Levelized Cost of Electricity (LCOE) Analysis Potentially Misguides You in the Power Markets

Levelized cost of electricity (LCOE) approach is very popular in the financial circles. When I was at American Electic Power (AEP), many of the large financial companies would come and speak with our executives and present LCOE on various technologies. However, the levelized cost method has too much simplicity, giving the presenter and the viewer internal biases. Levelized costing is way too simple and will typically produce results not valid in reality. I will present the case to you in this blog.

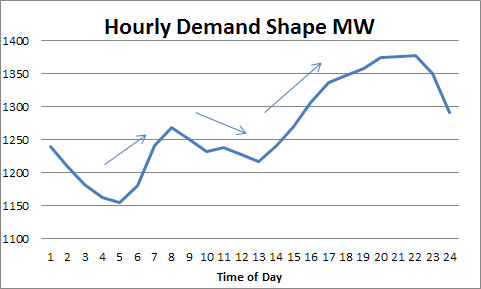

One must understand the reality of power; it is a market of instantaneous nature. There is minimal ability to have inventory unlike other products and commodities. This difference requires a market that trades intra-day and in many places intra-hour as load is not consistent through the day – as seen below for a typical load shape.

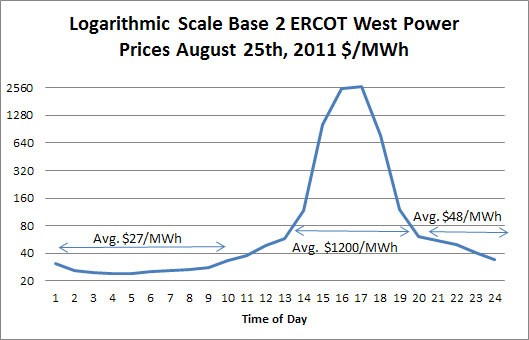

Not only is the load changing, but perhaps the supply to fill in the load could also change within the hour, depending on mechanical issues at each plant, transmission line, or distribution system. In addition with the implementation of wind and solar resources, we are now more dependent on the weather. As we see in our local news, the weatherman struggles; weather can be very unpredictable even just a day out. As result of load and supply availability changes, price swings within a day can be significant. Below is hourly price ERCOT West on August 25th 2011. The prices are so volatile that I had to plot it on a logarithmic scale, so you could see the variations. We had prices go from $24/MWh to $2600/MWh back to $34/MWh within a day. The second important realization is that only a few generation technologies can turn on and off within minutes to an hour. These units will likely have less efficiency than units who take their time to turn on. A fine economic balance is needed. Given the variations and the volatility I would always suggest a portfolio of technologies.

To show the misguided nature of levelized cost analysis, I have developed an excel file capable of dispatching various unit technologies to an hourly price curve for a year. In this example, I am using the actual 2011 ERCOT West hourly price curve. With the price curve and my model, I dispatched the unit. To prove the fallacy of the levelized cost mechanism, the easiest technology to model is the reciprocating engine. Given its ability to turn on and off in minutes and obtain full load heat rate, the reciprocating engine is an ideal candidate for hourly dispatching. With information that I obtained from Wartsila, I used the following design parameters 8 Heat Rate (mmbtu/MWh) for the initial and final hour and $4/MWh variable O&M. This unit either produced 0 MWh or 250 MWh based on whether the unit was economical to run. For the fuel price I used daily henry hub prices minus $0.20/mmbtu to account for the basis issue (Average fuel cost $3.79/mmbtu). Using my model, the unit produced a capacity factor of 30%.

For those interested, I have spent much time and analysis evaluating the Wartsila technology. If you are interested in an independent evaluation of their technology in your portfolio please do contact me. In most cases, I see a large value add in their technology for a resource portfolio, particularly when combined with various wind and solar resources.

Using the publicly available levelized calculator from the NREL, I supplied the same parameters from above plus the following financial condition: 30 year analysis, discount rate of 8%, capital cost $950/kW, fixed O&M $12/kW-yr. Levelized cost analysis concludes a cost of power of $71/MWh. With the average power price in ERCOT West in 2011 of $41/MWh, one may conclude the unit would be unlikely to produce much value in that environment. However, when we look at my model, including the corresponding financials of a reciprocating unit placed in that environment, the plant produces close to $34 million in net revenue in 2011 in power sales alone. Subtracting FOM and firm gas transport, we are still in the $30 million neighborhood. If we place this condition into a cash flow model, with the same economic parameters used in the levelized cost model, the internal rate of return (IRR) of the project over the 30 year period will be around 12%. This is in the environment of the average price of power for the year is $41/MWh versus the levelized cost calculation of $71/MWh. (Of course I am not endorsing that 2011 would be representative of the future, my purpose here is to point out the potential to be misguided by levelized costing. However, if you are interested in seeing various scenarios and forecasts, I would be more than happy to assist).

What went wrong with the levelized cost approach is the inability to actually be in the real world. Power is much too complex to simplify into a year model. In the example above, which represents real world economics, because of the significant price volatility, 10 days represented over 50% of the plants revenue.

I do believe in simplification versus paralysis analysis, but it has to be in context of the problem. By creating an hourly dispatched model in Excel, I did simplify real life, but not to the point it didn’t mean anything.

Some people feel comfortable using the levelized cost analysis to simply compare alternative technologies. Once again, I believe it will misguide you, probably towards traditional past generating technologies, largely because of the influence of the capacity factor assumed. Many people go back in time to quantify the capacity factor for various technologies, often not considering the environment nor the actual engineered capacity factor. Case in point, at AEP some wanted to use capacity factors of gas units in the teens because many of the units had experienced that or even less. When one put in a low capacity factor for the gas unit while putting in the high capacity factors (65+%) for the coal and nuclear plants the bias is tremendous. The lower historical heat rates were a function of the past market conditions. Obviously the market is changing with increasing load and increasing coal retirements. How will units respond given this changing environment? One will not know using the levelized costing approach. Levelized costing puts the threshold of gas very high relative to the reality of the world in the future. In addition, the capacity factors do not need to be high for units that are flexible because they will mitigate the hours where the units are losing money. However, units such as coal and even combined cycles will have to swallow many hours when the unit is out of the money in order to capture the times the unit is in the money. Another simple example is that solar technology will be generating only in the on-peak hours (unless you are in Alaska during summer times). Looking at the levelized cost of solar will mislead you in how bad the economics of solar is compared to wind, which in most places occur in off-peak periods. Levelized costing generalizes too much of the operations and interactions with the market. In conclusion, the levelized cost analysis is not appropiate to use for the power markets. My suggestion is to model units on an hourly basis incorporating some of the operations reality. I have many years of experience in evaluating various technologies, planning, and developing an integrated resource plan.

If you are looking for some insights and or additional points of view into the future technologies and/or power markets please contact All Energy Consulting.

Your Energy Consultant,

David K. Bellman

614-356-0484