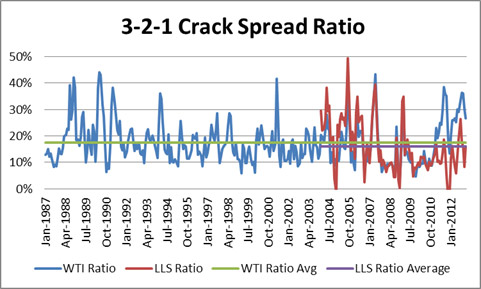

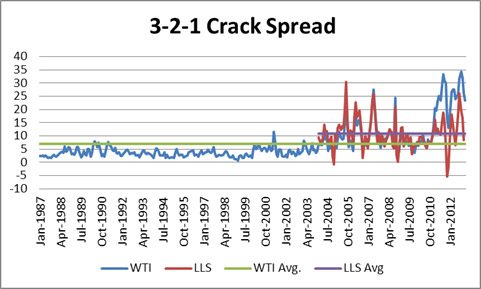

With the paradigm shift of higher prices allowed the spread of products to widen. It is only natural to think margins should move as percentages instead of absolutes. If your feedstock cost you $10 and your margin is $1 your return is 10%. If your feedstock is $20 and you still only obtained a dollar margin your return not drops down to 5%. This is likely going to hamper your ability to get financing and potentially put you out of business as your weighted average capital cost is above that unless you are regulated entity. This should be no different in the refining industry. The absolute value of the margin spread will be forever much larger than historical view until the feedstock falls back down. The proper view for refining margin is to view it as return on feedstock as seen below.

A return of 16-18% will likely suffice in the USGC to keep the industry going. WTI and LLS will converge to produce a return at that level. If we looked at it on an absolute basis – see below, it would suggest that refining margins will have much to fall in this $100/bbl environment, which is not the case.

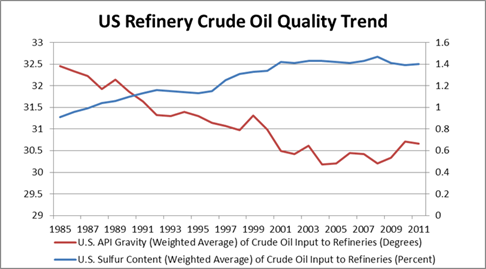

The second most significant change in refining was the underlying belief in the increasing lower API and higher sulfur crudes – figure below. This made the refining strategy focus on technology and those that can process the more complex crudes would win over the simple refiners.

This came at a cost in both technology and variable cost. However the shale revolution has changed that paradigm. The liquids being discovered within the shale did not increase in API and also has lower sulfur. This caused those who embarked on the above strategy a mismatch. The light/heavy differential is not as wide enough for the increase cost these refiners now have compared to the simpler configurations. This will likely not alter the long-term requirement of the crack spread to produce 16-18% return on feedstock, but it will impact inter-refinery competition and the strategy used to manage a refinery. Once again my services would include helping you review your refinery and from crude selection to refinery optimization.

In Part 2 we will discuss where the markets will go from here. If you review what we have covered you will likely have a good idea already where the markets will go. Critical thinking is key in the forecasting business. I have had good fortune in my career to build that skill set. Please do consider All Energy Consulting for your energy consulting needs.

Your Very Grateful Energy Consultant,

614-356-0484